What is included in SMSF accounting services?

Introduction:

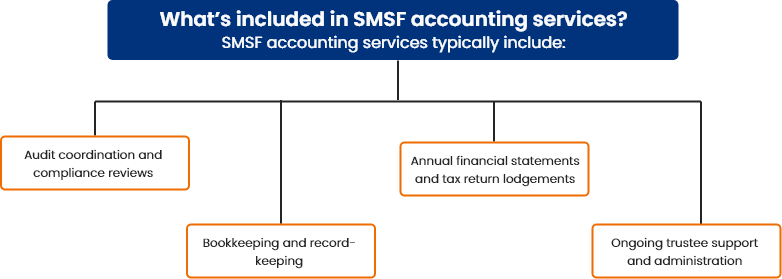

SMSF accounting services cover everything trustees need to manage their fund effectively, including record keeping, audits, annual lodgements, and compliance with ATO rules. Managing an SMSF is rewarding but can quickly become complex without the right support.

At CleanSlate, we provide complete end-to-end accounting services that help trustees stay compliant, organised, and confident about their fund’s performance. In this article, we explain what is included in SMSF accounting services, why working with a qualified accountant matters, and how our team supports every stage of your SMSF journey.

Key takeaways

SMSF accounting services cover setup, lodgements, and compliance.

Professional SMSF accountants help trustees meet ATO requirements.

SMSF bookkeeping ensures records stay complete and compliant.

Annual audits maintain compliance and protect fund status.

Financial statements and ATO lodgements are mandatory yearly.

CleanSlate provides SMSF accounting starting from $990 per year.

Why should trustees work with an SMSF accountant?

Some trustees attempt to manage their SMSF alone, but the risks are significant. The ATO applies a strict compliance framework, and breaches can lead to fines, rectification directions, frozen assets, or even a fund being made non-compliant and taxed at 45% of its income. In some cases, you can also be disqualified from running a fund again.

Without professional SMSF accounting services, you may face issues such as:

- Missing annual return deadlines or lodging them incorrectly

- Exceeding contribution caps or mismanaging pensions

- Breaching in-house asset rules or lending money to members

- Failing to keep proper records for the required five or ten years

An SMSF accountant helps you avoid these risks by managing compliance, maintaining accurate records, and preparing for audits. With expert support, your responsibilities as a trustee become easier to manage, and your fund stays on track with ATO requirements.

Here’s a closer look at each service.

SMSF accounting services we provide at CleanSlate

At CleanSlate, our SMSF accounting services cover all the major areas discussed below to ensure your fund remains accurate, compliant, and well-managed.

SMSF bookkeeping and record-keeping

Keeping accurate records is one of your most important responsibilities as a trustee. The ATO’s SMSF record-keeping rules require certain documents to be kept for five or ten years, and missing information can cause problems during audits or reviews.

Our virtual bookkeepers services help you stay compliant by:

- Recording all contributions, expenses, and investment income accurately

- Preparing member statements and maintaining balance records

- Documenting trustee meetings and investment decisions

- Organising records to meet ATO five- and ten-year retention rules

- Making sure your SMSF is always audit-ready

We manage your books so you don’t have to worry about missing data or compliance gaps. Everything stays organised, accurate, and up to date.

Investment compliance monitoring

With an SMSF, you have more freedom to choose your investments, but that freedom also comes with responsibility. Non-compliant investments can result in penalties or even the loss of your fund’s complying status.

We provide continuous monitoring to help you keep all investments within ATO guidelines. Our team will:

- Review your investment strategy to ensure it meets superannuation laws

- Check that asset valuations are updated each financial year

- Ensure investment decisions are supported by trustee minutes and documentation

- Identify prohibited transactions, such as loans to members or related parties

- Flag potential risks early and guide you in making compliant choices

With our support, you can invest confidently knowing your SMSF remains protected and fully compliant.

SMSF audit support

Every SMSF must complete an annual audit by an independent, ASIC-registered auditor to maintain its complying status. Missing or failing an audit can lead to penalties and loss of tax benefits.

At CleanSlate, we make this process straightforward by:

- Preparing and reviewing all audit documentation in advance

- Ensuring books of accounts and asset valuations are complete and accurate

- Providing the auditor with all required supporting evidence

- Addressing any issues before submission to avoid delays

- Liaising directly with the auditor on your behalf

Our goal is to ensure your audit is completed efficiently and without stress, keeping your SMSF compliant and ready for ATO lodgement.

