Seven key strategies for financially empowering your healthcare practice

Introduction:

Running a medical practice efficiently is a complex task that extends beyond excellent patient care. It requires sound financial management, an area where the expertise of an accountant, particularly one with experience in the medical sector, is invaluable.

This blog will focus on seven key strategies to enhance the profitability of your medical practice. These are not just theoretical concepts but practical approaches that have been successfully applied in various medical settings. The strategies range from refining billing processes and embracing advanced technology to strategic pricing and improving patient engagement. Each plays a vital role in strengthening the financial health of a medical practice.

The role of an accountant in this context is crucial. It's not just about managing books or taxes, it's about understanding the unique financial challenges in the medical field and implementing strategies that complement the primary goal of patient care.

We will provide insights and actionable steps to improve the financial performance of your medical practice. These strategies are designed to bolster the financial foundation of your practice, ensuring a balance between financial health and high-quality patient care.

Key takeaways

Optimise fee structures and doctor remuneration for balanced profitability and patient accessibility.

Invest in healthcare IT to streamline processes and enhance patient engagement.

Ensure regulatory compliance and tax efficiency to avoid penalties and maximise savings.

Utilise accountants' expertise in healthcare for tailored financial strategies and cost reduction.

Leverage technology for efficient billing and improved financial tracking.

7 proven ways to improve the profitability of a medical practice with the expertise of an accountant for doctors

Here are seven practical strategies that can significantly boost your medical practice's profitability and overall vitality:

Optimising fee structures and doctor remuneration is a critical strategy for balancing profitability with patient accessibility in medical practice. An accountant's expertise is invaluable in this process, as they can conduct a thorough financial analysis to determine the most appropriate fee levels.

This involves considering various factors such as local market rates, the cost of services, and patient demographics. The goal is to set fees that are competitive yet profitable, ensuring the practice's financial sustainability.

Similarly, for doctor remuneration, accountants can provide insights into industry benchmarks and help establish a remuneration system that is fair, motivating, and financially viable.

This system should reflect the doctors' experience, skills, specialities, and the value they bring to the practice. By carefully structuring these financial aspects, a medical practice can maintain a healthy balance between attracting and retaining top medical talent and ensuring overall profitability.

Leveraging healthcare information technology is essential for modern medical practices aiming to enhance efficiency and patient care. An accountant's role in this strategy involves evaluating the financial implications of investing in technologies like appointment management systems (AMS), telehealth, and practice management systems (PMS). These technologies can streamline clinical processes, improve patient engagement, and ultimately contribute to the practice's financial health.

Accountants can assist in budgeting for these investments, analysing their potential return on investment, and ensuring that the costs align with the practice's financial goals. They can also help identify funding opportunities or financial incentives available for technology adoption.

Furthermore, accountants can monitor the financial impact of these technologies post-implementation, ensuring they deliver value and contribute to the practice's profitability. This strategic approach to technology investment not only enhances operational efficiency but also positions the practice for future growth and adaptability in a rapidly evolving healthcare landscape.

Streamlining operational processes in a medical practice is crucial for enhancing efficiency and patient satisfaction. An accountant can play a significant role in this strategy by analysing the practice's workflow and identifying areas for improvement.

This might include simplifying patient intake procedures, optimising appointment scheduling, and enhancing billing and claims processing. By reducing redundancies and automating routine tasks, the practice can save time and resources, allowing staff to focus on patient care and other high-value activities.

Accountants can also recommend the implementation of practice management software that integrates various operational aspects, from scheduling to billing, into a single, efficient system. This not only improves the practice's operational efficiency but also provides better data for financial analysis and decision-making. Streamlined processes lead to reduced operational costs, improved patient experiences, and increased capacity for patient care, all contributing to the practice's profitability.

