What is bank reconciliation, & Why is it important for small businesses?

Introduction:

A general ledger tracks all the money flowing in and out of your business, while a bank statement records the actual transactions processed by your bank. Ideally, these two records should match perfectly, but small differences often appear due to timing delays, missed entries, or bank charges. This is where bank reconciliation becomes important.

In this blog post, we will explain what bank reconciliation is, why it matters for every business, and how it helps you keep your records accurate and up to date. We’ll also walk you through the steps involved, highlight common errors to watch out for, and show you how professional bookkeeping services can simplify the entire process.

Key takeaways

Bank reconciliation is the process of matching a company's bank statement with its cashbook to confirm accurate financial records.

Reconciliation gives a clear view of the company’s financial status, allowing for better decision-making regarding investments and operational needs.

High-transaction businesses should reconcile daily, while smaller businesses can do so weekly or monthly.

Reconciling items include uncleared cheques, uncredited deposits, direct debits, and more.

What is bank reconciliation?

A bank reconciliation statement compares the balance in your accounting records with the balance shown on your bank statement. It helps confirm that all payments, deposits, and adjustments are recorded correctly.

This process ensures your business records reflect your true bank position.

At CleanSlate, we prepare reconciliation statements that make this process easier for small and medium businesses. Our bookkeepers review every transaction, fix mismatches, and keep your records ready for BAS, tax, and reporting compliance.

Check the latest BAS due dates for the 2025–26 financial year to plan ahead and meet every lodgement deadline on time.

Pro tip

How often should I reconcile bank statements?

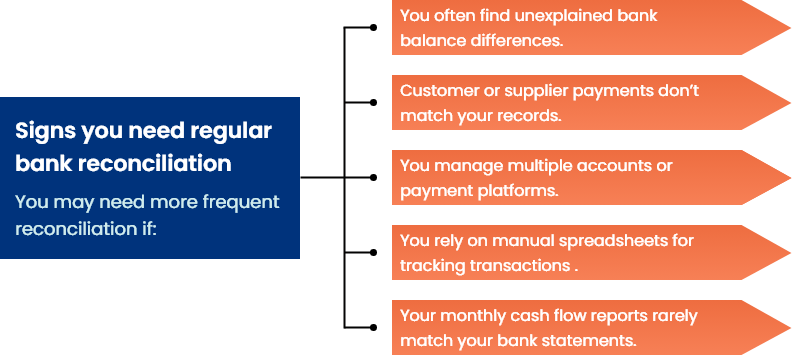

How often you reconcile your bank statements depends on how busy your accounts are.

- For most small businesses, a monthly reconciliation works well because it aligns with regular billing and reporting cycles.

- If your business processes a large number of daily transactions, such as a retail store or service provider, weekly or even daily reconciliation is more effective.

Reconciling your accounts more often helps you detect errors quickly, manage your cash flow better, and spot any unauthorised transactions before they become serious.

What are the 7 steps to bank reconciliation?

Below are the seven steps to complete a proper bank reconciliation.

Step 1: Gather your records

Start by collecting your bank statements and accounting records for the same period, usually one month. You can download your statement through online banking and open your accounting report in your chosen software. Having both ready helps you trace transactions easily

Step 2: Check the opening balance

Begin by confirming that the opening balance in your accounting system matches the opening balance on your bank statement. If there is a difference, review your previous reconciliation to find uncleared transactions or missed entries. This ensures you are starting from the correct balance.

Step 3: Match incoming payments

Review all deposits listed on your bank statement and match each one with income recorded in your books. These may include customer payments, refunds, or interest received. Add any missing entries so your total income aligns with the bank.

Step 4: Match outgoing payments

Check all outgoing payments, such as supplier bills, subscriptions, payroll, and bank fees. Each expense on the bank statement should also appear in your accounting records. Add any missing payments and remove duplicates if necessary.

Step 5: Identify discrepancies

If transactions do not match, make a note of them and find out why. Common reasons include timing delays, missing entries, or incorrect data. Once you understand the cause, you can correct it in the next step.

Step 6: Make adjustments

Update your accounting records so they match the bank statement. Add missing deposits, record bank fees, and correct any inaccurate entries. Always make these changes in your accounting software rather than altering the bank statement.

Step 7: Confirm the closing balance

Once all entries are reviewed and corrected, compare the closing balance in your books with the one on your bank statement. Both should now be the same. When they match, your reconciliation is complete. This makes your accounts ready for audits and business tax return filing.

