10 reasons why every small business owner must outsource payroll processes in Australia

Introduction:

Running a small business in Australia is no small feat. Amidst the countless demands of daily operations, small business owners often find themselves grappling with the complexities of managing payroll. From ensuring accurate calculations and deductions to navigating ever-evolving payroll regulations, the burden can quickly become overwhelming.

Fortunately, there's a solution that offers respite and unlocks a myriad of benefits: outsourcing payroll processes. By entrusting this critical task to specialised professionals, small business owners can reclaim their time, streamline operations, and achieve greater peace of mind.

At CleanSlate, we understand the challenges faced by small businesses. As one of the premier outsourcing accounting and bookkeeping service providers in Australia, we are committed to empowering small business owners with comprehensive financial solutions.

In this blog, we will explore ten compelling reasons why every small business owner in Australia should consider outsourcing payroll processing. From cost savings and compliance to expertise and scalability, outsourcing payroll function presents a strategic opportunity to propel your business forward.

So, join us as we embark on a journey to discover the transformative power of outsourcing payroll services Australia.

Key takeaways

Leverage the expertise of professionals to reduce costs and improve compliance.

Experience accurate and reliable payroll services tailored to your specific needs

Ensure compliance and accuracy with outsourced payroll services

Reduce reliance on a single individual for payroll processing

Free up time to focus on core business activities

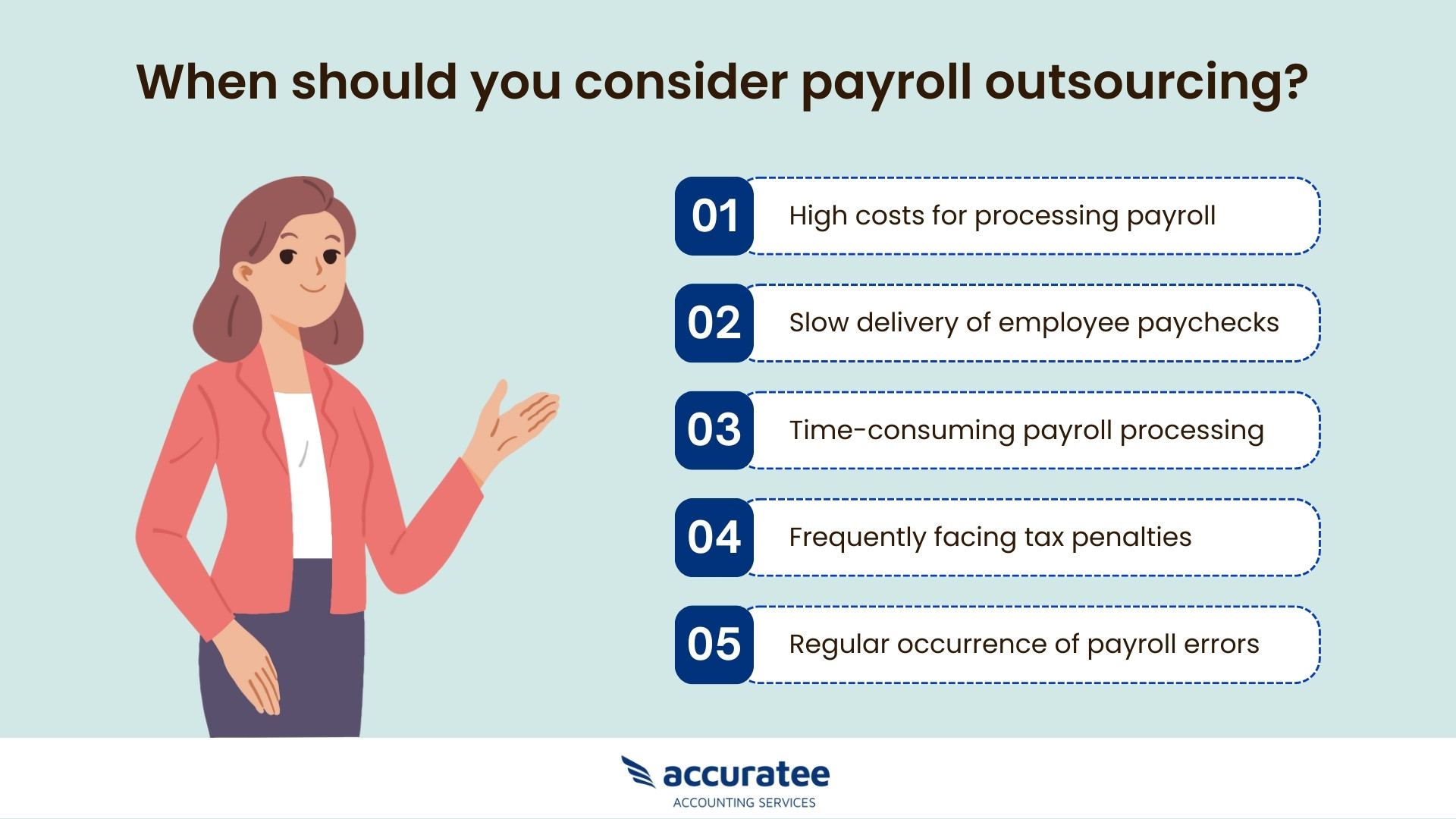

What are the top 10 reasons why every small business owner must consider outsourcing payroll processes?

When it comes to managing bookkeeping and payroll, small business owners face numerous challenges that can consume valuable time and resources. However, by embracing the power of outsourcing, these hurdles can be overcome, leading to a host of benefits which we have discussed below.

1. Cost efficiency

-

Reduce labour costs:

Payroll outsourcing can significantly reduce labour costs for small business owners. Instead of hiring dedicated staff or burdening existing employees with additional responsibilities, outsourcing allows you to pay for services based on your specific needs. This eliminates the need for ongoing payroll salaries, benefits, training, and other related expenses.

-

Avoid penalties and fines:

Payroll mistakes can lead to costly penalties and fines from regulatory bodies, such as Australian Taxation Office (ATO), or Fair Work Ombudsman. By outsourcing payroll to professionals well-versed in Australian payroll regulations, you minimise the risk of errors and ensure compliance.

2. Time savings

-

Focus on core business activities:

By delegating payroll tasks to professionals, you can redirect your time and energy towards strategic initiatives that drive business growth. Outsourcing payroll allows you to focus on core activities such as business development, customer acquisition, and improving products or services

-

Minimise administrative burden:

Managing payroll requires meticulous attention to detail and administrative tasks that can be time-consuming. By outsourcing your payroll, you alleviate the burden of administration, including calculating wages, processing employee deductions, generating reports, and keeping up with legislative changes.

