How to prepare BAS for small business?

Introduction:

Mastering the intricacies of preparing a Business Activity Statement (BAS) is an important step for small business owners in Australia.

This pivotal financial document serves as a bridge between your business and the Australian Taxation Office (ATO), facilitating accurate tax reporting and payments. Despite its importance, the BAS often becomes a source of stress due to its complexity.

This blog aims to change that narrative by offering a step-by-step guide to simplify the BAS preparation process. From decoding tax codes to understanding GST calculations, we'll provide actionable insights to make your tax reporting less daunting and more efficient.

Key takeaways

Business Activity Statement (BAS) is a form that businesses must submit to the ATO in order to report and pay their tax.

Organising financial records is the first step in preparing an accurate BAS.

Accounting software can automate many tasks involved in BAS preparation, such as recording transactions and calculating GST.

Common mistakes in BAS preparation include clerical errors, incorrect tax classifications, and double-counting purchases.

What is the BAS statement?

The BAS statement is a government form that all businesses must lodge to the Australian Tax Office before the deadline. It's the business way of showing how much GST they paid or will pay during specific periods.

If you are registered for GST (Goods and Services Tax), the BAS statement needs to be lodged on a monthly, quarterly, or annual basis.

What taxes can you report and pay using your BAS?

Your BAS statement will help you report and pay for the following:

- Goods and services tax (GST)

- Pay-as-you-go (PAYG) income tax instalment

- PAYG withholding tax

- Fringe benefits tax (FBT) instalment

- Luxury car tax (LCT)

- Wine equalisation tax (WET)

- Fuel tax credits

Who should lodge a BAS?

If you're involved in any business that requires registration for the GST, then it is necessary to submit a BAS. You must submit a BAS if:

- Your business has a GST turnover (gross income minus GST) of $75,000 or more per financial year.

- You are a registered charity or not-for-profit organisation with an annual turnover of $150,000 or more.

- You are a taxi or ride-sharing driver no matter what your turnover is.

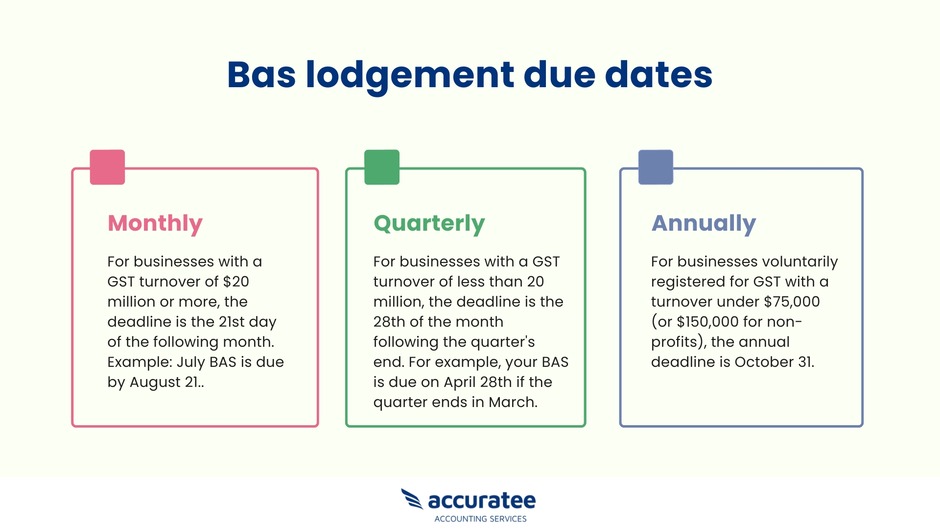

BAS lodgement due dates

Your BAS due date for lodging and paying is displayed on your BAS statement. If the due date is on a weekend or public holiday, you have until the next business day to get this done. You will be required to file your GST returns and make all necessary payments within one of the following timeframes

How to prepare a BAS statement for small business effectively before the given deadline?

Preparing your BAS statement is an important process. You can follow these simple steps to make sure you file it before the deadline:

-

Step 1: Organise your financial records

The first thing you need to do is get your financial records in order. This involves keeping track of all your sales and purchases. Use accounting software like Xero, or Quickbook to keep everything organised.

Make sure to reconcile your accounts to ensure that your bank statements match your accounting records. Also, record any cash expenses and purchases, as well as information related to the creditors.

-

Step 2: Identify missing transactions

Even with the best accounting software, there may be transactions that are missing or not automatically recorded. Go through your receipts and invoices to identify any missing transactions. For each, you'll need to record the date, the total amount of the transaction, the GST charged, and a brief description. This step is crucial for the accuracy of your BAS.

-

Step 3: Calculate GST

Once all transactions are documented, it's time to compute the Goods and Services Tax (GST). Your accounting software will likely have a feature that allows you to generate an activity statement summarising the GST you owe or are owed for the tax period. Alternatively, you can use our specialised GST calculator for precise calculations. Always ensure to double-check your figures, as mistakes can result in penalties.

-

Step 4: Calculate PAYG withholdings

If your business employs staff, it's essential to compute the PAYG withholdings, which represent the tax deducted from their salaries. Examine your payroll records, noting both the tax withheld and the total wages for each worker.