Common errors found during bank reconciliation

Below are six common bank reconciliation errors and how to correct them.

Unmatched transactions

Unmatched transactions happen when the amounts recorded in your books don’t align with those shown on your bank statement. This can occur due to missing entries, incorrect figures, or timing differences between when a payment is recorded and when it clears the bank.

To fix this, review each entry in your accounting records alongside your bank statement and identify any inconsistencies. Check supporting documents such as invoices, receipts, and payment confirmations to verify amounts and dates. Using cloud-based tools like Xero bookkeeping software or QuickBooks bookkeeping software helps automatically flag unmatched transactions, saving time and keeping your records accurate and up to date.

Bank statement mismatches

A mismatch between your recorded balance and the bank statement can create confusion during reconciliation. This often occurs when previous reconciliations weren’t completed correctly or when bank fees, interest, or adjustments were not recorded.

Before starting a new reconciliation, verify that your opening and closing balances align with the previous period. Review your statement carefully for unrecorded fees, direct debits, or interest payments and enter them promptly. Keeping your balances aligned at the start ensures a smoother and more accurate reconciliation process.

Avoiding duplicate entries

Duplicate entries are a common mistake that can inflate both income and expenses. This usually happens when the same transaction is entered manually and also imported automatically from a bank feed.

To prevent duplicates, review all transactions before posting them to your books. Most accounting software includes duplicate-detection features that alert you to identical amounts or dates. Keeping a simple checklist for your reconciliation process can also help ensure each payment or deposit is recorded only once.

Incorrect data entry

Typing errors are one of the simplest but most frustrating causes of reconciliation differences. Entering the wrong amount, date, or description can cause your records to go out of sync with the bank.

To prevent this, always double-check large entries before saving them and cross-verify totals against receipts or statements. Using cloud-based accounting tools that flag unusual amounts or out-of-range entries helps detect mistakes before they affect your reports. Accuracy in data entry saves hours of correction work later.

Software configuration errors

Software-related errors can occur when your accounting platform isn’t configured properly or when bank feed connections fail. Incorrect settings may cause transactions to post to the wrong accounts or not import at all.

To avoid this, review your software setup regularly and ensure that bank feeds are correctly linked. Test new updates and confirm that imported transactions appear in the correct categories. Staying on top of software maintenance reduces discrepancies and improves the reliability of your reconciliations.

Timing differences

Timing differences arise when a transaction appears in your records before it is processed by the bank, or vice versa. For example, a deposit made after hours might show up in your books immediately but not appear on the bank statement until the next day.

Keep track of such timing gaps by noting pending transactions during each reconciliation. Record payments and deposits with accurate posting dates and review any uncleared items before closing the period. Understanding how timing affects your balances will help you interpret reconciliation differences correctly and keep your records consistent.

Want your reconciliation done accurately without the hassle?

Book a call and connect with us to get started right away

Why is bank reconciliation important for every business?

Here are a few reasons why reconciling bank statements is so important for every business.

Helps identify bank errors

Even the most reliable banks can make mistakes. Simple processing errors, duplicate entries, or misplaced decimal points can alter your account balance and cause confusion.

Regular reconciliation helps you catch these errors before they affect your books. Detecting and correcting discrepancies early ensures your recorded balance reflects what’s truly in your account, keeping your records reliable and up to date.

Detects fraud and unauthorised transactions

Reconciliation acts as a safeguard against unauthorised or suspicious activity. By regularly comparing your bank statements with your internal records, you can identify any transactions that don’t belong.

This might include employees using company funds for personal purchases or suppliers altering payment details. Consistent review of your accounts makes it easier to detect irregularities quickly, preventing losses and strengthening trust in your systems.

Keeps accounts receivable in order

For many businesses, reconciling customer payments is a common challenge. A cheque might bounce, a transfer could be delayed, or a customer might pay the wrong amount. Regular reconciliation helps you identify these differences early so you can follow up and resolve them quickly. Strengthening your accounts receivable management ensures every customer payment is tracked accurately, your records stay clean, and your cash flow remains consistent.

Tracks bank fees, interest, and adjustments

Banks often apply service fees, account charges, or interest payments that may not appear immediately in your books. Without reconciliation, these small amounts can easily go unnoticed and cause your recorded balance to drift from the bank’s actual figure. By reconciling regularly, you can record every charge, fee, and adjustment, ensuring your account balances remain accurate and complete.

