Emerging technologies in bookkeeping and taxation: Opportunities and challenges

Introduction:

In the age of rapid digital transformation, every industry is undergoing profound changes. The world of bookkeeping and taxation is no different. It's experiencing a seismic shift, powered by innovative technologies that promise to reshape how we manage business finances. These technologies bring in a new era of possibilities, streamlining financial processes, and making them more efficient and accurate than ever before. However, they also introduce a new set of challenges that businesses need to navigate.

In this blog post, we'll delve into some of the most significant technological advancements currently revolutionising the field of bookkeeping and taxation. We'll explore the opportunities they present and the challenges they pose, and how your business can adapt to take full advantage of this technological evolution. Whether you're a tech-savvy entrepreneur or a business owner just starting to dip your toes into the digital landscape, this post will provide valuable insights to guide your journey.

Key takeaways

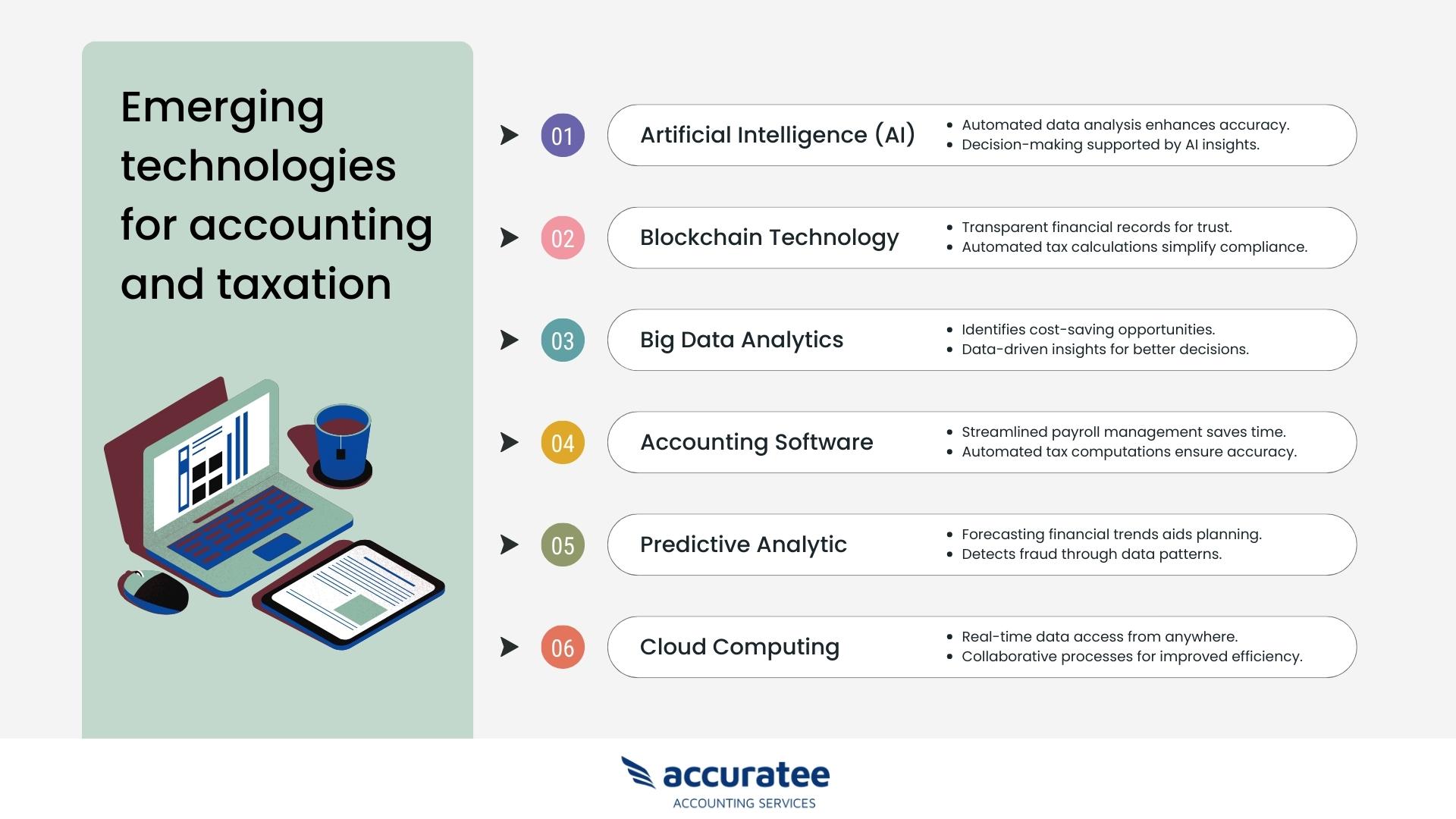

Emerging technologies (AI, Blockchain, Big Data Analytics, etc.) are transforming bookkeeping and taxation, offering efficiency and accuracy.

