End of year Accounting checklist for your SMSF

Introduction:

As the year is coming to a close, now is the perfect time for all Self-Managed Super Fund (SMSF) holders to analyse their financial situation and assess whether or not they are mandated to make any additional contributions, withdrawals, or updates. Managing an SMSF requires careful attention to detail, especially when it comes to year-end accounting tasks.

To assist with this process, we have compiled an indispensable end-of-year checklist that will guide you through various scenarios that could potentially affect your SMSF. By following this checklist, you can ensure that your SMSF remains compliant, maximises its financial potential, and sets a strong foundation for the upcoming year.

Let's dive into the essential steps you need to take to wrap up your SMSF's financial affairs and start the new year on the right foot.

Key takeaways

The SMSF end-year accounting checklist is a thorough list of tasks to be completed at the financial year-end for an SMSF.

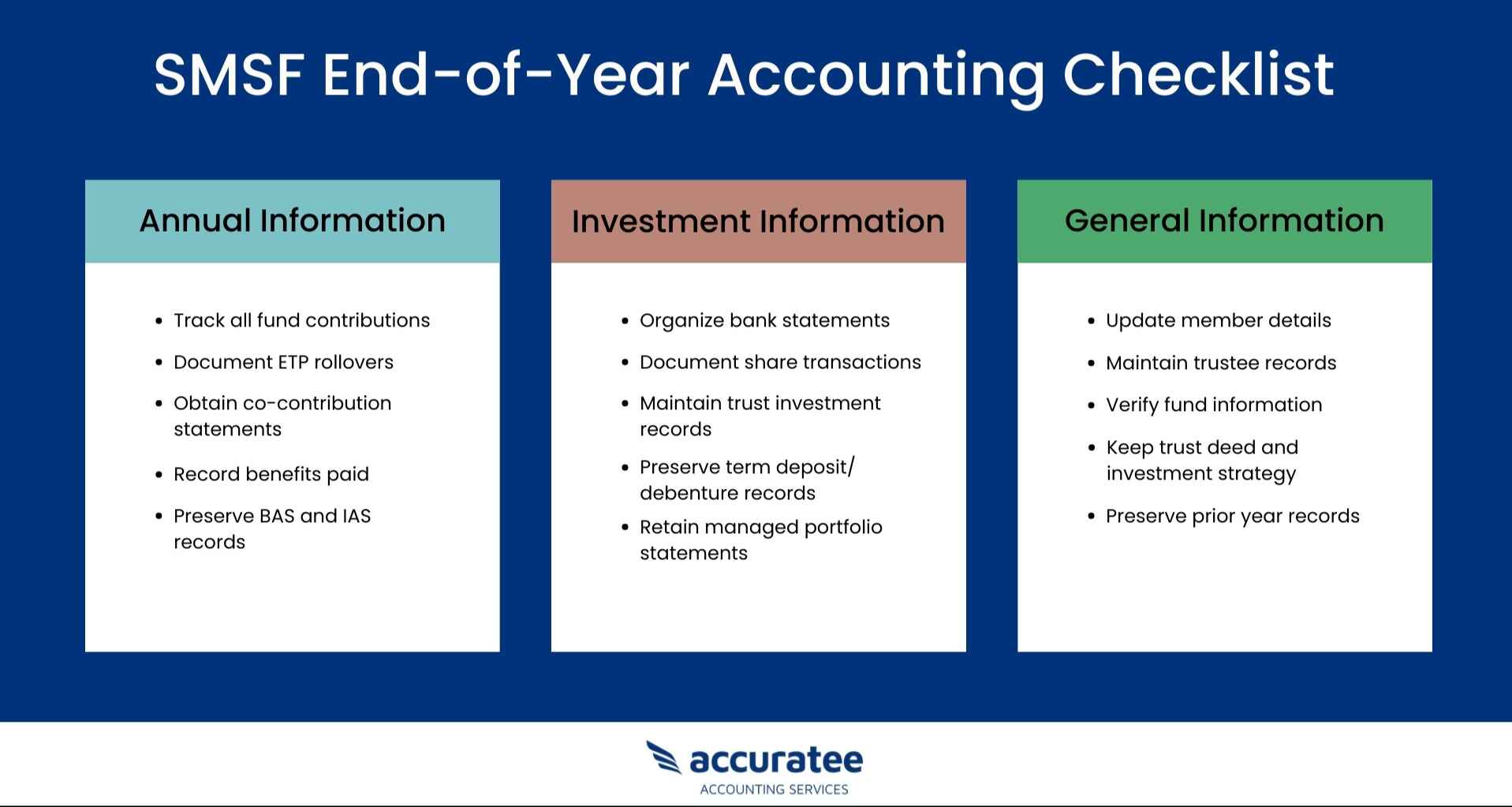

The checklist covers three main categories: annual information, investment information, and general information.

