Is your 2025 business tax return ready? Avoid these common mistakes

Introduction:

The ATO is expanding its use of data matching programs to identify tax return errors in 2025. By collecting information from banks, employers, government agencies, and other organisations, the ATO compares external data with its own records to ensure taxpayers meet their obligations. This process plays an important role in identifying under-reported income, incorrect deductions, and potential fraud.

For this reason, it is important to review your return carefully before lodging. Even small mistakes, such as missing income, overstated deductions, or incomplete records, can lead to delays, additional questions, or penalties. Taking the time to check the accuracy of your return helps reduce the risk of avoidable issues.

In this blog post, we explore some of the most common tax return mistakes that taxpayers generally make and solutions to avoid them during the 2025 tax season.

Key takeaways

The ATO is using expanded data matching to catch income and deduction errors in 2025.

Rental deductions only apply when the property is genuinely available for rent.

Declare all income, including contract, investment, rental, and overseas earnings.

Always check pre-filled data for missing or incorrect details before lodging.

Foreign income might be exempt, but only if strict ATO rules are met.

Avoid these 7 tax return mistakes that could cost you penalties

Below are seven common mistakes our accountants often observe individuals and business owners make when preparing their returns. Avoiding these errors can help you get your tax returns right and make your 2025 tax season smooth and stress-free.

To be deductible, an expense must be directly linked to the duties you perform as part of your job. It must be paid for out of your own pocket, not reimbursed by your employer, and supported by a record such as a receipt, invoice, or written log.

The ATO continues to see claims for items that are personal in nature, including home appliances, gaming consoles, clothing not specific to an occupation, or travel that is part of everyday commuting. Even if these items are used at work or intended to improve comfort during work hours, they won’t qualify if they are not essential to performing your role.

If an expense has both personal and work-related use, only the work-related portion can be claimed. You’ll need to clearly document how that portion was calculated.

Misusing the $300 rule:

At tax time, many Australians misuse the $300 no-receipt deduction rule, assuming they can automatically claim up to that amount without any evidence. While the ATO does allow up to $300 in work-related deductions without receipts, you’re still required to prove:

- You spent the money.

- It was work-related.

- You can explain how you calculated the amount.

This rule does not apply to car expenses, travel allowances, or meal payments. Even for claims under $300, the ATO may ask for diary entries, bank statements, or other forms of documentation.

Throwing away receipts without keeping records can raise red flags and lead to audits. The ATO uses industry benchmarks to detect suspicious claims, so even “small” deductions can result in big problems if not handled properly. Working with professional bookkeepers makes it easier to maintain accurate records and avoid costly mistakes at tax time.

EOFY 2025 checklist to avoid costly tax errors

Overclaiming rental property deductions

Claiming expenses on a rental property depends on how the property was used throughout the year. You can only claim deductions for periods when the property was genuinely available for rent. If it was used for personal holidays or occupied by family or friends, those timeframes must be excluded from your claims.

Care should also be taken when claiming repair costs. If repairs are made to fix issues that existed when the property was purchased, they are not considered deductible. These are treated as capital expenses and are added to the property's cost base for future capital gains calculations.

When significant upgrades are made, such as renovations, structural changes, or installing new appliances, the cost must be claimed over time under capital works or depreciation rules. These types of expenses cannot be claimed in full immediately, regardless of when the money was spent.

Where only part of a property is used to generate rental income, such as renting out one room in a house, expenses must be adjusted to reflect the portion used for income-earning purposes. This ensures deductions are proportionate and compliant with tax rules.

Misunderstanding crypto tax rules

Cryptocurrency is a fast-growing area of investment, with more Australians entering the market each year. However, many still misunderstand how crypto activity should be reported on their tax return. The ATO is focusing on this area, and mistakes, whether accidental or deliberate, can lead to audits, penalties, or amended assessments.

One common error is thinking that gains are only taxable when converted back to Australian dollars, or assuming that crypto income is tax-free. In reality, any disposal of cryptocurrency, including trading, exchanging, or using it to pay for goods or services, may trigger tax obligations. Investors are generally subject to capital gains tax, while frequent traders may need to declare their profits as business income.

