How CleanSlate helps Australian businesses stay organised with their bookkeeping?

Is our team spending more time fixing receipts, sorting invoices and updating accounts than actually serving customers or growing revenue? Many businesses lose hours each week on bookkeeping tasks that should take far less time.

This is not just tiring. It slows cash flow, increases ATO risks and disrupts your ability to stay organised and make confident decisions. When bookkeeping falls behind, the impact spreads quickly across the entire business.

Over the past few years, our professional online bookkeepers have helped hundreds of Australian businesses get their books in order, reduce manual admin hours and regain better control of their numbers. Your accounts stay accurate, your BAS is prepared on time and your payroll checks run without interruption.

If you want your bookkeeping handled properly so your energy goes back into running the business, this blog post shows exactly how CleanSlate keeps your accounts updated and compliant.

Key takeaways

Eliminate tax season stress with fully organised books of accounts that are ATO-compliant and ready for reporting.

Payroll is made easy as we handle everything from superannuation calculations to STP submissions.

Our expert team ensures timely BAS preparation and lodgement keeping your business compliant.

Enjoy fixed monthly pricing so you know exactly what to expect without surprise fees or costs.

Why is bookkeeping important for your business?

Bookkeeping is often seen as a basic admin task, but it has a direct impact on how your business runs each day. When your records are updated regularly, you can see what is coming in, what is going out and how the business is tracking overall.

It also supports the requirements outlined in the ATO record-keeping guidelines, which explain what needs to be kept, how long it must be stored and the level of detail expected.

When bookkeeping falls behind, cash flow becomes difficult to manage, bills are missed, GST gets confusing and planning for the months ahead becomes challenging. A consistent bookkeeping routine gives you:

- organised records to support day to day decisions

- a clearer understanding of whether the business is profitable

- assurance that GST, payroll and BAS are handled properly

- quicker access to information for your accountant or the ATO

- a routine that prevents last minute catch ups

Many businesses face challenges not because they lack customers, but because their bookkeeping is inconsistent. CleanSlate keeps your accounts organised, updated and aligned with how your business operates, so your numbers help you move forward instead of holding you back.

Fixed monthly fee for

a defined scope of services

Many clients appreciate having bookkeeping and tax services under one roof, while also enjoying the predictability of a fixed fee. Below is our indicative fee for a standard scope of work:

Cancel anytime

Cancel anytime

Unlimited support

Unlimited support

Quick onboarding

Quick onboarding

Only Bookkeeping & BAS

Only bookkeeping and BAS (Does not cover tax returns, payroll and super):

$165/month *ex GST

Bookkeeping & Tax combined

For bookkeeping, BAS and tax returns (but no payroll or super included):

$225/month *ex GST

Bookkeeping, Tax & Payroll

All inclusive package: Bookkeeping, BAS, payroll, Super and tax returns:

$280/month *ex GST

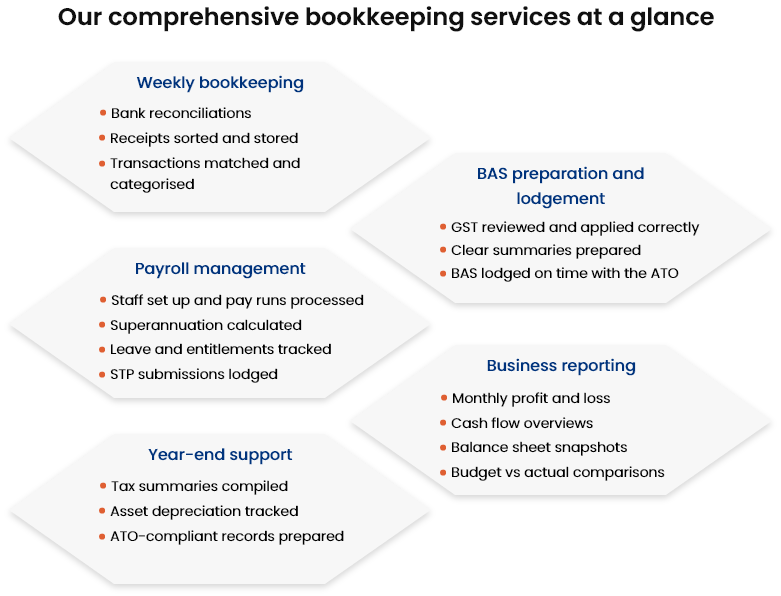

What CleanSlate’s online bookkeeping team manages for your business?

Small business owners often do not need one or two hours of bookkeeping each week. They need a complete bookkeeping system that keeps accounts updated, supports cash flow and removes the pressure of staying on top of day to day financial admin.

At CleanSlate, we provide exactly that.

