Invoice management strategies every business should use to reduce late payments

Introduction:

Late payments continue to cause stress for businesses across Australia. Nearly 90% of small businesses report facing issues with late payments, according to research by the Australian Small Business and Family Enterprise Ombudsman. These delays are making it more difficult for business owners to cover ongoing expenses, manage operations, and plan ahead with certainty.

Nearly one in four businesses has had to seek short-term funding to manage the gaps caused by unpaid invoices. Time spent chasing payments often takes attention away from more valuable work and can hold back growth.

If your business is regularly impacted by delayed payments, it may be time to strengthen the way invoices are issued, tracked, and followed up. This blog outlines approaches that support better control over your billing process and help reduce the financial pressure caused by outstanding payments.

Key takeaways

Automate your invoicing to reduce manual errors and save time.

Send invoices immediately after the work is completed to speed up payment.

Set up automated reminders to follow up before and after due dates.

Offer small discounts for early payments to encourage faster settlement.

Add a polite thank you message to each invoice to maintain goodwill.

What is invoice management?

Invoice management is the process of handling invoices that a business receives from its suppliers. It involves receiving the invoice, checking if the information is correct, getting approval, making the payment, and keeping a record of it. This process helps a business avoid paying late, reduce mistakes, maintain good relationships with suppliers, and keep track of its spending.

Today, many Australian businesses use invoice management software to make this process faster and more accurate. Instead of managing paper documents or email manually, the software helps handle everything smoothly from the moment the invoice is received until the payment is made.

