Top 10 strategies to prevent and manage overdue payments

Introduction:

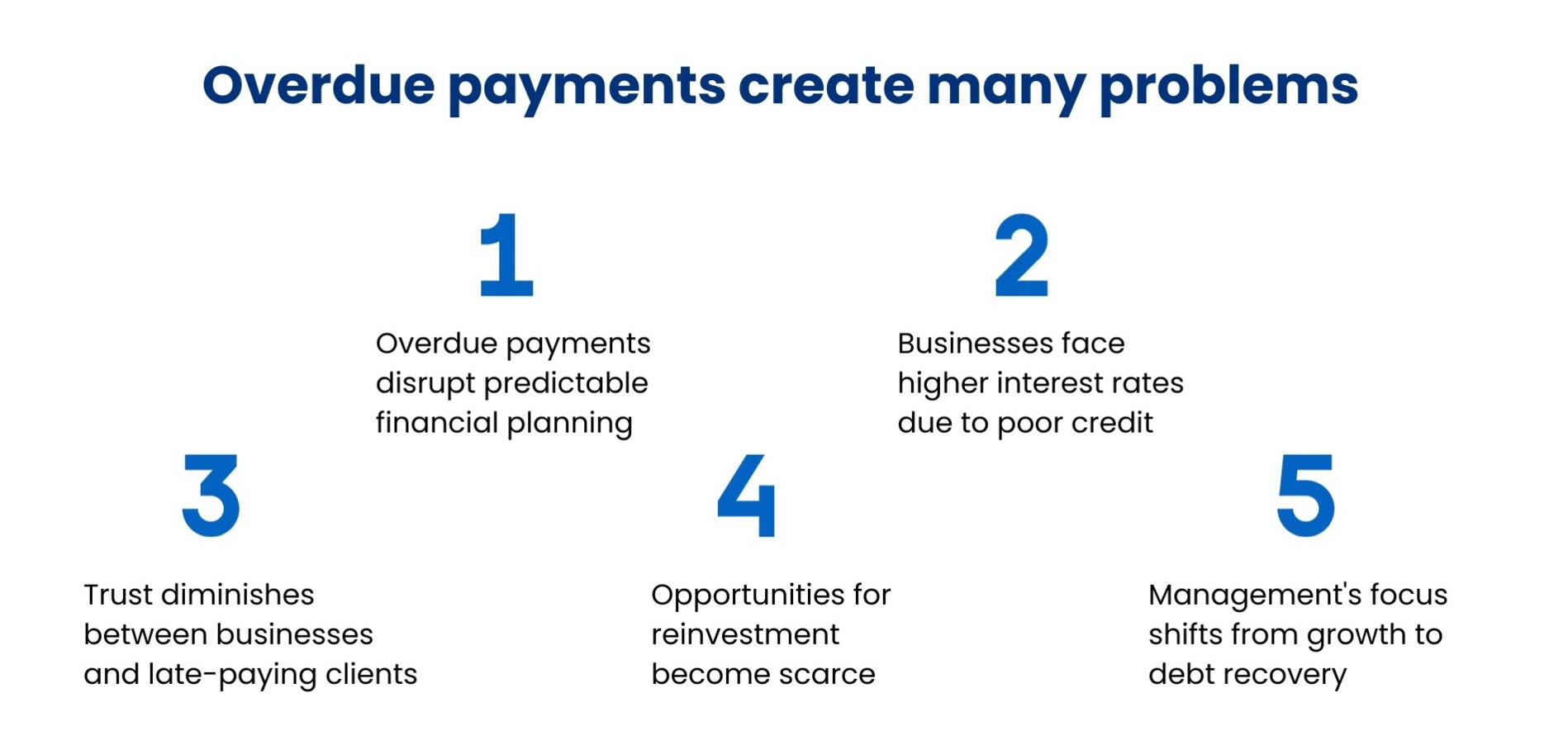

Consistent cash flow is the backbone of a successful business. While securing clients and achieving sales targets are critical milestones, they can be undermined by the persistent issue of overdue payments. Such delays not only disrupt a company's financial stability but also pose challenges in meeting operational costs, investing in new ventures, and even retaining workforce morale.