A structured, tech enabled bookkeeping service where our team manages the entire process from start to finish.

Let’s explore in detail how CleanSlate handles every aspect of your bookkeeping.

Your accounts updated properly each week

When transactions fall behind, visibility drops and decisions become slower. Our team keeps your books of accounts updated consistently so your numbers always reflect what is happening in real time.

We take care of:

- Matching payments and receipts to the correct accounts

- Fixing entries that sit in the wrong place or create confusion

- Organising receipts and documents for audit readiness

- Making sure supplier and customer balances align

- Maintaining bookkeeping cycles throughout the month

This keeps your books tidy and your information ready for review whenever you need.

Ready to get your books organised without the stress?

Book a call now

BAS preparation done early so you never miss a lodgement

BAS often becomes stressful when records are incomplete, GST is misapplied or the review is left until the last moment. At CleanSlate, our BAS preparation and lodgement support removes this pressure by checking your accounts carefully and getting everything ready well before the deadline.

We take care of:

- Reviewing transactions to ensure GST is applied correctly

- Identifying any issues that could affect your BAS

- Preparing summaries in an easy to understand format

- Lodging your BAS with the ATO through the right channels

- Monitoring upcoming BAS periods and reminders so nothing is missed

This keeps your compliance steady throughout the year and prevents any last minute rush.

Explore these helpful reads

Payroll managed correctly every pay cycle

Payroll often becomes one of the most time-sensitive tasks in a business. A late payment, an incorrect super amount or a missed STP submission creates unnecessary pressure and disrupts your week. Our payroll management support that keeps every step organised, compliant and handled on time.

We take care of:

- Setting up new employees

- Weekly, fortnightly or monthly pay runs

- Reviewing requirements under the Fair Work payroll obligations

- Super calculations

- Single Touch Payroll submissions

- Leave entitlements

- Year-end payroll summaries

Your team is paid correctly, your records stay up to date and your payroll obligations are managed consistently throughout the year.

Receivables and payables that keep your cash flow predictable

Cash flow becomes unpredictable when customers delay payments or when supplier bills are left unattended. Our team manages your receivables and payables so your incoming and outgoing money stays organised across the month.

Accounts receivable

With our accounts receivable management, your invoices are issued on time and overdue customers are followed up professionally so payments keep moving.

We take care of:

- Issuing invoices promptly

- Tracking overdue accounts

- Sending follow ups

- Maintaining communication notes

Accounts payable

Our accounts payable management ensures every supplier bill is recorded, scheduled and reviewed properly so nothing is missed. We take care of:

- Recording supplier bills

- Organising due dates

- Scheduling payments

- Reviewing supplier statements

When receivables and payables are handled consistently, your cash flow becomes more stable and far easier to manage.

Prepare reports that help you understand Your numbers without confusion

Reports only matter when they are presented in a way that makes sense. Our team helps you prepare financial statements that give you a proper view of how your business is performing and what may need your attention.

You receive:

- Profit and loss summaries

- Cash flow overviews

- Balance sheet snapshots

- GST summaries

- Budget versus actual comparisons

Everything is explained in simple terms so you can understand your numbers and use them confidently in day to day decisions.

Tax time ready books every month, Not once a ear

Tax time becomes overwhelming when records are incomplete or details are scattered across different systems. Our team maintains your accounts throughout the year, which allows us to support the preparation of your business tax return with organised, up to date data that is ready when needed.

We take care of:

- Reviewing expenses so deductible items are recorded properly

- Tracking asset purchases and maintaining depreciation details

- Keeping accurate records of loan movements and interest

- Preparing summaries for payroll, super obligations and liabilities

- Compiling year end reports that align with ATO requirements

Did you know?

How do we keep your books of account secure?

Bookkeeping involves handling sensitive information, and businesses need assurance that their data is protected at every step. At CleanSlate, we use secure systems and defined processes to safeguard your records from the moment they are received to the moment they are stored.

We maintain security by:

- Using encrypted platforms for all bookkeeping activities and document access

- Keeping information within approved cloud environments with restricted permissions

- Applying role based access so only authorised team members handle your records

- Following documented procedures for file handling, storage and internal reviews

- Maintaining audit trails and activity logs for full transparency

These measures ensure your records remain protected, confidential and handled in a professional, secure environment at all times.

Why do Australian businesses choose CleanSlate for their bookkeeping needs?

Businesses choose CleanSlate because we provide support that goes beyond routine entries. Our team works consistently, maintains professional communication and manages the full scope of bookkeeping requirements that small businesses deal with each month.

With affordable pricing and an experienced local team, you receive organised support without needing to coordinate multiple service providers.

