How CleanSlate helps small and medium businesses get accurate financial reports with ethical bookkeeping services?

Introduction:

In the fast-paced world of small and medium businesses, accurate financial reports are the compass that guides success. They provide valuable insights, enable informed decision-making, and ensure compliance with legal requirements. However, for many business owners, navigating the intricacies of bookkeeping can be overwhelming and time-consuming.

That's where CleanSlate comes in, your trusted partner in providing tailored outsourcing bookkeeping services for small business. With a strong commitment to ethics and precision, we empower businesses to unlock their financial potential and achieve reliable, timely, and accurate financial records.

At CleanSlate, we understand that managing bookkeeping tasks can be a challenge for small and medium businesses juggling multiple responsibilities. That's why we offer comprehensive bookkeeping service specifically designed to alleviate the burden and help you focus on what you do best—running and growing your business.

With our expertise and dedication, we ensure your financial statements are not just accurate but also reflect the true financial health of your business. Read on to understand how we achieve this feat with our ethical bookkeeping outsourcing services.

Key takeaways

Leverage secure and advanced bookkeeping software to streamline processes and maintain accurate records for financial reporting.

Utilise popular bookkeeping software, such as Xero, MYOB, and QuickBooks.

Embrace automation tools to reduce manual effort and minimise the risk of human error.

Rely on CleanSlate for accurate financial reports, ethical bookkeeping services and real-time data synchronisation.

What is financial reporting?

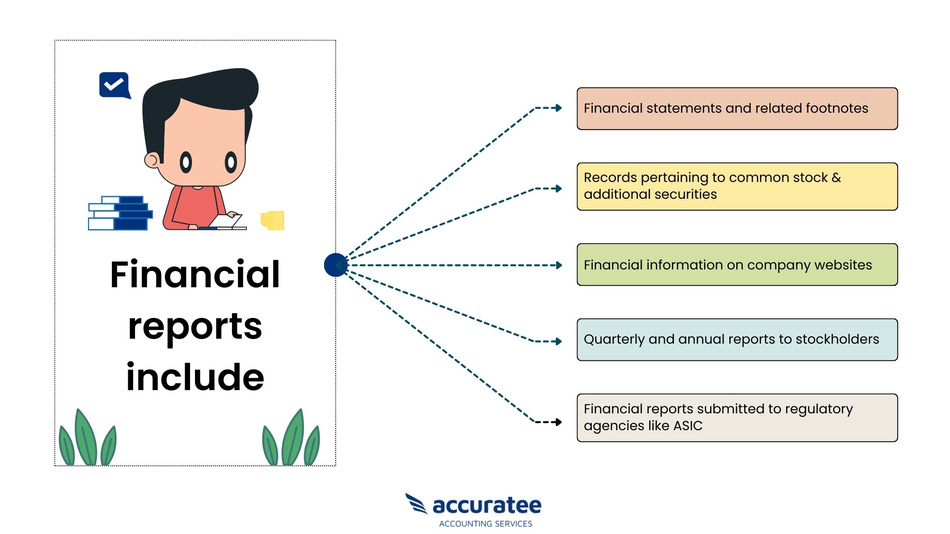

Financial reporting refers to the process of preparing and presenting financial information about a business or organisation to various stakeholders. It involves documenting, summarising, and disclosing relevant financial data, which provides insights into the financial performance, position, and cash flows of the entity.

The financial reporting in Australia is based on the International Financial Reporting Standards (IFRS). The Australian Accounting Standards Board (AASB) plays a significant role in setting these standards, ensuring consistency and comparability in financial reporting practices.

Furthermore, financial statements must comply with Australian Tax Office (ATO) requirements, ensuring proper disclosure of taxable income, deductions, and other relevant tax-related information.

What are the different types of financial reports?

Financial reporting generally includes the preparation of accurate financial statements, which are standardised reports presenting the financial results and position of a company. The primary financial statements include:

-

Balance sheets:

Balance sheets present the financial position of the company at a specific point in time, showcasing its assets, liabilities, and shareholders' equity.