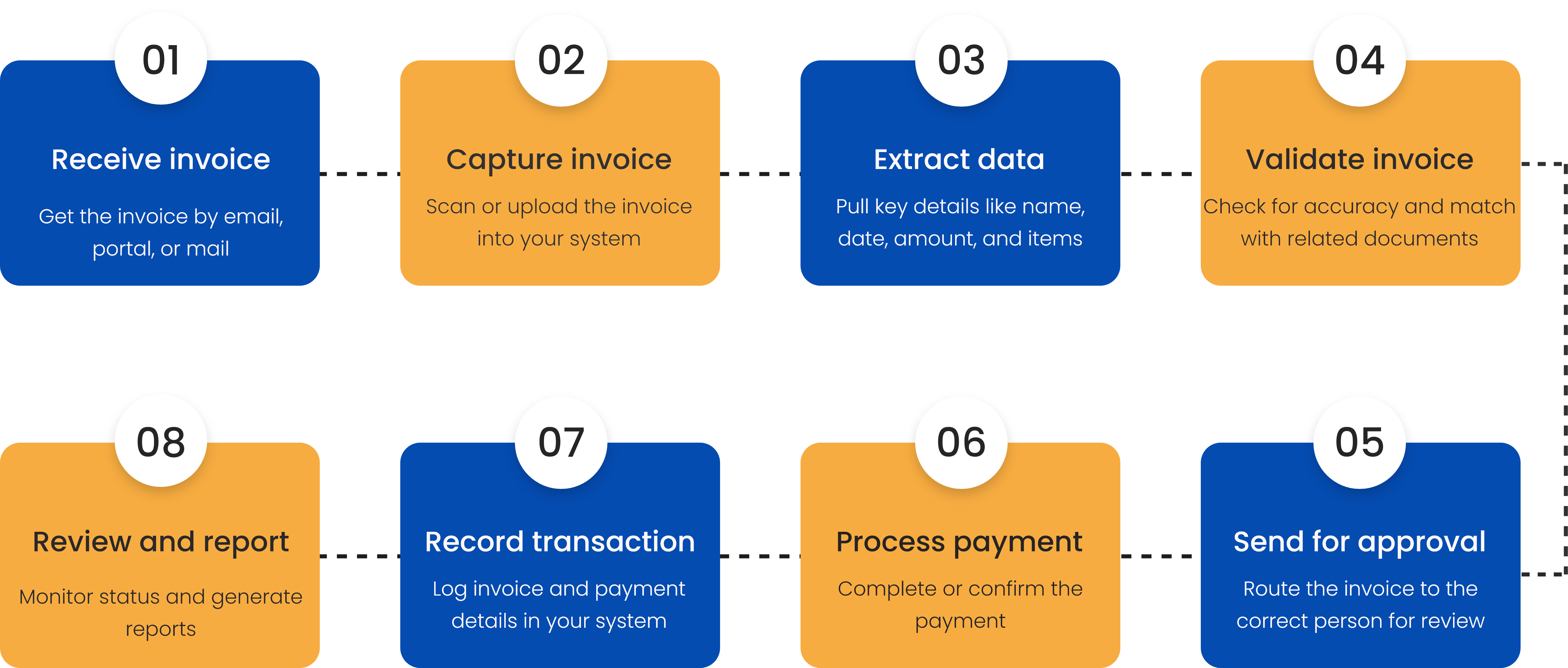

Invoice processing steps

Follow the steps below to ensure each invoice is handled accurately from receipt to reporting.

Best Invoice practices that help you get paid on time

While it may not be possible to avoid late payments altogether, the strategies below can help you manage them more effectively and minimise their impact on your business:

Automate your invoice process:

When you rely on manual processes for invoicing, you create more work for yourself. You may forget to send an invoice, lose track of whether it was paid, or fail to follow up promptly. These small errors can easily lead to delayed cash flow.

By using invoicing software like QuickBooks, Xero, FreshBooks, or Bonsai, you can create a system where invoices are generated automatically, scheduled in advance, and tracked through every step of the payment process.

Automation helps you eliminate repetitive tasks, reduce human error, and ensure consistency. In fact, recent data shows that businesses that automate their invoicing reduce processing time by more than 80 percent and receive payments nearly 50 percent faster. This means you spend less time chasing money and more time growing your business.

Issue invoices without delay:

One of the simplest ways to improve your cash flow is to bill promptly. Even a short delay after completing the work can increase the chances of late payment, often because clients become distracted, forget details, or face internal processing slowdowns.

When you invoice immediately, you keep the momentum going while the project is still top of mind for your client. This not only shortens the payment timeline but also reinforces that you run a professional, well-organised operation.

Did you know that, according to data released by Xero, businesses that invoice on the same day the job is completed are nearly 50 percent more likely to get paid on time? Prompt billing isn't just a best practice, it’s a proven way to improve cash flow and reduce the stress of chasing payments.

Use a professional invoice format:

A confusing invoice can result in payment delays, even from clients who are eager to pay you. If someone from your client’s accounting team cannot easily understand your invoice, they may set it aside or request clarification. You can prevent this by creating a clean layout that presents all the key information in a logical and easy-to-read manner.

Your invoice should clearly show your business name, the invoice number, the issue and due dates, a detailed description of services or products delivered, the applicable taxes, and the total amount due.

Payment instructions should be obvious, including your preferred payment methods and banking details. A visually organised invoice with no clutter or unnecessary information reinforces your professionalism and helps you get paid faster.

Provide multiple ways for clients to pay you:

Allowing your clients to choose from a range of payment options can significantly increase how quickly you get paid. Limiting payments to just one method, such as direct bank transfer, may unintentionally create friction, especially if it doesn’t align with your client’s preferences.

In Australia, payment behaviours are changing rapidly. Card payments remain dominant, with total transaction values rising by 5.8 percent year-on-year, led by strong growth in debit card use. Mobile wallets now account for 39 percent of card transactions, reflecting a sharp shift toward contactless and digital-first preferences.

At the same time, real-time bank transfers through the New Payments Platform (NPP) have grown by more than 17 percent in value, indicating broader adoption of instant, account-to-account payment methods for higher-value transactions.

These trends show that clients expect speed, convenience, and choice.