3. Compliance with Australian payroll regulations

-

Stay up to date with ever-changing payroll laws:

Keeping track of the frequent changes in Australian payroll laws can be challenging and time-consuming. By outsourcing payroll, you can rely on professionals who specialise in payroll management and stay updated with the latest government regulations. They continuously monitor changes, ensuring that your payroll processes align with current legal requirements.

-

Reduce the risk of non-compliance and legal consequences:

Non-compliance with payroll regulations can result in severe legal consequences and financial penalties for businesses. By outsourcing to experts, you minimise the risk of errors and non-compliance. They have the knowledge and expertise to navigate complex regulations, reducing the likelihood of costly mistakes that could harm your business.

4. Confidentiality and security

-

Mitigate the risk of data breaches and identity theft:

Data breaches and identity theft pose significant risks to businesses and their employees. By outsourcing, you mitigate these risks as payroll service providers prioritise data security and employ proactive measures to prevent breaches. They maintain rigorous security protocols and undergo regular audits to retain the integrity and confidentiality of employee data, reducing the likelihood of payroll fraud and identity theft incidents that could have severe consequences for your business.

-

Implement robust security measures:

Payroll service providers invest in advanced security measures to ensure the protection of payroll data. These measures may include encryption, secure servers, firewalls, multi-factor authentication, and regular data backups. By leveraging the expertise and infrastructure of a professional payroll service provider you can benefit from the latest security technologies and protocols that may be challenging to implement independently.

Expert Bookkeeping at Your Fingertips!

5. Expertise and accuracy

-

Benefit from specialised payroll professionals' knowledge:

Payroll provider possess specialised knowledge and expertise in the complex realm of payroll management. By outsourcing, you tap into this wealth of knowledge, leveraging their understanding of laws, tax compliance, and industry best practices. They stay updated with the latest changes, ensuring your payroll processes align with current standards and maximising compliance.

-

Ensure accurate calculations, tax withholdings, and deductions:

Accurate payroll calculations are crucial to ensuring employees are paid correctly and all tax withholdings and deductions are precise. Payroll outsourcing provider have the necessary tools and expertise to handle complex calculations, including taxes, superannuation contributions, and employee benefits. They minimise the risk of errors and discrepancies, ensuring that employees receive their correct wages and deductions are accurately processed.

6. Scalability and flexibility

-

Accommodate business growth without additional payroll resources:

As your business grows, managing payroll can become increasingly complex and resource-intensive. By outsourcing your payroll, you can seamlessly accommodate growth without the need to hire an additional in-house team. The payroll service provider can handle increased payroll volume, ensuring payroll processes remain efficient and accurate, even as your business expands.