-

Income statements:

Also known as the profit and loss statement, it provides a summary of the company's revenues, expenses, gains, and losses over a specific period. Income statements show the net profit or loss generated by the business during that period.

-

Cash flow statements:

Cash flow statements highlight the inflows and outflows of cash and cash equivalents from operating activities, investing activities, and financing activities. It shows how changes in balance sheet accounts impact the company's cash position.

-

Statement of changes in equity:

It outlines the changes in the company's shareholders' equity during a specific period, showing contributions, distributions, and changes due to profit or loss.

Why is financial reporting necessary?

Financial reporting serves several purposes, including:

-

Decision-making:

Accurate financial reporting is essential for conducting analysis that underpins business decisions. The utilisation of financial statements enhances accountability and facilitates the examination of crucial financial information. Key documents such as income statements and balance sheets offer up-to-date information that enables tracking of performance, identification of significant expenditure areas, and more precise forecasting.

By employing robust data models and conducting detailed financial analysis, reporting empowers businesses to assess present operations and make informed decisions to drive future growth.

-

Monitoring revenue and expenditure:

Financial reporting plays a crucial role in monitoring income and expenses. It supports effective debt management, facilitates budget allocation, and provides a clear understanding of significant spending areas. By closely monitoring financial statements, companies can ensure transparency in competitive markets and maintain regular tracking of debts.

Accurate financial reporting also enables the tracking of current liabilities and assets, allowing small businesses to measure important metrics such as debt-to-asset ratios. Investors rely on these metrics to evaluate a company's ability to effectively manage debt and generate revenue.

-

Compliance:

Financial reporting involves a series of processes that companies must adhere to in order to meet mandatory accounting regulations. Every document utilised to assess financial activities undergoes scrutiny by various financial regulatory institutions. Therefore, precise documentation is of utmost importance to ensure that all financial records align with tax regulations and meet the criteria for financial reporting.

Accurate financial reporting not only streamlines tax planning, valuation, and auditing procedures but also reduces the time required to fulfil essential financial obligations, thus reinforcing financial compliance.

-

Stakeholder communication:

Current financial records play a crucial role for key stakeholders, investors, executives, and professionals when making decisions, creating budgets, and monitoring performance. Open communication and transparency are essential in facilitating funding, investment opportunities, and financial evaluation.

Investors and creditors heavily rely on the information conveyed in financial statements to assess profitability, risk factors, and potential future returns. Maintaining clear and transparent financial reporting supports informed decision-making and fosters confidence among stakeholders.

How can CleanSlate help small and medium businesses?

We play a pivotal role in ensuring the accuracy of financial reports through various practices:

-

Detailed recording and categorisation of financial transactions:

CleanSlate employs meticulous recording and categorisation techniques for all financial transactions. By capturing and organising each transaction with precision, we establish a solid foundation for accurate financial reporting. This process involves diligently documenting income, expenses, assets, and liabilities, ensuring that no financial transaction goes unnoticed or is misinterpreted.

-

Implementing robust reconciliation processes:

At CleanSlate, we place great emphasis on implementing robust reconciliation processes. This involves cross-checking financial track record against external sources, such as bank statements and invoices, to identify and rectify discrepancies. By reconciling accounts regularly, we ensure the accuracy and integrity of financial data, providing clients with a reliable and comprehensive overview of their financial health.

-

Regular monitoring and review of financial data:

We adopt a proactive approach to monitor and review financial records consistently. We analyse key financial indicators, assess trends, and identify any irregularities or potential areas of concern. This ongoing monitoring allows timely intervention; ensuring issues or errors are promptly addressed and rectified. By regularly reviewing financial statements, we help businesses maintain accurate and up-to-date financial reports.

Expert Bookkeeping at Your Fingertips!

How do we provide ethical practices in bookkeeping services for small business?