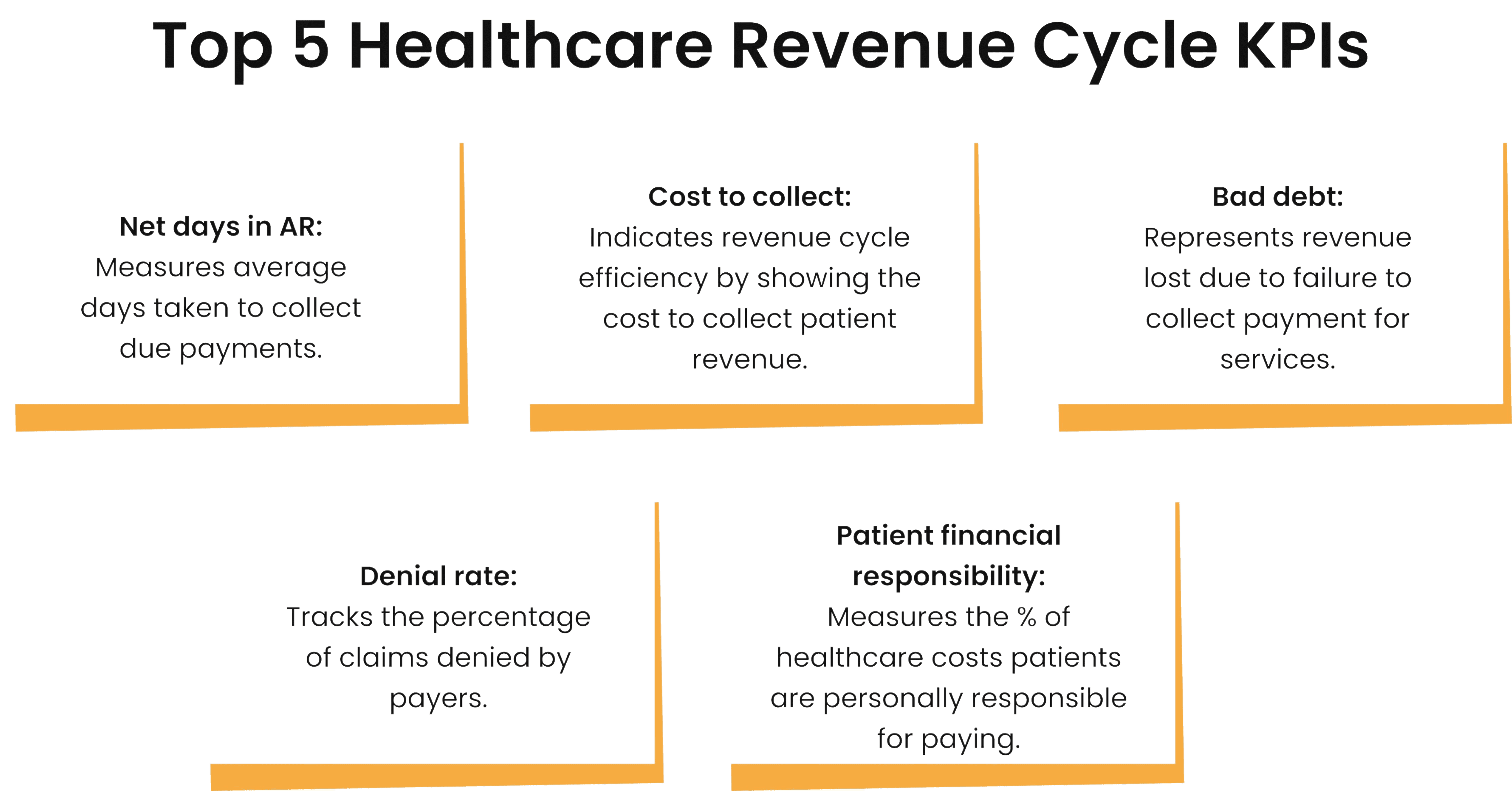

Implementing robust financial management is vital for the sustainability and growth of a medical practice. An accountant's expertise is crucial in establishing and maintaining adequate financial systems. This includes accurate bookkeeping, comprehensive financial reporting, and strategic financial planning.

Accountants can help medical practices track and analyse revenue streams, manage expenses, and ensure profitability. They can also provide insights into financial performance, helping the practice make informed decisions about investments, expansions, or cost-cutting measures.

Additionally, accountants can assist in budgeting and forecasting, enabling the practice to plan for future financial needs and opportunities. Effective financial management also involves ensuring compliance with accounting standards and regulatory requirements, areas where accountants can provide valuable guidance. By maintaining a solid financial foundation, medical practices can focus on delivering high-quality patient care while ensuring their long-term financial health and stability.

