Why hiring a medical accountant is critical for your business?

Introduction:

Running a medical practice is not just about providing top-quality healthcare services to your patients. It also requires managing the finances of your business, and this is where things can get tricky. From handling billing and insurance claims to managing payroll and taxes, there are countless financial aspects to consider, and overlooking any of them can be costly. That's why having an expert in accounting management for health services is crucial to the success of your business.

A medical accountant is a financial specialist who understands the unique financial challenges faced by a medical practice business. They have the knowledge and expertise to manage your finances efficiently and effectively, allowing you to focus on delivering exceptional patient care. With a medical accountant on your team, you can be confident that your bookkeeping is accurate and compliant with regulatory requirements, and that you are maximizing your revenue potential and business growth.

In this blog, we will discuss the importance of hiring a medical accountant for your business, and how they can help you achieve financial success and peace of mind with comphrehensive services.

Key takeaways

Hiring a specialist accountant is crucial for managing a medical practice's financial management in Australia.

Non-specialist accountant may make accounting errors due to the unique regulations in the medical industry.

Best accounting practices for Australian doctors include maintaining accurate financial records, monitoring cash flow, and hiring a specialist.

When searching for an accountant, consider their specialization in healthcare, qualifications, experience, referrals from other healthcare professionals, and communication skills.

A professional accountant can provide valuable guidance on tax planning, financial statements, payroll and superannuation compliance, and other financial obligations, ensuring the long-term success of your medical practice.

Importance of hiring a specialist medical accountant

In the Australian medical industry, hiring a specialist medical accountant is essential for managing the financial aspects of private practice. Here are some reasons why:

- A specialist medical accountant can help an Australian medical practice navigate complex tax laws and regulations specific to the industry, such as the Australian Taxation Office's (ATO) rules for healthcare providers.

- They can provide expert guidance on tax planning of the Goods and Services Tax (GST), income tax obligations, and superannuation contributions.

- Medical accountants can help with budgeting, financial planning with financial statements, cash flow management, and other financial obligations which are crucial for long-term success in the industry.

- They can assist with payroll and superannuation compliance, including compliance with the Australian Taxation Office's Single Touch Payroll system.

Common mistakes medical practitioners make when they choose a non-specialist accountant

The medical industry in Australia has several unique limitations and regulations that a medical practice must adhere to. Unfortunately, non-specialist accountants may not be aware of the intricacies involved in medical accounting. Consequently, a non-specialist accountant might make several accounting mistakes, such as:

- Miscalculating superannuation contributions due to a mix of self-employment and employment

- Incorrect tax treatment of superannuation paid or due, leading to the application of incorrect tax relief

- Double taxation of the business by including income where PAYG withholding has been applied already

- Incorrect GST claims due to netting off income and expenses

- Incorrect allocation of profits can impact balance, especially for personal service income.

- Make inaccurate estimations and calculations on financial reporting responsibilities

Expert Bookkeeping at Your Fingertips!

Best accounting practices for doctors in Australia

Here are some of the best medical accounting practices that you can adopt as a doctor in Australia.

- Keep detailed and accurate financial records of all income and expenses.

- Use a separate business bank account to keep track of business transactions.

- Monitor your cash flow regularly to ensure that your business has enough cash to meet expenses.

- Prepare a detailed budget that includes all expenses and projected income.

- Regularly review and update your financial plan to ensure that it aligns with your business goals and objectives.

- Ensure that you meet your tax responsibilities within the deadlines and make use of relevant tax deductions and save money

- Hire a specialist medical accountant who understands the unique financial challenges faced by medical practices in Australia.

How can medical professionals find the best medical accountants for their business?