Maintaining previous year records and investment strategy documentation helps maintain a complete history and supports compliance.

What does the SMSF end-year accounting checklist mean?

The SMSF end-year accounting checklist refers to a comprehensive list of tasks and procedures that need to be completed at the end of the financial year for a Self-Managed Superannuation Fund (SMSF). This checklist ensures that all necessary accounting and reporting obligations are fulfilled, enabling accurate financial reporting and adherence to legal and regulatory obligations for the SMS.

End-of-Year accounting checklist for your SMSF: Top consideration

As the financial year draws to a close, it's crucial to ensure your Self-Managed Superannuation Funds (SMSF) are optimised for maximum financial potential. To achieve this, there are three central categories of considerations to keep top-of-mind: annual, investment, and general information. The following details highlight the various items covered within each category.

-

Annual information:

Here is what you need to consider in the ‘annual information’ category:

- Contributions to the fund:

- Review and document all contributions made to the SMSF during the financial year. This includes both non-concessional (undeducted) and concessional (deducted) contributions. Keeping track of contributions is essential for calculating the fund's tax liability and for meeting minimum contribution requirements.

- ETP rollover statements:

- If there have been any rollovers of eligible termination payments (ETPs) into the SMSF, ensure you have the necessary statements and documentation. This includes details of the ETP amounts, source of the rollover, and any tax components associated with the rollover.

- Government Co-contribution statement:

- If any members are eligible for government co-contributions, obtain the relevant statements. These statements show the contributions made by the government to the SMSF during the financial year.

- Benefits paid from the fund:

- Document any lump sum withdrawals or pension payments made from the SMSF, including PAYG payment summaries for lump sums and income streams. This information is crucial for tracking member benefit payments and ensuring compliance with superannuation regulations.

- Business activity statements (BAS) and Instalment activity statements (IAS):

- Maintain records of BAS and IAS, along with details of calculations, if applicable. BAS and IAS provide information on the SMSFs business activities, including GST obligations, PAYG withholding, and PAYG instalments.

- ATO portal printouts:

- Gather any ATO portal printouts that are not available through the tax agent. These printouts may include information on member contributions, rollovers, and other relevant details that need to be cross-checked with the SMSF records.

-

Investment information:

When assessing your SMSF's investments, the following considerations should be taken into account for each investment:

- Bank accounts:

- Collect bank statements for all SMSF bank accounts, ensuring you have details and documentation of all transactions, including expenses. This helps reconcile the SMSF's financial position, track income and expenses, and maintain accurate accounting records.

- Shares:

- Keep records of the contracts or statements from brokers when you buy or sell shares for your SMSF. Also, gather any forms or documents related to shared applications and allocations. Obtain statements that show how many shares you hold (holding statements) and any dividends you receive. These records are important for properly tracking your SMSF's share investments and determining if you have made a profit or loss when you sell shares.

- Trusts:

- Collect the paperwork that proves you have bought or sold investments in trusts. This includes documents showing the purchase and sale transactions. Also, gather notices that show how much income you received from the trust (distribution notices) and any tax statements related to the trust's activities at the end of the year. This information is important for reporting the income, gains, and losses from the trust investments within your SMSF.

- Term deposits/debentures:

- Keep the paperwork that reminds you to renew your term deposits or debentures and statements that show how much money you have earned from these investments. These documents are important for figuring out how much income you made, knowing when your investments will be finished, and understanding how well they are doing.

- Managed portfolios:

- Save the yearly statement and tax statement at the end of the year for any managed portfolios. These statements give a summary of the investments made by your self-managed superannuation fund (SMSF) in managed funds. They include information about income, distributions, and taxes related to these investments.

- Property:

- For newly purchased properties, gather purchase documentation, the certificate of title, and lists of depreciable fixtures and fittings, as well as deductible construction costs. For properties held during the financial year, retain rental income statements, property expense documentation, and valuations by agents or trustees at year-end. These records are necessary for accurate property valuation, rental income reporting, and capital gains tax calculations.

- Loans:

- Maintain the loan agreement and interest statements for any loans taken by the SMSF. These documents provide proof of the borrowing arrangements, repayments made towards the loan, and the amount of interest paid by the SMSF.

- Unlisted trusts and companies:

- Ensure you have the financial statements and income tax returns for both related and unrelated unlisted trusts and companies. Additionally, include the valuations conducted by trustees or the trust/company at the end of the year. These records contain valuable information about the investments held in unlisted trusts and companies, such as their financial performance, income distributions, and any changes in their assessed value.

