Why is it important to separate business and personal finances?

Introduction:

There are myriad reasons to maintain a clear separation between personal and business finance. The decision to separate these expenses becomes not a matter of possibility but a necessity over time. Small business owners frequently encounter a blending of personal and business assets, which could put personal wealth at risk.

This blog will explore why drawing a clear line between personal and business expenses is crucial for small business owners, along with tips for effectively separating business and personal finances.

Key takeaways

Separating business and personal finances minimises personal liability and protects personal assets.

Dedicated business accounts allow for maximised tax deductions and easier financial management.

Registering a business and defining business vs. personal expenses clearly separates finances.

Professional bookkeeping services ensure financial records are organized, and business finances are distinct.

8 important reasons to separate business and personal finances

Minimise your liability

The key reason to separate your personal and business finances is to reduce your personal liability. This separation means that your personal assets remain protected if your business faces legal issues, debts, or other problems. Similarly, in the event of personal legal troubles, such as a lawsuit from a car accident or personal bankruptcy, having distinct finances ensures your business and its assets are shielded from these personal setbacks.

Streamline business administrative tasks

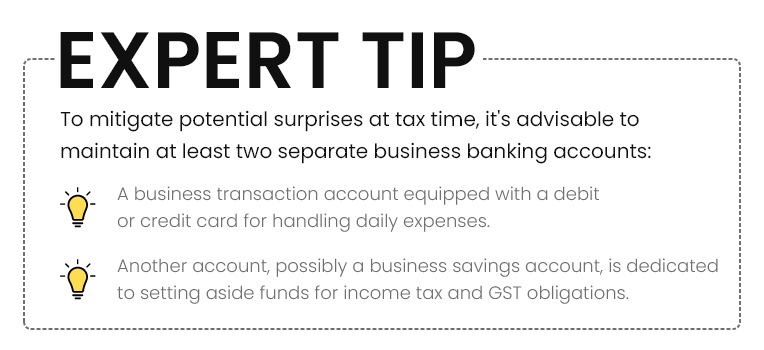

Managing business administration tasks like lodging tax returns and business activity statements can be time-consuming. Time spent on these tasks takes away from activities directly contributing to generating income or serving customers. That's why it's crucial to streamline administrative processes wherever possible.

You can take advantage of tax deductions

Using a dedicated business account for all expenses is a smart move for maximising tax deductions and ensuring proper financial management. By consolidating all business transactions into one account, business owners can easily track expenses, identify tax deductions, and streamline their accounting processes. This approach saves time and helps prevent necessary deductions from being overlooked or lost in the shuffle of personal expenses.

You will be easily able to access your funds

A business bank account is often required when seeking funding opportunities like grants and rebates. Moreover, maintaining thorough financial records is crucial when pursuing external funding options such as bank loans, overdrafts, or seeking investment from stakeholders. To effectively leverage lending solutions for business expansion, possessing reliable, unbiased financial data will significantly enhance your chances of securing the necessary funding.

Your savings won’t be at risk

Using your savings to finance a business venture can jeopardise your household finances. Businesses naturally experience highs and lows, and relying on personal savings exposes you to these fluctuations, potentially affecting your ability to save, invest, and cover essential expenses. Establishing a separate business bank account is essential for managing and budgeting for the various irregular expenses associated with owning a business. This approach ensures you can meet business needs without dipping into your savings.

Boost your business cash flows

Effectively managing your business cash flow can be significantly improved by separating your business and personal finances. This separation allows for a clearer overview of your business's financial health, particularly if personal funds are used for startup costs. Consider these essential banking products for your business:

-

Centralised small business checking account:

Streamline all your business financial transactions in one place, making it easier to manage cash flow.

-

Mobile banking:

Access banking services directly from your smartphone, including features like deposits, ACH, bill payments, and wire transfers, to manage your business finances on the go.

-

Online banking:

Enhance your financial management with the ability to track and manage your business finances easily from anywhere.