The ATO receives transaction data from Australian exchanges and uses it to match against tax returns. If your crypto activity is not declared correctly, it will be detected. Keep detailed records and speak with a tax adviser who understands cryptocurrency.

Using estimates instead of accurate figures

Your tax return must reflect actual amounts, not approximations. Rounding numbers or entering rough guesses for your income, expenses, or deductions increases the likelihood of errors and may lead to your return being questioned.

The ATO receives detailed information from multiple sources, including employers, banks, and government agencies. Any mismatch between what you declare and what the ATO holds can result in delays or a review of your return.

To avoid issues, refer to original documents such as income statements, bank records, and receipts when completing your return. If any information is missing or unclear, take the time to confirm it before lodging.

Failing to declare all income

Income from all sources must be reported on your tax return. This includes regular wages as well as additional amounts received through contract work, rental arrangements, financial investments, digital platforms, and overseas employment.

Even though the self-assessment system allows returns to be processed as submitted, they can still be reviewed after lodgment. If a review finds that income was not reported correctly, the tax office may adjust the return within the legal time limits.

When inconsistencies are identified, further action may include a reassessment, interest charges, and financial penalties depending on the circumstances.

Receiving overseas income?

Relying too heavily on pre-filled data

Pre-filled information from the ATO can be a useful tool, but it’s not foolproof. Data may be delayed or incomplete, especially in the early stages of tax season.

If you rely solely on pre-filled figures without verifying them, you could underreport your income or miss out on deductions. In either case, it’s your responsibility to ensure the accuracy of what’s submitted.

Cross-check pre-filled entries with your actual documents: income statements, dividend notices, health insurance records, and bank interest summaries. It may take a few extra minutes, but it could save you from headaches down the track.

Basic administrative errors

Errors in personal details are a frequent cause of delays at tax time. Issues like an incorrect tax file number, an outdated address, a misspelt name, or a wrong bank account can disrupt the processing of your return.

Such mistakes may lead to rejected lodgments, delayed refunds, or important notices not being delivered.

Before submitting your return, review all personal information carefully. Check that your name, contact details, and banking information match what’s registered with the ATO. Making sure these are correct can help avoid avoidable issues and ensure your return proceeds without interruption.

How to amend a tax return?

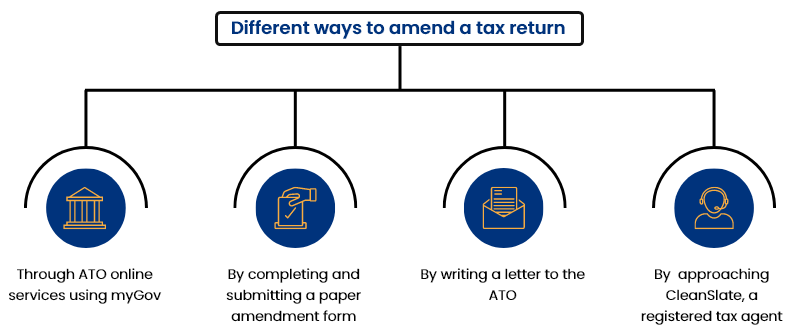

If you have made a mistake or left something out of your tax return, you can submit an amendment once the ATO has processed your original return. Waiting for the initial processing helps prevent delays.

Time limits apply to amendments. If the deadline has passed, you may need to lodge an objection instead.

ATO deadlines are approaching - Get your 2025 return lodged with a registered tax agent

Managing a business already takes up most of your time and energy. Lodging your 2025 tax return shouldn’t be another burden. If you miss key details, submit an incomplete return, or delay lodgement, you could face ATO scrutiny, lose valuable deductions, or incur financial penalties.

CleanSlate is here to handle it all for you. Our experienced tax accountants will review your records, ensure full compliance with ATO requirements, and help you claim every deduction you’re entitled to. Whether you're behind schedule or want to avoid issues before they arise, we can step in immediately and get your return lodged properly.

Don’t leave your 2025 tax return to chance. Reach out to CleanSlate today and let our experts take care of your business tax obligations, so you can stay focused on growing your business.