Focusing on regulatory compliance and tax efficiency is essential for medical practices to operate legally and maximise profitability. Accountants specialising in healthcare can guide practices through the complex landscape of healthcare regulations and tax laws. They ensure compliance with industry-specific regulations, helping practices avoid legal penalties and maintain their reputation. This includes adherence to patient privacy laws, accurate billing practices, and meeting other regulatory requirements.

On the tax front, accountants can identify tax-saving opportunities and ensure that the practice takes advantage of all applicable tax deductions and credits. This might involve strategies for efficient tax planning, managing taxable income, and navigating the intricacies of healthcare-related tax laws. Accountants can also assist in preparing and filing tax returns, ensuring accuracy and compliance. By focusing on these areas, medical practices can minimise their tax liabilities, stay compliant with regulations, and maintain a robust financial position.

Concerned about regulatory compliance in your practice?

Developing a solid healthcare network and patient support system is a strategy that can significantly enhance a medical practice's profitability and patient care quality. Accountants can play a pivotal role in this strategy by helping practices analyse the financial benefits of forming partnerships with other healthcare providers, such as specialists, allied health professionals, and diagnostic centres. These collaborations can lead to more comprehensive patient care, increased referrals, and expanded service offerings.

Accountants can assist in evaluating potential partnerships' financial viability, negotiating terms, and managing the revenue-sharing models. Additionally, they can help implement patient support systems that improve patient engagement and satisfaction, leading to higher retention rates and positive word-of-mouth referrals.

This might include financial planning for patient education programs, support groups, or technology-based solutions like patient portals. By fostering a strong network and support system, medical practices can enhance their market position, attract more patients, and improve their financial performance.

Enhancing a medical practice's online presence and marketing efforts is crucial in today's digital age. Accountants can contribute significantly to this strategy by helping allocate marketing budgets effectively and measuring the return on investment of various marketing channels.

They can assist in analysing market trends and identifying the most effective platforms for reaching the target audience, whether through social media, search engine optimisation, or online advertising. Accountants can also help track the performance of marketing campaigns, providing insights into patient acquisition costs and the overall effectiveness of marketing strategies.

Additionally, they can advise on the financial aspects of website development and maintenance, ensuring that the practice's online presence is not only engaging and informative but also cost-effective. By enhancing their online presence and marketing efforts, medical practices can attract more patients, build brand recognition, and ultimately increase their profitability.

Does your medical practice need an accountant’s help?

Are you a medical professional finding it challenging to manage the accounting aspects of your practice? At CleanSlate, we recognise that dealing with financial records, tax compliance, and payroll can be overwhelming when your primary focus is patient care. This is where our specialised doctor's accounting services come into play, specifically designed for the healthcare sector.

Our approach is not just about managing books; it's about creating a seamless financial strategy for your practice. From personalised tax planning to efficient payroll management, we aim to maximise your financial efficiency and savings. Our team, with its deep understanding of the healthcare industry, is adept at reducing accounting costs significantly, ensuring you get quality service without straining your budget.

We believe in transparent and straightforward pricing with no hidden fees, providing you with a clear understanding of your financial commitments. Our commitment to ensuring the security of your financial data and meeting all compliance deadlines offers you peace of mind. With CleanSlate, you can focus on what you do best – caring for your patients while we expertly handle all your accounting needs.

Wrap up!

Enhancing the profitability of your medical practice is a multifaceted endeavour that extends far beyond the scope of everyday patient care. By implementing these seven strategic approaches, ranging from optimising fee structures to leveraging healthcare technology and enhancing marketing efforts, you can significantly improve your practice's financial health. The role of a specialised accountant in this journey cannot be overstated. Their expertise in navigating the unique financial landscape of the medical sector is a critical asset

At CleanSlate, we understand the complexities of healthcare accounting and are dedicated to tailoring our services to meet the specific needs of your practice. By partnering with us, you can ensure that your practice not only thrives financially but also continues to provide the highest standard of patient care. Remember, a healthy practice balances excellent patient services with robust financial management, and we are here to help you achieve just that. Contact us to know more.