Keeps accounting simpler and more manageable

Separating your personal and business finances simplifies the accounting process and makes managing your finances more efficient. Dedicated business accounting tools like QuickBooks, Xero, and FreshBooks can significantly ease this process. These tools are specifically designed for business financial reporting and help provide a clear and detailed view of your business's financial health.

Prepare your business for sale

If you're considering selling your business, presenting it in the best possible light is crucial. Ensuring that your business's financial position is transparent and well-documented can make the sales process smoother and potentially increase the value of your business. Accurate and detailed financial records are key to this process. On the other hand, using personal savings for business expenses or mingling personal and business accounts can obscure your business's financial health, making it harder for potential buyers to assess its true value.

Tips to separate your personal and business finances

Register your business

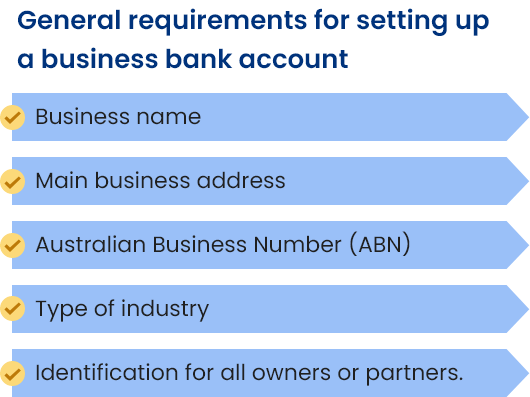

Registering for an Australian Business Number (ABN) is a crucial first step, whether launching a new business or shifting from casual cash work to a formal full-time venture. This step officially recognises your business and facilitates invoicing, ordering, GST credit claims, PAYG tax avoidance, energy grants credits, and acquiring an Australian domain name. Though not mandatory for all, obtaining an ABN is a straightforward way to distinguish your personal and business finances.

Clearly define business vs. personal expenses

Some expenses may overlap between personal and business use, especially for small business owners. For example, a car might be under your name but used primarily for business. It’s important to determine what percentage of such expenses is for a business to attribute them to your business account correctly.

Pay yourself a salary

Compensating yourself consistently is key. Allocate a set amount for your salary, fitting it into the business budget. This helps maintain financial stability and enables precise personal budgeting.

Communicate this separation

Just as you must manage the separation of business and personal finances, it's equally important to communicate this separation to others involved. This includes partners with whom you share personal accounts and anyone involved in your business finances. Ensuring everyone understands the distinction in your accounting practices helps avoid future issues.

Utilise expense tracking tools

If managing expenses feels overwhelming, consider using expense tracking tools like Hubdoc and Expensify. These platforms automate expense tracking and document management, making separating business and personal finances easier with features like receipt scanning and automated report generation.

Buy separate electronic devices, if possible

Investing in separate devices for work and personal use can aid your transition if you're financially able. For instance, if you've been using an old personal laptop or phone for business, consider getting a dedicated business laptop or phone. This not only potentially aids in tax deductions but also simplifies tracking your expenses. For example, if determining the business portion of your phone bill is challenging, having a work-specific phone means the entire bill qualifies as a business expense.

Conclusion

Starting a business in Australia presents unique finance and tax challenges, especially for those new. The key to a strong foundation is separating personal from business finances, which is crucial for protecting assets and optimising tax benefits.

This separation not only safeguards personal assets but also sets the stage for improved profit margins, directly impacting the success of your venture. As you streamline this aspect of your business, you're not just managing finances but laying the groundwork for your dreams to flourish.

At CleanSlate, our professional bookkeepers ensure your financial records are organised and your business finances are distinct from personal ones. Our services go beyond traditional bookkeeping; we engage in a partnership designed to support and improve the financial vitality of your business.

With our help, every financial decision is informed, strategic, and compliant with tax laws. For a collaboration that supports your business's financial clarity and success, contact us today Together, we can work towards achieving your business objectives.