Unit trust set up: A complete guide on how to set up a unit trust in Australia

Introduction:

When it comes to setting up a unit trust, there can be a lot of contradictory information out there. Everyone has an opinion on the ‘right way’ to do it, but often that advice is based on limited experience and potentially outdated information.

That’s before even getting into the different laws and regulations around trusts in each country you might have investors from. But don't let all this scare you off.

Setting up your unit trust doesn't need to be overwhelming or complex. Establishing one for your business can be straightforward by understanding a few key principles.

So, read this blog post without further ado to better understand the unit trust establishment process.

Key takeaways

A unit trust in Australia is a form of regulated investment scheme that allows many people to pool their investment funds together.

The key elements of a unit trust include; trustee, trust fund/property, units, unitholders, unit pricing, unit trust deed, and assets.

Income generated by the trust is distributed among holders in proportion to their investments, and taxation of a unit trust can be beneficial for investors.

Unit trusts offer many benefits. However, some limitations also need to be considered.

What is a unit trust?

A unit trust in Australia is a form of regulated investment scheme and not a separate legal entity. However, It allows many people to pool their investment funds together to set up a business or invest in financial assets. The structure enables the trustee to hold and manage the property for the benefit of all the unitholders (investors).

Unit trusts typically have a wide range of assets and are considered professionally managed investments with high levels of diversification, which makes them suitable for certain long-term investment objectives.

By pooling investor funds, this type of trust can benefit some investors who lack the expertise or resources to manage their portfolios.

In addition, units can usually be bought and sold at any time. The number or classes of units held by the unitholders determine the distribution of income from a unit trust.

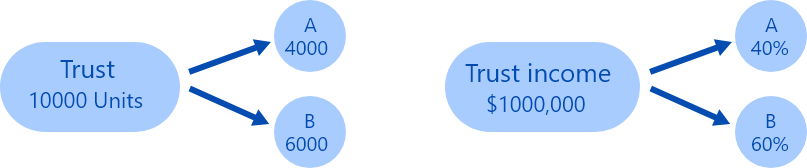

For example, A and B are two friends forming a unit trust, with A owning 4000 units and B owning 6000 units. The income of the trust is $ 1,00,000. In this case, A will get 40% of the income, and B will get 60%.

(Income distribution in a unit trust is based on number of units held)

What is a fixed unit trust?

Fixed unit trusts are investment vehicles that remain static in the asset mix, meaning any changes to the portfolio require trustee approval. Every unit holder has fixed entitlements based on the number of units held.

As a result, fixed trust tends to be much less volatile and can act as a good option when investor confidence is low, or they have specific long-term investment objectives.

These types of trusts also have some advantages for investors. They are generally managed more efficiently due to their static nature and can provide greater security through diversified asset classes.

For income tax purposes, these trusts are generally treated as 'fixed trusts', which are taxed at the same rate as ordinary income.

Fixed unit trust for NSW land tax purposes

A fixed unit trust for land tax purposes is a trust fund set up in accordance with the NSW Land Tax Management Act 1956.

It establishes a formal framework of land ownership in which each beneficiary's land holding is fenced off into individual units, allowing land tax obligations to be managed more effectively.

Each landholding can have a separate land tax assessment, and any change in land ownership will require unanimous approval from the trustees and beneficiaries.

By incorporating this structure into land taxation, visibility of landholding improvements and fairness in assessing land tax liabilities across all trusts can be achieved.

Furthermore, it increases coordination efforts when dealing with multiple properties while preserving tenants' rights and security over their interests.

Elements of a unit trust

The key elements of a unit trust are as follows:

A trustee or trustees (the legal owner) is responsible for the management of the trust and is accountable to the unitholders. The trustee must comply with their legal duties as set out by the trust deed and applicable legislation.

The trust fund or property is the trust assets held and managed by the trustee to benefit all unitholders.

These can include financial assets such as shares, bonds, and other investments, as well as physical assets such as real estate or tangible items like artwork.

Units are the interests held by investors in the trust fund. Owning units in the trust gives investors a share in the income and capital gains generated by trust assets.

Unitholders are the investors who own units in the trust. They have a right to vote on matters concerning the trust and can seek redress if they feel their rights have been infringed upon. A unit holder can also sell or transfer his/her existing units to other unit holders at any time for a price determined by the market.

The price of each unit is determined by dividing the trust's total value by the number of units in the issue. This is known as the net asset value.

This trust deed sets out all the terms and conditions governing the operation of the unit trust. It includes details about how units are issued, redeemed, transferred, and priced, as well as any legal obligations which must be complied with.

The assets in a unit trust are the investments that make up the fund, such as stocks and bonds. The performance of these assets will directly affect the value of the units. It is important to understand the composition and risk profile of the assets in a unit trust before investing.

Any income generated by the trust is distributed among unitholders in the proportion of unit holdings held in the trust. This is known as the distribution yield.

Investing in a unit trust can have considerable financial benefits as the trust is subject to taxation at a lower rate than some other investments. However, before investing any funds, investors must take time to understand the trust tax return process and associated implications.

Why do people use unit trust in Australia?

Unit trusts are a popular way for Australians to manage their investments. They offer net income benefits and provide important tax concessions that can reduce or defer a client's total tax liability.

Such managed funds have become an attractive investment option due to their opportunities to access increased net income with reduced taxation, allowing investors to make the most of their returns.