CleanSlate upholds ethical standards in its bookkeeping outsourcing practices by focusing on the following principles:

-

Transparency and confidentiality of client information:

We prioritise transparency in our interactions with small business owner, ensuring open communication and clarity regarding financial processes. We are an ISO 27001-certified company. We maintain strict confidentiality protocols to safeguard sensitive client information, adhering to data privacy laws and regulations. Clients can trust that their financial data remains secure and confidential throughout the bookkeeping process.

-

Adherence to industry regulations and standards:

Our firm complies with all relevant industry regulations and standards governing bookkeeping practices. We stay updated with changes in accounting standards, tax laws, and other regulatory requirements to ensure accurate and compliant financial reporting. By following these guidelines, we promote trust, credibility, and professionalism in our bookkeeping outsourcing services.

-

Avoidance of conflicts of interest:

We maintain a strong commitment to avoiding conflicts of interest. Our firm operates with integrity, ensuring that our actions and recommendations are solely in the best interest of our clients. We avoid engaging in activities that could compromise objectivity or raise potential conflicts, safeguarding the trust and confidence placed in our services.

What is CleanSlate’s approach to ethical bookkeeping service?

We demonstrate our commitment to ethical bookkeeping services for small business through our unique approach:

-

Client-centric approach and tailored solutions:

Our bookkeeping outsourcing firm adopts a client-centric approach, understanding that each small business has unique bookkeeping service requirements. We tailor the services to meet the specific needs and goals of each client, providing customised solutions that align with their small business objectives. By prioritising client satisfaction and delivering personalised support, we establish long-term partnerships built on best practice and mutual success.

-

Qualified and experienced bookkeeping professionals:

CleanSlate boasts a team of experienced and certified public bookkeepers. These professionals possess in-depth knowledge of accounting skills, principles, tax regulations, and industry best practices. Their expertise ensures accurate and reliable bookkeeping service, enabling clients to have confidence in the financial tax preparation generated by them.

-

Use of secure and advanced bookkeeping software:

We leverage secure and advanced bookkeeping software to streamline processes and enhance data accuracy. By utilising cutting-edge technology, we improve efficiency, reduce errors, and maintain data integrity. The use of secure cloud computing software also ensures the confidentiality and privacy of customer information.

How do we utilise software and automation for accurate financial reporting?

At CleanSlate, we utilise popular bookkeeping software that is widely used in Australia. These software solutions, such as Xero, MYOB, and QuickBooks, offer robust features and functionalities that streamline bookkeeping processes.

We use the most advanced tools for recording transactions, managing invoices, tracking expenses, payroll services, and generating financial reports. We leverage the capabilities of these software platforms to ensure accurate and efficient financial reporting for our customers.

-

Benefits of automation in bookkeeping service:

Automation tools play a pivotal role in modern bookkeeping practices. They help streamline repetitive and time-consuming tasks, reducing manual effort and minimising the risk of human error.

Automation tools can automate processes such as data entry, bank reconciliations, invoice processing, payroll services, and expense categorisation. By automating these tasks, certified bookkeeper can save time, improve accuracy, and focus on value-added activities like financial analysis and strategic planning.

The benefits of automation in bookkeeping outsourcing are significant. It improves efficiency by speeding up processes and reducing the likelihood of errors.

Automation also provides real-time data synchronisation, ensuring that financial information is always up to date. Additionally, automation enhances data accuracy and consistency, allowing for more reliable financial reports and better decision-making.

By embracing technology, CleanSlate enhances its bookkeeping outsourcing services, delivering accurate financial reports that support informed management for small and medium businesses.

Wrapping up

CleanSlate is your trusted partner for accurate financial reports and ethical bookkeeping services for small business. With our meticulous recording, robust reconciliation processes, and continuous monitoring, we ensure the accuracy and integrity of your financial statements.

Leveraging popular bookkeeping software and automation tools, we streamline processes, reduce errors, and provide real-time data synchronisation. This means reliable and up-to-date financial statements that empower you to make informed decisions for your small businesses.

Visit our website to learn more and take the first step towards financial success. Contact us to know how we can make your financial journey a seamless one.