Improves cash management and business planning

A reconciled account gives you an exact picture of how much money your business truly has. This clarity allows you to make better decisions about when to spend, when to save, and when to invest.

Knowing your available balance helps you manage daily expenses, plan upcoming payments, and prepare for new opportunities with confidence. With accurate reconciliation, you can keep your business running smoothly and avoid cash shortfalls.

Simplifies month-end and year-end reporting

When you keep your bank accounts reconciled regularly, closing your books becomes faster and easier. Instead of reviewing months of backlogged transactions, your records are already accurate and ready for review. This reduces stress at reporting time, ensures compliance, and gives you more time to focus on strategic tasks rather than catching up on old entries.

Strengthens control and transparency

Reconciliation builds discipline and consistency in how your business manages money. It provides visibility into every transaction and adds an extra layer of oversight across your accounts. This process promotes accountability, ensures nothing goes unnoticed, and gives you peace of mind that your books are always correct.

Bookkeeping & Tax combined

For bookkeeping, BAS and tax returns (but no payroll or Super included):

Save 10+ hours weekly with expert bank reconciliation support

Keeping your bank accounts aligned with your books can easily take hours each week. With expert bank reconciliation support, you can save more than 10 hours weekly while keeping your accounts accurate and up to date.

At CleanSlate our experienced online bookkeepers handle the entire process for you. We review every transaction, identify and correct mismatches, and make sure your records match your bank statements perfectly.

Our bookkeeping and BAS lodgement packages start from $225 per month (ex GST) and include day-to-day bookkeeping, income & expense tracking, and complete reconciliation support to keep your accounts organised.

Here’s how you benefit from our expert support:

- Save valuable time every week by automating reconciliation tasks

- Reduce human errors with expert review and secure systems

- Always know your real cash position with accurate reporting

- Keep your books ready for BAS, tax, and audit reviews

Book a call with us today and let our experts handle your bank reconciliation efficiently and accurately.

Bank Reconciliation FAQs

What do you mean by bank reconciliation?

Bank reconciliation is the process of comparing your company’s accounting records with your bank statement to ensure every transaction matches correctly. It helps confirm that your books reflect the true balance in your bank account and keeps your records accurate.

What is the formula for bank reconciliation?

The basic formula is:

Adjusted Bank Balance = Bank Statement Balance +

Deposits in Transit – Outstanding Cheques

After adjusting both your bank and book balances, the two should match exactly.

How is a bank reconciliation statement prepared?

A bank reconciliation statement is prepared by comparing your internal cash book with the bank statement. Any differences, such as unrecorded fees, interest, or timing delays, are identified and corrected. The final statement shows the adjusted balance that matches the bank’s record.

When should a bank reconciliation be prepared?

For most small businesses, reconciling bank accounts once a month works well. Businesses with a high transaction volume, like retailers or service providers, often benefit from weekly or daily reconciliations to keep records current.

Who prepares the bank reconciliation statement?

Usually, a company’s bookkeeper or accountant prepares the bank reconciliation. Many businesses now delegate this task to professional online bookkeepers to save time and ensure accuracy.

Is bank reconciliation required for BAS or tax returns?

Yes, bank reconciliation plays a crucial role in preparing accurate BAS and tax returns. When your records match your bank statement, you can be confident that your reported sales, purchases, and GST figures are correct.

Can AI or ChatGPT do bank reconciliation?

AI tools can assist with automated matching and detecting unusual transactions, but professional oversight is still essential. At CleanSlate we use technology alongside expert bookkeepers to ensure your reconciliation is accurate, compliant, and always handled with care.

Conclusion

Accurate bank reconciliation is vital for maintaining balanced financial records and preventing issues like missed payments or fraud. If managing reconciliation yourself is time-consuming or stressful, consider hiring a professional bookkeeper.

At CleanSlate, our dedicated bookkeepers simplify the most challenging aspects of reconciliation by automating the tracking of settled orders, fees, and chargebacks. This ensures that these transactions are accurately recorded in your general ledger. By eliminating the need for manual excel workbooks, our solution reduces errors and speeds up the entire reconciliation process, making it easier to manage your finances.

So, if you’re tired of juggling bookkeeping tasks and want someone to manage it all – including the bank reconciliations – get in touch with us now. We’ll make bookkeeping stress-free for you.