If you offer multiple payment methods such as credit cards, debit cards, mobile wallets like Apple Pay, or real-time transfers via NPP, you make it easier for clients to pay on time.

Follow up with a professional reminder system:

Clients often miss payment deadlines simply because they're caught up in other tasks. That’s why it helps to have a structured follow-up system. Following up once, or worse, not at all, leaves too much to chance. You need a structure that reminds clients before the due date, confirms receipt on the due date, and follows up again if payment has not been made.

You can use your invoicing software to automate these messages. Begin by sending a polite reminder three days before the invoice is due.

On the due date, send a confirmation that payment is expected. If no payment is received after three days, send a more assertive follow-up. Keep your tone professional and respectful, but firm. Consistency in communication significantly increases the rate of on-time payments.

Track invoice delivery and views:

Knowing whether a client has received and opened your invoice is incredibly helpful. It lets you tailor your follow-up approach and avoid unnecessary back-and-forth. If your invoice hasn’t been opened, your reminder might focus on verifying the right contact or resending the invoice. If it was opened and ignored, you may want to escalate the tone slightly in your next message.

Most invoicing platforms allow you to track when a client opens the invoice email or clicks on the payment link. This gives you valuable insight into the client’s responsiveness and helps you manage expectations. Businesses that use this data report significantly better results from follow-ups, with faster payment cycles and fewer disputes.

Align your invoices with signed contracts to prevent disputes:

Every invoice you send should reflect the terms outlined in a signed contract. A contract sets clear expectations, including what work will be delivered, when it will be completed, how much it will cost, and when payment is due. It also covers details such as late fees or special conditions. When your invoice follows these agreed terms, it reduces the chance of confusion or disagreement.

If you do not already use contracts for your projects or services, now is the time to start. A written agreement gives you a clear point of reference if a client questions an invoice. It supports your billing and helps avoid misunderstandings.

To make this connection stronger, you can mention the relevant part of the agreement directly in the invoice. For example, include the project phase or the contract date. This shows that your charges are based on what was agreed, helping to build trust and keep your payment process smooth.

Over $132 million was lost to invoice scams in Australia in just one year.

Offer discounts for prompt payment and fees for late payment:

You can shape client behaviour by offering small financial rewards for paying early or applying penalties for late payments. A common incentive is to offer a discount, for example, two per cent, if the invoice is paid within ten days. This not only encourages early payment but also strengthens goodwill.

At the same time, you should clearly communicate any penalties for overdue payments. Many businesses apply a one to five percent late fee for every 30-day period past the due date. Make sure these terms are included in your initial agreement and noted on the invoice.

Add a thank you message to your invoice:

At the end of every invoice, take a moment to thank your client. A short, sincere note like “Thank you for your business. We appreciate your prompt payment” adds a human touch that helps strengthen the relationship. It turns what could be a cold financial transaction into a respectful business interaction.

While it may seem like a small gesture, this type of language reinforces your brand, boosts professionalism, and can even increase client retention. People remember how you made them feel, and consistent appreciation leaves a lasting impression that goes beyond the numbers.

Streamline your invoice management process with CleanSlate

Need help staying on top of unpaid invoices? Our bookkeeping team at CleanSlate manages the entire receivables

Here’s what we take care of for you:

- Timely and accurate invoicing that reduces delays.

- Professional follow-ups that keep your clients accountable.

- Full visibility into which payments are complete and which are overdue.

- Precise reconciliation to ensure nothing slips through the cracks.

- Consistent reporting so you always know where your business stands.

Ready to stop chasing payments and start getting results? Book a call with one of our bookkeepers today.

Final thoughts

Getting paid on time shouldn’t be a constant challenge. A well-managed invoicing process helps reduce delays, limits the need for repeated follow-ups, and makes it easier to stay on top of clients' payments. Book a free consultation call with one of our bookkeepers today to help you improve how your business handles invoicing and keep payments on track.