Comprehensive technology assessments are essential to identify areas where emerging technologies can be integrated for maximum impact.

Phased implementation of new technologies minimises disruption and allows teams to adjust gradually.

Outsourcing certain bookkeeping and taxation tasks to experts can ensure seamless integration of emerging technologies and dedicated support during the process.

Emerging accounting and taxation technologies that business must keep an eye on

So, let us look at the latest accounting and taxation technologies that you must take note of:

-

Artificial intelligence (AI):

AI has significantly transformed the fields of bookkeeping and taxation, providing numerous benefits. In bookkeeping, AI-powered tools streamline data analysis, categorization, and error detection, improving accuracy and efficiency. This enables accountants to focus on more valuable tasks, like financial analysis and client advisory, leading to better financial insights and decision-making for businesses.

In taxation, AI assists with tax research, data analysis, and monitoring law changes, empowering tax professionals with quick and accurate answers to complex queries. It also facilitates strategic tax planning and compliance efforts. As AI technology continues to advance, its potential in bookkeeping and taxation will unlock new opportunities for valuable insights and efficiency, benefiting businesses of all sizes. By leveraging AI, companies and professionals can achieve greater productivity and better financial management.

-

Blockchain technology:

Blockchain technology offers immense potential for bookkeeping and taxation. Its main value lies in its ability to record financial transactions transparently and securely on a tamper-proof, distributed ledger. In accounting, blockchain offers transparent, real-time financial records, enhancing the auditing process.

As for taxation, each transaction recorded on the blockchain can be used to automatically calculate tax liabilities, eliminating errors in manual computations. Blockchain's potential to resolve issues related to double taxation in international transactions further solidifies its importance in taxation.

-

Big data analytics:

Big Data Analytics is revolutionising the approach to accounting by processing vast amounts of financial data to identify cost-saving opportunities or areas for financial process improvement. It provides insights into customer behaviour, enabling businesses to make data-driven decisions that boost profitability.

In the realm of taxation, big data can compare a company's tax situation with similar entities, offering a comparative standpoint and highlighting areas for improvement. It's also used by tax authorities to identify fraud and non-compliance, enhancing the efficiency of tax administration.

-

Accounting software:

Accounting softwares such as QuickBooks and Xero revolutionise the realm of accounting and taxation. These solutions monitor revenue and expenses, facilitate hassle-free payroll management, and make invoice creation a breeze. Additionally, such tools automate computations for Goods and Services Tax (GST) and assist with the compilation of Business Activity Statement (BAS) filings. Adherence to the regulations prescribed by the Australian Taxation Office (ATO) is ensured, making these software solutions a vital asset for businesses.

-

Predictive analytics:

Predictive analytics uses statistical algorithms and machine learning techniques to predict future outcomes based on historical data. In accounting, it helps forecast financial trends and cash flows, informing strategic financial decisions. Predictive analytics also identifies potential risks and anomalies in financial data, acting as an early warning system for fraud detection. In terms of taxation, it can forecast tax liabilities based on past trends and business performance, enabling proactive compliance measures.

-

Cloud computing:

Cloud computing in the realm of bookkeeping and taxation is revolutionising how businesses manage financial data. By storing data and software on remote servers, businesses can access real-time updates and collaborate on financial matters from any location with internet connectivity.

Cloud accounting platforms facilitate seamless tax computation, filing, and record-keeping, significantly improving productivity. It also enables businesses to scale resources according to their needs, making it an economical solution for small businesses looking to optimise their bookkeeping processes.

Opportunities offered by technology in bookkeeping and taxation

-

Cost reduction:

As technology becomes more prevalent, the costs of many bookkeeping and taxation processes are reduced. Tasks that required several hours of human labour can now be done automatically, saving a considerable amount of time and money.

-

Scalability:

As businesses grow, their financial needs become more complex. Emerging technologies offer scalability to adapt to the changing needs of businesses, without requiring significant investments in additional human resources.

-

Improved client retention:

With advanced data analysis, businesses can understand their client's needs better and provide personalised service, leading to improved client satisfaction and retention.

-

Opportunities for remote work:

The increased use of cloud-based applications enables remote work possibilities for bookkeepers and tax professionals, allowing businesses to access talent regardless of geographic location.