Furthermore, in the quest to retrieve overdue amounts, businesses often risk straining their client relationships, which can have long-term repercussions. Addressing this, it becomes imperative for businesses, especially those in their growth phase, to adopt strategies that ensure timely payments.

This article highlights this concern by outlining the top 10 proven strategies to prevent and manage overdue payments, allowing businesses to maintain a healthy balance sheet and foster positive client relationships.

Key takeaways

Utilise accounting softwares Xero, MYOB, and QuickBooks to ensure invoices are sent to customers immediately after transactions.

Always specify exact due dates on invoices to avoid confusion.

Before initiating any business dealings, constantly assess the credit history of potential clients to mitigate financial risks.

Regularly follow up with clients regarding overdue payments.

Top 10 proven strategies to prevent overdue payments

Here are the strategies that help businesses tackle the challenge of overdue payments. By implementing these top 10 proven methods, you can enhance your accounts receivable management, ensuring timely collections while maintaining a positive rapport with your clients.

-

Send invoices to customers immediately

Running a small business comes with its challenges, and as it grows, managing invoices becomes one of them. With an expanding customer base, it's easy to get overwhelmed with paperwork, spreadsheets, and digital files. Sometimes, you may overlook sending an invoice or mistakenly follow up on one that was never sent, potentially damaging your business's reputation.

Modern payment collection systems, like Xero, "MYOB", and QuickBooks, offer a solution. These tools make the invoicing process efficient, sending out bills promptly and securely. For customers, this means they can easily view, track, and pay their invoices.

Prompt and clear invoicing not only builds trust but also strengthens the business-client relationship. By keeping clients well-informed, businesses can ensure smoother operations and pave the way for continued success.

-

Set clear payment terms

For smooth business operations, transparent payment terms are paramount. It's essential to clearly state when you expect a payment, whether immediately upon receiving the invoice or after a specified number of days. This clarity is crucial in avoiding misunderstandings.

Ambiguous phrases like 'Due in two weeks' can lead to confusion, so it's always best to specify an exact due date on the invoice. By providing such precise details, you not only streamline the payment process but also eliminate any guesswork for the client, ensuring a smoother transaction for both parties.

Also, mention the accepted payment methods and any potential late fees. For those dealing internationally, it's crucial to indicate the preferred currency. If you're offering credit, its terms should be straightforward. By establishing these clear guidelines, businesses can build client trust and ensure consistent cash flow.

-

Set clear credit rules

Setting clear credit rules is pivotal for maintaining a business's financial stability. By being transparent about the company's credit policies, businesses can create a solid foundation that reduces the chances of late payments. This entails specifying the maximum credit amount, identifying which customers or entities are eligible, and clearly stating the expected payment deadlines.

It's essential that all team members, especially those handling finances, are familiar with these rules to ensure consistency in their application. Moreover, understanding the potential consequences of breaches is vital to enforce adherence. Given the dynamic nature of the business environment, it's also essential to periodically review these rules, making adjustments in response to evolving market conditions and the company's financial strategy.

-

Avoiding bad credit history

Before entering any business transaction, it's crucial to assess the creditworthiness of potential clients. Engaging with customers who have a tarnished credit record can be risky. Such records, whether for an individual or a company, often signal potential financial challenges ahead. Especially for emerging businesses aiming for growth, it's tempting to extend credit to attract more clients.

However, if you decide to work with customers with questionable credit histories, it's essential to set and communicate your credit terms firmly from the outset. Limit their access to your products or services until they demonstrate reliability. Always ensure that any business dealings are backed by a signed agreement to safeguard your interests.

Businesses aiming for smooth transactions should prioritise offering a variety of payment methods. This ensures that if one option is unavailable, another can be used to complete the transaction.

-

Offer multiple payment options

There are numerous payment options available for business transactions. Some are straightforward money transfers, while others use third-party intermediaries to facilitate the payment process. Many businesses prefer credit card transactions or bank transfers because of their convenience and efficiency.