Hiring an accountant versed in medical accounting for your business is critical to the financial success of your medical practice. Here are some tips to help healthcare professionals find the right medical accountant:

-

Determine your accounting needs

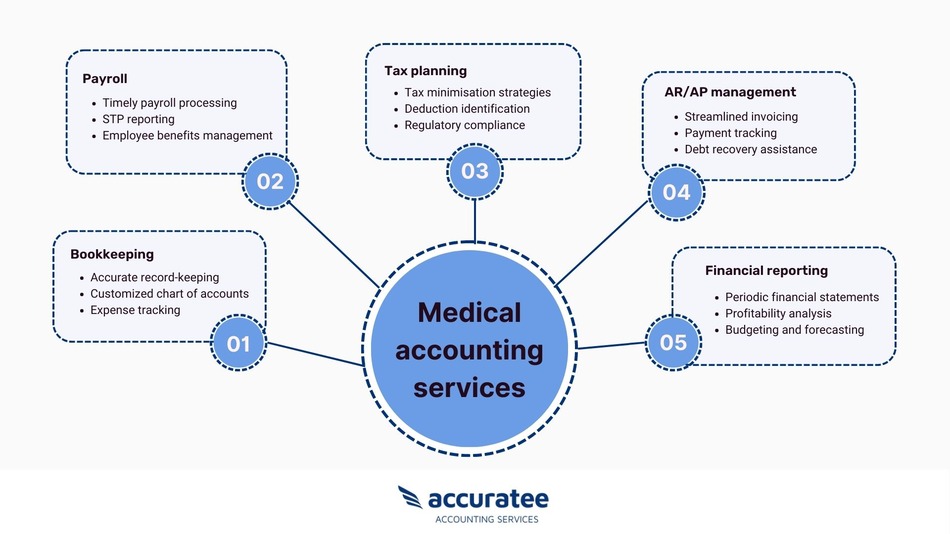

First and foremost, medical professionals should determine their accounting needs. This includes assessing their current financial situation, identifying areas of improvement, and determining what specific services they require from a medical accountant. You can see some of the services offered by medical accountants below,

-

Look for specialization in the healthcare industry

When looking for a medical accountant, it's essential to find someone who specializes in the medical industry. They should have experience in medical accounting, and tax services and understand the unique financial challenges that come with managing a medical business. Additionally, they should be up-to-date with any regulatory changes in the industry, such as compliance with the Australian Taxation Office's rules on tax obligations in the medical field.

-

Check for professional qualifications

Medical professionals should check for professional qualifications when searching for an expert in accounting. Look for someone who has relevant degrees, certifications, and licenses, such as a Chartered Accountant (CA) or Certified Management Accountant (CMA). These qualifications indicate that the accountant has undergone extensive training and has the necessary skills to handle accounting tasks in medical accounting.

-

Look for experience

Experience is another critical factor to consider when selecting a medical accountant. Ideally, you want someone who has worked with medical practices similar to yours in terms of size, specialty, and location. This can help ensure that the accountant has a thorough understanding of your business's financial needs and can provide valuable insights based on their previous experience.

-

Seek referrals

One of the most effective ways to find qualified medical accountants is to seek referrals from colleagues in the healthcare industry. Ask other medical professionals, including doctors and practice managers, for recommendations for experts in medical accounting. They may be able to refer you to a reputable accountant who has helped them with their accounting management.

-

Conduct interviews

Before hiring medical accountants, it's essential to conduct interviews to assess their qualifications and experience. During the interview process, ask questions about their experience working with medical practices, their knowledge of regulatory requirements, and their approach to accounting management. This can help you determine if they are the right fit for your business.

-

Consider communication and availability

Lastly, medical professionals should consider communication and availability when selecting an accountant. They should choose someone responsive and available to answer any questions or concerns. Additionally, they should be comfortable communicating financial information and working collaboratively to achieve the financial goals of the medical practice.

Conclusion

All in all, hiring a professional medical accountant for your business is an invaluable asset to have. These professionals understand the complexities and ever-evolving changes in tax codes, healthcare laws, and other areas of compliance. They will ensure your financial aspects are managed securely while maintaining peace of mind.

Not only do they help you stay organized, but they can also deter the complexities surrounding medical accounting. Whether you need help with accounting, tax calculations, or practice management, it’s best to consult with a highly-trained professional who has expertise in this particular field and can provide the solutions you need for the better financial health of your organisation.

If you’re looking for the best possible accounting firm for your business setup and accounting services, contact CleanSlate for our comprehensive medical practice setup services today!