-

Integration of multiple systems:

Emerging technologies often come with the capability to integrate various systems, which can centralise and simplify the bookkeeping and taxation process, making it easier to manage.

Expert Bookkeeping at Your Fingertips!

Challenges in adopting emerging technologies in bookkeeping and taxation

-

Data security concerns:

With increased digitization, the risk of data breaches and cyber-attacks grows. Companies must ensure their data is secure and meets all the necessary compliance requirements, which can be challenging and costly.

-

High implementation costs:

The initial setup cost for new technologies can be significant. Small businesses need to consider this financial impact and evaluate if the long-term benefits justify the upfront expense.

-

Technology compatibility:

Sometimes, new technologies may not integrate well with existing systems, leading to potential operational issues or the need for additional investment in compatible infrastructure.

-

Learning curve:

The adoption of new technologies often comes with a learning curve. Training staff to use new tools can be time-consuming and may initially impact productivity.

-

Regulatory compliance:

As technology evolves, so do regulations. Keeping up with changes in financial reporting standards, data privacy laws, and taxation rules can be challenging for businesses, especially small ones without dedicated legal or accounting departments.

Strategies to overcome challenges in adopting emerging technologies in bookkeeping and taxation

To overcome the challenges presented by the adoption of emerging technologies, businesses can employ several strategies. Here's how they can navigate through these hurdles and fully embrace the potential benefits of these new tools and technologies.

-

Comprehensive technology assessment:

Begin by conducting a comprehensive assessment of your current bookkeeping and taxation processes. Identify pain points, inefficiencies, and areas that could benefit from the integration of emerging technologies. Understanding your specific needs will guide you in selecting the most suitable technologies for your organisation.

-

Phased implementation:

Avoid overwhelming your organisation by taking a phased approach to implement emerging technologies. Start with a pilot project or choose one or two technologies that offer the most immediate value. Gradually expand the implementation as your team becomes comfortable and gains expertise in using these technologies.

-

Investing in cybersecurity measures:

Investing in robust cybersecurity measures is crucial to protecting your financial data. Consult with cybersecurity experts to identify potential vulnerabilities in your systems and implement the necessary measures to protect your data. Cyber insurance can also be considered to cover potential financial losses in the event of a data breach.

-

Regulatory compliance consultation:

Given the rapid changes in financial reporting standards and tax regulations, businesses can benefit from consulting with legal or accounting experts who specialise in compliance. These professionals are up to date with the latest changes in regulations and can provide guidance on the necessary system updates or procedural changes. This approach can help businesses avoid costly penalties associated with non-compliance and stay on the right side of the law.

-

Outsourcing to expert service providers:

Businesses who lack expertise can consider outsourcing certain bookkeeping and taxation tasks to specialised service providers who have expertise in utilising emerging technologies. Partner with reputable vendors who can seamlessly integrate with your existing systems and provide dedicated support during the integration process.

How CleanSlate empowers your business amidst technological evolution?

In the ever-evolving landscape of digital technology, navigating the realm of bookkeeping can appear intricate and challenging. At CleanSlate, we strive to simplify this process for you. Our comprehensive outsourced bookkeeping and taxation services are designed to empower small businesses to embrace these technological transformations seamlessly.

Being ISO 27001 certified, we adhere to internationally recognized best practices for information security management. This highlights our commitment to ensuring the security and integrity of your sensitive financial data.

Harnessing the potential of emerging technologies, we deliver efficient and dependable services. From utilising cloud accounting for real-time financial insights to leveraging AI for error minimization and process automation, we integrate innovative solutions for enhancing your business's financial management.

At CleanSlate, we're not just about keeping up with the latest technological advancements; we're about leading the charge. We continuously update our services and methodologies to stay at the forefront of technological innovation in our sector. This commitment ensures that our clients are always equipped with the most secure, efficient, and cutting-edge bookkeeping solutions.

Ending note

In our fast-paced, digital era, bookkeeping and taxation are changing dramatically, driven by innovative technologies. These changes bring forth new ways of doing things, potentially making businesses run smoother and more effectively. While embracing these new technologies might seem daunting, it is crucial to remember that the end goal is to streamline operations, save time, and improve overall efficiency.

At CleanSlate, we are equipped to assist businesses in this journey, simplifying the process and making it easier for you to adjust to the digital shift. We use top-tier technology to manage your financial matters, ensuring your data's safety and reliability.

As your trusted partner, we will guide you through this evolving landscape, offering our expertise and technological solutions tailored to your needs. Our goal is to help your business not just keep up, but thrive amidst these technological advancements.