Annual compliance and ATO lodgements

Once your audit is finalised, the next step is meeting annual compliance and reporting obligations. Every SMSF must prepare accurate financial statements, finalise its audit, and lodge the SMSF Annual Return (SAR) with the ATO each year.

At CleanSlate, we handle the full compliance cycle for you:

- Preparing year-end financial statements and member reports

- Managing ATO lodgements, including the SMSF Annual Return (SAR)

- Calculating income tax, credits, and supervisory levies

- Preparing and submitting Transfer Balance Account Reports (TBAR) when required

- Maintaining accurate records for ongoing ATO compliance

With us managing your annual obligations, you can stay confident that your SMSF remains compliant, up to date, and aligned with all ATO requirements.

Want to explore how the ATO monitors self-managed super funds? Check out our blog, “SMSF Compliance and the ATO,” for helpful compliance tips and insights.

Managing an SMSF doesn’t have to be complicated.

Book a call now

Ongoing SMSF administration and trustee support

Trustees often face year-round responsibilities that go beyond accounting. From recording member changes to staying updated with new super rules, ongoing administration plays a key role in keeping your fund compliant and organised.

Our SMSF administration support helps you manage these tasks efficiently. We:

- Keep records current, including contribution caps and pension payments

- Update investment strategies when members' needs or rules change

- Track legislative updates and explain how they affect your fund

- Handle documentation and reporting so your records are always audit-ready

With our support, you can focus on managing your investments while we take care of the daily administration your SMSF requires.

How much does SMSF accounting cost?

Understanding how much SMSF accounting costs is just as important as knowing what the work involves. We believe in simple, transparent pricing that helps you plan ahead without hidden extras or unpredictable bills.

We follow a fixed-fee model, so you pay for outcomes, not hourly rates. Each package includes the essential setup, accounting, and compliance tasks your fund needs to stay in line with ATO requirements.

SMSF setup fees- Simple SMSF: $450 (ex GST)

- With a corporate trustee: $1320 (ex GST)

- With property investment: $2375 (ex GST)

Fixed annual accounting fee

$990 per year (ex GST), covering:

- Preparation of annual financial statements

- Coordination of the independent audit

- Lodgement of the SMSF tax return with the ATO

For a deeper look at SMSF pricing trends, read our latest blog, “What Are the Average SMSF Accountant Fees in Australia? It explains how fees vary across different fund types and what to expect from fixed-fee models.

SMSF Accounting Services FAQs

What does an SMSF accountant do?

An SMSF accountant records transactions, prepares annual financial statements, manages ATO lodgements, and supports trustees during audits. The accountants at CleanSlate also monitor compliance deadlines and assist with year-end reviews to keep your fund operating smoothly.

Can accountants help with SMSF setup?

Yes. CleanSlate’s SMSF accounting team assists you in setting up your fund. From preparing key documents and registering with the ATO to ensuring all compliance requirements are met, we handle the entire setup process professionally.

To learn more about each stage of the process, you can also read our blog “How to set up and manage self managed super funds (SMSF)” which explains everything you need to know before getting started.

Do I need a financial adviser to manage my SMSF?

Not necessarily. Trustees can make their own investment decisions, but a licensed financial adviser can help design or review your investment strategy and ensure it aligns with superannuation laws and retirement goals.

Can I buy an Airbnb with my SMSF?

You can buy an investment property through your SMSF, including one used for short-term rentals, provided it meets ATO investment rules. The property must be held solely for investment purposes and cannot be used personally by fund members or related parties.

When is the SMSF annual return due?

The SMSF annual return is usually due by 28 February if your fund is registered with a tax agent. For newly established SMSFs or those lodging directly, the due date is 31 October each year.

What happens if an SMSF lodgement is late?

Late lodgements can lead to ATO penalties, removal from the Super Fund Lookup, and loss of tax concessions. Regular accounting support helps ensure deadlines are never missed.

Final thoughts

So if you have decided to use our SMSF accounting services, Book a call with our SMSF accountant.

We work closely with you to understand your fund’s needs and provide complete hands-on support at every stage, from setup and bookkeeping to annual audits and ATO lodgements.

Our team ensures every detail is managed with accuracy and compliance in mind. With our guidance, you can run your SMSF efficiently, avoid unnecessary stress, and stay focused on growing your retirement savings the right way.