Clients choose us because they receive:

- A bookkeeping partner who responds promptly and explains processes in a way that is easy to follow

- A team that understands day to day business pressures such as cash flow timing, supplier expectations and seasonal workload changes

- Bookkeeping, payroll, BAS and tax time readiness delivered from one trusted place

- Fixed pricing suited to small business budgets with no unexpected charges

- Systems and workflows established correctly to reduce repeated issues and prevent unnecessary rework

- Support from a team familiar with Australian regulations, deadlines and common compliance requirements

CleanSlate vs DIY bookkeeping vs hiring a in-house bookkeeper

Bookkeeping can be handled in different ways, but each option works very differently. DIY bookkeeping becomes time consuming as transactions grow, and the hidden cost of doing your own bookkeeping starts to show in the form of missed entries, slow reconciliations and avoidable GST mistakes. In-house bookkeepers can help, although their consistency often depends on workload. The table below compares all three choices.

| CleanSlate vs DIY bookkeeping vs Hiring an in-house bookkeeper | ||||

|---|---|---|---|---|

| Features | DIY bookkeeping | In-house bookkeeper | CleanSlate | |

| Weekly update | Sometimes | Depends on workload | Always | |

| BAS preparation | Usually last minute | Depends on schedule | Done Early | |

| Payroll accuracy | High risk of errors | Moderate | Professionally managed | |

| Cash flow support | Limited time | Limited | Full AR and AP support | |

| Fixed monthly cost | No | No | Yes | |

| Data security | Varies | Depends on internal controls | Secure cloud system | |

| Year end readiness | Unpredictable | Varies | Always prepared | |

Signs you are ready for professional bookkeeping support

Many businesses reach a point where inconsistent records start causing issues. You may be ready for support if:

- You spend evenings or weekends fixing entries

- BAS work is delayed often

- Cash flow feels unpredictable

- Reconciliations fall behind

- Your accountant requests corrections every year

CleanSlate steps in to organise everything and keep the cycle steady

FAQs about CleanSlate bookkeeping services

1. Do I need to switch software to work with CleanSlate?

Not necessarily. We work with leading cloud bookkeeping software such as Xero bookkeeping software, QuickBooks Online bookkeeping and MYOB bookkeeping software, and we adapt to whichever platform your business already uses. If your current setup is working well, we continue within that system without requiring any changes.

If we identify issues such as duplicate accounts, unclear categories or bank feeds that do not reconcile properly, our team can suggest improvements or a staged transition if needed. Every change is discussed with you first and planned carefully so your daily operations continue without disruption.

2. What information do I need to provide each month?

Most of your activity feeds directly into the system through bank connections and uploaded documents, so you only need to provide items that do not appear automatically. This may include once off purchases, funding documents, new contracts or updates that affect how transactions should be recorded.

At the beginning, we guide you on exactly what to send and how to send it. As the months progress, this becomes a short, predictable process rather than something you need to think about each week.

3. Can CleanSlate help if my books are already behind?

Yes. Many businesses start with us when their records are incomplete or significantly out of date. We begin by reviewing what exists, identifying gaps and rebuilding the missing periods so everything aligns with your statements and activity.

After this catch up stage, your bookkeeping moves into a consistent routine where entries are maintained properly each month, preventing you from returning to the same backlog again.

4. How do I know if my business is ready for professional bookkeeping support?

Many business owners realise over time that bookkeeping is taking more effort than it should. A few common signs include:

- Spending too much time handling admin instead of running the business

- BAS or tax work being delayed because records are not complete

- Relying on old numbers or estimates to make decisions

- Regularly falling behind on reconciliations

- Feeling unsure about cash flow or upcoming payments

If you often end up doing bookkeeping at the end of the week or late at night, or if your accountant needs extra time every year to fix your records, it is usually a sign that professional bookkeeping support from CleanSlate would make a significant difference.

5. How does CleanSlate’s bookkeeping pricing work?

Our bookkeeping pricing is based on fixed monthly packages, giving you predictable costs without hourly surprises. Each package includes a clearly defined scope of work, whether you need bookkeeping and BAS only, bookkeeping with tax returns, or the full bookkeeping, tax and payroll option.

Before you start, we review your business activity and recommend the package that suits your transaction volume and requirements. This makes your monthly cost consistent and ensures you only pay for the level of bookkeeping your business actually needs.

Final thoughts

Bookkeeping should feel manageable, not overwhelming. When your accounts are kept up to date, it becomes much easier to understand where your business stands and what needs attention.

Our team helps keep things organised so you are not spending nights fixing entries, sorting receipts or trying to piece together what happened during the month. You get steady support that fits the pace of your business and takes the pressure off your shoulders.

If you want your bookkeeping to feel lighter and more structured, we can guide you through a simple setup that keeps everything on track. Contact us today and see how easy it can be to stay organised throughout the year.