-

Easily adjust payroll services based on business needs:

Business needs are dynamic, and payroll requirements may change over time. Outsourcing payroll provides the flexibility to tailor services to your specific needs. Whether you need to add or remove employees, adjust pay structures, or incorporate new benefits or deductions, the payroll service provider can easily accommodate these changes. This eliminates the need for extensive retraining or restructuring of in-house payroll systems.

7. Enhanced employee experience

-

Provide employees with timely and accurate payments:

Timely and accurate payment of wages is vital to maintaining employee morale and satisfaction. Payroll service providers have streamlined systems in place to handle payroll efficiently, reducing the likelihood of payment delays or errors. This consistent and reliable payroll process contributes to a positive employee experience.

-

Access to self-service portals and mobile apps:

Many payroll service providers offer self-service portals and mobile apps that empower employees with convenient access to their payroll information. Through these platforms, employees can view their pay stubs, access tax documents, update personal information, and manage direct deposit preferences. Such self-service options enhance convenience, transparency, and autonomy, enabling employees to take control of their payroll-related tasks.

8. Access to advanced technology and tools

-

Stay current with payroll software and technology advancements:

Managing payroll processing in-house often requires investing in and maintaining up-to-date payroll software and technology. By outsourcing the payroll process, you can leverage the expertise of service providers who stay at the forefront of payroll software advancements. These systems automate tasks such as data entry, payroll calculations, tax withholdings, and generating pay stubs. This ensures that your business benefits from the latest features, functionalities, and compliance updates without the need for significant investment or continuous software upgrades.

-

Generate reports and analytics for better financial insights:

Outsourcing provides access to comprehensive reporting and analytics capabilities. Payroll companies can generate various reports, including payroll summaries, tax filings, and year-end reports. These reports provide valuable financial insights, allowing you to analyse payroll trends, track expenses, and make informed decisions for your business. By leveraging these insights, you can optimise your financial strategy and better plan for the future.

9. Avoid payroll continuity issues

-

Prevent disruptions due to employee turnover or leaves:

Employee turnover or leaves can disrupt payroll operations, especially if the responsible individual possesses specialised knowledge or skills. The outsourced payroll provider can help minimise the impact of such disruptions. The payroll service provider has a team of professionals who can seamlessly handle payroll responsibilities, ensuring continuity even when employees responsible for payroll are absent or leave the company.

-

Reduce reliance on a single individual for payroll processing:

Relying on a single individual for payroll processing poses a risk to business continuity. By outsourcing payroll processing, you distribute the responsibility across a team of professionals. This reduces the vulnerability to disruptions caused by individual circumstances and ensures consistent and reliable payroll activities.

10. Peace of mind and business focus

-

Ensure compliance and accuracy:

Managing payroll in-house can be complex and time-consuming, carrying the risk of payroll errors and non-compliance. By outsourcing your payroll to professionals specialising in it, you can ensure compliance and accuracy without worrying about payroll administration. These experts handle all payroll-related tasks, ensuring that it is processed accurately and in accordance with legal requirements.

-

Concentrate on business growth and customer service:

Payroll outsourcing frees up valuable time and resources, enabling you to concentrate on growing your business and serving your customers. Instead of spending hours on payroll administration and calculations, you can focus on strategic initiatives, expanding your customer base, developing new products or services, and improving overall business performance. By shifting your focus to core business activities, you can drive growth and success.

Why choose CleanSlate?

- CleanSlate guarantees precise and dependable outsourcing payroll services Australia, ensuring that every payment is calculated and processed accurately.

- You can trust us to efficiently set up your payroll operations without any hassle.

- We handle all aspects of payment processing, ensuring that your employees receive their salaries on time and with precision.

- Our efficient reporting system keeps everyone informed and ensures transparency in transactions.

- We stay up to date on all relevant laws and regulations, ensuring payroll compliance.

- By entrusting us with tax-related responsibilities, you can save time and focus on other critical aspects of your business.

- CleanSlate goes beyond processing payments by offering valuable insights and analysis on payroll trends and performance.

- Our outsourced payroll services are flexible and can be tailored to fit your specific business needs. We work closely with you to customise our services, ensuring that they align perfectly with your requirements.

Wrapping up

Outsourcing payroll processes is a strategic move that can significantly benefit small business owners. By leveraging the expertise of professionals, you can reduce costs, ensure compliance, and free up valuable time to focus on core business activities.

With CleanSlate as your trusted partner, you can experience accurate and reliable payroll services tailored to your specific needs. Embrace the benefits of outsourcing payroll and position your business for success and growth.