- Collectibles:

- Retain purchase documentation, lease agreements, and valuations by dealers or trustees at year-end for any collectible investments held by the SMSF. This includes artworks, antiques, jewellery, and other collectible assets. These records are necessary for accurate valuation, compliance with regulations regarding collectibles, and potential capital gains tax calculations.

-

General information:

In addition to the investment information mentioned above, there are some general records that need to be kept for your SMSF. These include:

- Members:

- If there have been any changes, update information such as member names, dates of birth, Tax File Numbers (TFNs), dates joined the fund, and eligible service dates. It is important to have up-to-date member information for accurate reporting, tracking contributions, and determining member entitlements.

- Trustees:

- Provide updated details for corporate trustees or individual trustees/directors, including their ACN/ABN. This ensures that the SMSF's trustee information is current and aligns with regulatory requirements.

- Fund information:

- Confirm the date the SMSF was established and ensure the TFN and Australian Business Number (ABN) are up to date. This information is necessary for maintaining the SMSFs legal and tax compliance.

- Fund documentation:

- Have the signed Trust Deed and Investment Strategy readily available. These documents outline the rules and guidelines for operating the SMSF and its investment objectives, ensuring that the fund is managed in accordance with the law.

- Prior year records:

- Keep financial statements, audit reports, records of asset purchases, and the data file from previous years. Holding onto these records from past years helps to maintain a complete history of the self-managed superannuation fund's (SMSF) financial activities. This is important for accurate reporting and ensuring compliance with regulations.

By attending to these considerations at the end of the financial year, you can ensure that your SMSF is compliant and well-documented, enabling accurate reporting and efficient management of your superannuation fund.

Other important considerations

Here are a few more areas to pay attention to when preparing for the end of the financial year for your SMSF:

-

Salary sacrifice contributions:

Keep records of any salary sacrifice contributions made by members and employers. This information is important for compliance purposes, as it will be used to report these contributions on the members' annual tax assessments. You should also retain documents such as pay slips and other evidence of salary sacrifice payments made during the financial year.

-

Spouse contribution:

Retain records of any spousal contributions that have been made to the SMSF during the financial year. Documentation such as payment summaries and bank statements will help you prove that these payments were received by the fund. This information is important for identifying which member's account should be credited with these payments.

-

Personal deductible contributions:

Keep records of any personal deductible contributions made by members to the SMSF. This deductible includes documentation of any payments from family or friends, as well as records of any rollover superannuation amounts transferred into the fund. This information is essential for understanding how much each member has contributed and ensuring accurate reporting when submitting tax returns.

-

Changes made in SMSF investment strategy

For any changes made to the SMSF's investment strategy, maintain documentation of updates, decisions, and discussions. This record works as a reference for understanding why certain changes were made and are important for compliance purposes. It can also be used to inform future investment decisions based on your past performance.

-

Insurance policies:

Collect all paperwork related to any life insurance policies held by your SMSF. This includes policy numbers, payment records, documentation of beneficiaries on the policy, and other relevant documents. These records are important for tracking the premiums paid by your SMSF and determining who is covered by each policy in the event of a claim.

-

Estate planning documents:

If you have any estate planning documents in place, ensure that they are kept up to date and relevant for your SMSF's needs. This includes wills, superannuation binding death benefit nominations, powers of attorney, guardianship declarations, and trustee declarations or minutes of appointment. These documents help to legally protect the members ' entitlements and ensure that their wishes are respected in the event of death or incapacity.

-

Tax planning strategies:

Retain all documents related to any tax planning strategies used by your SMSF, such as contribution splitting, concessional contributions, and transition to retirement strategies. These documents help to provide evidence to claim a tax deduction on your SMSF 's annual tax return.

-

Reportable fringe benefits:

Retain evidence of any reportable fringe benefits provided to members or associates through your SMSF. This includes information about the amount, type, and recipients of the benefit, as well as their TFNs. This is necessary for accurate reporting and compliance with government regulations.

How CleanSlate can help?

When it comes to managing your SMSF's end-of-year accounting tasks, partnering with a trusted professional can greatly simplify the process. At CleanSlate, we specialize in providing top-notch SMSF accounting services tailored to your unique requirements. With our expertise and in-depth knowledge of SMSF regulations, we ensure meticulous attention to detail and accuracy in every aspect of your accounting needs.

From reconciling financial statements to preparing tax returns and reviewing compliance obligations, our dedicated team handles it all. By relying on our services, you can have peace of mind knowing that your SMSF's accounting will be meticulously managed, allowing you to focus on other crucial aspects of your fund's administration.

Trust CleanSlate to be your partner in streamlining your SMSF's year-end accounting process, ensuring it is accurate, compliant, and hassle-free. Contact us now for more information.