Efficient payroll services can further streamline the PAYG withholding calculations, ensuring timely and accurate wage distributions to employees. However, if you don't have any employees, you can bypass this step.

-

Step 5: Fill out the BAS form

Now that all the calculations are done, you can start filling out the BAS form. This will include the amount of GST you owe or are claiming back, the PAYG tax you've withheld, and any PAYG instalments you've made. Double-check all the numbers for accuracy. If your business also deals with other taxes like Luxury Car Tax or Wine Equalisation Tax, include those as well.

-

Step 6: Review and make adjustments

Before you submit the BAS, review all the information carefully. If you find any errors or discrepancies, now is the time to correct them. This is also the time to make any adjustments for errors in past BAS submissions.

-

Step 7: Lodge your BAS

You have several options for lodging your BAS. You can use your accounting software if it has this feature, lodge it through your myGov account, use the ATO's online business portal, or have a registered tax agent lodge it for you. Choose the method that's most convenient for you.

-

Step 8: Keep records

After lodging your BAS, it's vital to refresh your records. Engaging a bookkeeping service provider guarantees precision in the documentation. This meticulous approach is essential for future audits and financial accuracy.

What are the different BAS statement mistakes I can make?

Here are a few of the common mistakes you can make while preparing your BAS statement:

- Clerical or transposition errors

- Classifying a GST-free sale or purchase as taxable

- Classifying a taxable sale or purchase as GST-free

- Double counting some of your purchases.

How can I rectify mistakes made in the BAS statement?

if you have realised that you’ve made a mistake on an activity statement that’s already been lodged, you can correct a mistake on your next BAS or revise the original statement. Depending on whether it was a debit or credit error, different conditions may apply.

If you have made any mistakes relating to GST and fuel tax credit, they can be corrected in your next BAS. If you can't resolve your mistake in your next BAS, you need to lodge a revision. You can find more information about fixing BAS mistakes or making adjustments on the ATO website.

Are correcting mistakes made on earlier BAS the same as making an adjustment?

Making an adjustment to your BAS statement is different from correcting a mistake.

An adjustment relates to a reported sale or purchase that was correct at the time of lodgment, but something occurred later that changed its value in accordance with current taxation laws.

For example, you may have reported a GST-inclusive figure, but the item was actually GST-free. In this case, you would make an adjustment to your activity statement.

On the other hand, a mistake is when you incorrectly report a sale or purchase amount in your activity statement.

Feeling overwhelmed with BAS preparation?

Tips to make the BAS statement process easy for you

Here are some tips you can follow to make the process of preparing and lodgment of your BAS statement easier:

-

Make a habit of collecting and storing business receipts for 5 years

The Australian Tax Office is strict about taxation. Hence, it is important for you to keep track of all receipts related to sales, expenses, wages, or other business costs as well taxes.

This will help ensure there are no discrepancies with your revenue and expenditure records in case they're requested by the ATO. Anyhow ensure to keep all your tax invoices and other GST records for five years.

-

Ensure to cross-check invoices

To make the statement process easier, it's important to cross-check whether any particular invoice has been recorded twice. At the same time, make sure you don't forget to enter the invoice or receipt of any business transactions.

It's always better, when submitting your work manually, that you calculate yourself and check figures before submission so there are no mistakes on behalf of our business.

-

Ensure to fill only relevant fields

Ensure to fill only the relevant fields in your BAS statement. And if there's nothing else required to report, just enter a zero.

The best way to avoid additional fees or taxes on your earnings at work is by entering the whole dollar amount and leaving cents out. You can't round up any dollars because this could result in an expensive rounding error.

-

Use the correct accounting method

There are two types of GST accounting methods- Cash accounting and accruals accounting. You should use the one that is most suited to your business. If your business is big, you might be required to use the accruals method. However, if you have a small business, the cash method would suffice.

The main difference between the two methods is the timing of when you report GST. Under the accruals method, GST is reported on income as soon as it is earned, regardless of when the money is actually received. Conversely, under the cash method, GST is only reported on income once it has been received.

-

Check the ATO website for updates

The Australian Taxation Office is always updating its website with the latest information, so it's important to check there regularly. This will help you keep up to date with any changes that may affect your business activity statement.

-

Seek professional help

If you're still unsure about anything to do with your BAS statement, you can seek professional help. This can be from a registered tax agent or BAS agent. You can even outsource the entire BAS lodgement process to a professional company like CleanSlate.

Conclusion

Preparing a Business Activity Statement (BAS) for a small business in Australia is a meticulous but essential task. It serves as a vital link between your business and the Australian Taxation Office (ATO), requiring accurate reporting of various taxes like GST, PAYG, and others.

While the process can be complex, leveraging accounting software and professional help can make it significantly easier. If you find yourself struggling to lodge or prepare your BAS, don't worry—We are here to help!

At CleanSlate, our team of experts can assist you in every step of the process, from understanding what's included in a BAS to rectifying any mistakes made on previous statements.

By staying organised, double-checking your work, and keeping abreast of ATO updates, you can make the BAS preparation and lodgment process less daunting and more efficient. Contact us today for more information or assistance with lodging your next BAS statement.