Through proper management, investors using unit trusts can benefit from meeting their individual financial goals with less risk and more potential reward by managing investments across a wider asset base than what may be achieved through direct investments.

Expert Bookkeeping at Your Fingertips!

How does unit trust work in Australia?

Unit trusts are a type of investment option available to Australians. When you purchase a unit trust, your money is pooled with other investors and invested into shares, bonds, fixed-interest investments, and property.

In return for your investment, you receive units based on the current market value of the assets purchased with your funds. This ensures your unit trust remains up to date with market movements, meaning the value of each unit can change frequently.

For example, if the total value of assets in the trust increase by 10%, the unit holder will also receive a proportional increase in the value of your units.

Additionally, professional fund managers monitor and manage investments within a unit trust, this ensures funds are allocated towards higher earning options as far as possible.

How to establish a unit trust in Australia?

Setting up a unit trust can be a complex process that requires careful consideration and planning. The following steps should be taken to set up a unit trust in Australia:

Step 1: Choose an appropriate structure for the trust

- A sole or corporate trustee will need to be appointed, and legal advice should be sought as to which is best suited to your circumstances.

Step 2: Appoint a trustee company

- A trustee company must be appointed to manage the trust. The role of the trustee is to ensure that all legal requirements are met and that unitholders’ interests are protected.

Step 3: Draft the trust deed of settlement

- The trust deed outlines the rules and regulations that govern the operation of the trust, as well as details about investments and distributions of the income of the trust to beneficiaries.

Step 4: Stamping

- The Australian Taxation Office must stamp the settled trust deeds to have legal effect. The stamp duty for a unit trust is based on the value of its assets.

Step 5: Register the trust

- ASIC registration is a legal requirement for unit trusts to operate in Australia. Without proper registration, a unit trust cannot legally conduct business or operate within the country.

Step 6: Open a bank account

- A separate bank account should be opened for the trust to manage income, expenses, and investments.

Step 7: Commence the trust activity

- Once all the above steps have been taken, the trust can commence operations and invest in assets.

Step 8: Report to ASIC:

- The trustee must lodge a yearly return with ASIC disclosing details about the trust’s activities and asset holdings. This will ensure that all legal obligations are met.

Wide range of ASIC services and expert advice to help you stay compliant. Try our services.

Registered ASIC agents

What are the benefits of setting up a unit trust?

Setting up a unit trust can provide several benefits, including:

-

Professional management:

The trust is managed by professional fund managers with experience in investing and knowledge of the financial markets. This can help ensure that your funds are managed effectively and that your investments are diversified across various asset classes.

-

Asset protection:

A trust can help protect your assets from claims and judgments against you, as the trust’s assets are separate from an individual or company’s assets.

-

Tax efficiency

The trust offers tax efficiency because investors only pay capital gain tax when they sell units in the trust. This benefits investors with a long-term investment horizon, allowing them to defer paying taxes until later.

-

Liquidity

Unit trusts are highly liquid investments because the underlying assets can be sold quickly and easily on the open market. This makes them a great option for investors who need access to their capital in a short period.

-

Diversification

The trust allows investors to diversify their portfolios by investing in multiple asset classes, such as stocks, bonds, and property. This can reduce risk and increase the potential return on investments over the long term.

-

Cost savings

The trust offers cost savings compared to other types of investments because the management fees are lower than those associated with traditional investment vehicles, such as stocks and bonds.

-

Transparency

The trust provides investors with a high degree of transparency since all information about the underlying assets within the trust is publicly available. This allows investors to make informed decisions about where to invest their money. An attractive option for many investors.

What are the drawbacks of setting up a unit trust?

Although setting up a unit trust can offer many benefits, there are also some drawbacks. These include:

-

Limited control:

The trust is managed by professional fund managers who decide how the funds are invested and allocated. This means that investors have limited control over their investments and may be unable to choose individual stocks or bonds.

-

Risk of loss:

The unit trust is subject to market volatility, which means that the value of an investor’s units may change quickly and unexpectedly. This can result in a capital loss if investment decisions are not managed appropriately.

-

Fees:

This type of trust typically charges management fees which can reduce the returns on investments over time. It is important to compare the fees charged by different unit trusts and ensure they are reasonable.

-

Lack of transparency:

Unit trust can be opaque investments since all information about its underlying assets may not be publicly available. This means that investors need to rely on fund managers for accurate information about their investments.

-

Regulatory risk:

The unit trust is subject to regulatory risk because it is regulated by governments and financial authorities. Investors need to be aware of any potential changes in regulations that could impact their investments.

Measuring your business performance regularly is important to know how you are tracking

Download our free e-guide on important metrics to measure your financial health

DownloadConclusion

When it comes to investing, a unit trust can be a great tool for those looking to secure their financial future. Though several elements must come together for a successful unit trust, with the right knowledge and guidance, anyone can make the most of what this type of trust offers.ed with us today.

Unit trusts provide many benefits, from flexibility to tax efficiency, making them an attractive investment option for Australians. However, there are also some risks involved with setting up one.et start

To ensure you’re taking full advantage of everything that unit trusts offer and avoiding any possible pitfalls, consult with professionals when considering your options.

At CleanSlate, we specialize in unit trust set-up services and provide thorough legal advice on how best to ensure your financial security moving forward. So don’t wait; fill out our trust setup form and get started with us today.