By offering a wide range of payment methods, businesses not only cater to the diverse preferences of their customers but also increase their chances of receiving timely payments. This flexibility benefits the business and the customer, leading to efficient and hassle-free transactions.

-

Consider extending payment deadlines

When managing business finances, it's not uncommon to encounter overdue invoices. However, it's essential to discern whether a customer's delay in payment is chronic or due to temporary financial challenges. If it's the latter, consider offering flexibility. An extended payment deadline or instalment plans can be beneficial.

For instance, a customer unable to pay a lump sum of $10,000 might manage monthly payments of $500 over 20 months. Before implementing such measures, assess your business's cash flow to ensure it can handle potential short-term strains.

If immediate liquidity is a priority, consider accepting a partial payment, like $6,500 for a $10,000 debt, and then arrange a plan for the remaining balance. Such gestures, while aiding your cash flow, also foster customer trust and loyalty.

-

Offer a reward for early payment

Businesses often face challenges with late payments. One effective strategy to combat this is by offering early payment discounts. For example, a 2% discount on invoices paid within 10 days can motivate clients to settle their bills promptly. But discounts aren't the only incentive.

Companies can also provide perks like free shipping, bonus products, or even extended warranties to those who pay ahead of schedule. These incentives not only encourage timely payments but also foster a positive relationship between the business and its clients.’

-

Consider late fees

Introducing late fees can help businesses ensure timely payments. If you're considering this, clarity is essential. Define in your terms when payment becomes "late" and communicate this to your customers. When setting the fee, be transparent about its amount and the basis for its calculation.

While some businesses opt for a fixed percentage, others might use a tiered system based on the delay duration. It's essential to strike a fair balance for your business and the customer.

For instance, a high fee for a single minor delay might seem excessive. Instituting such fees emphasises the importance of punctuality, nudging customers to prioritise their payments.

-

Be organised

Being organised in handling finances is a cornerstone for successful business operations. When invoices are prioritised, and clear due dates are set, it underscores your commitment to professionalism. Sending timely reminders to customers about their dues can increase the likelihood of on-time payments. A streamlined and transparent process encourages customers to settle their bills without delays.

Moreover, maintaining a systematic record of all transactions helps in identifying patterns. You can easily spot which customers are regular defaulters and who are punctual. This data-driven approach allows for better planning, whether it's introducing early payment incentives or setting up more frequent reminders. In essence, an organised approach not only ensures timely payments but also builds a foundation of trust with your clientele.

-

Follow up with every client

Consistent follow-ups are essential in ensuring timely payments from clients. The process often starts with a courtesy reminder, which can be sent via phone, email, or a posted letter shortly after the payment becomes overdue. This initial reminder can address oversights or errors, such as payments made to incorrect bank accounts.

If the payment remains pending, it's crucial to send an overdue payment reminder. This can be done through another call, email, or letter, emphasising the outstanding amount and the importance of settling it.

If the client continues to delay, a final notice should be dispatched, urging them to address the overdue invoice. If emails or letters don't yield results, direct contact, like a phone call or even an in-person visit, can be more effective. This direct approach can foster a personal relationship, potentially facilitating future transactions.

However, if all these efforts don't lead to payment, more formal steps might be necessary. A formal demand letter can be sent, although this might strain the business relationship. After exhausting all communication avenues, a debt collection agency might be considered to recover the owed amount.

Having issues with the overdue payments?

Wrap up!

As a small business owner, ensuring customers pay on time is a top priority. The ten strategies you've learned offer a solid foundation. However, CleanSlate's expertise in accounts receivable management can take your approach to the next level. Our dedicated team focuses on providing meticulous attention to ensure accuracy and security throughout the process.

We've assisted numerous Australian businesses in boosting their cash inflow and optimising their working capital. Whether you need a streamlined invoice system or specialised reporting, we tailor our strategies to your unique business needs. With CleanSlate, you can confidently leave your accounts receivable worries behind and focus on a prosperous future. Get in touch with us to know more.