Payday superannuation: Is your business ready for the change?

Introduction:

Big changes are coming for Australian businesses in the way superannuation must be managed. From 1 July 2026, employers will be required to pay super on payday instead of quarterly. This means every time you pay wages, the super contribution must also be made.

This shift, known as Payday Super, is designed to give employees faster access to their retirement savings and reduce delays in payments. For employers, it brings new timing requirements and added pressure on payroll systems and cash flow.

If you employ staff, the best approach is to prepare early. That means working with payroll specialists who can review your setup and make sure you are compliant from the first pay cycle.

In this blog post, we will explain how Payday Super works, the challenges it may bring, and the steps businesses can take to prepare. If you need support getting your payroll ready for the 2026 changes, our team at CleanSlate is here to help.

Key takeaways

From 1 July 2026, employers must pay super on payday, not quarterly.

Contributions must reach employee funds within seven calendar days of payday.

The reform aims to stop billions in unpaid super and improve retirement balances

The ATO will monitor compliance using Single Touch Payroll and super fund reporting.

Businesses that prepare early can benefit from smoother cash flow management and simpler payroll processes.

Seeking professional guidance from payroll specialists ensures your business is fully prepared for Payday Superannuation.

What is payday superannuation?

Superannuation is Australia’s compulsory retirement savings system. Employers must contribute a percentage of an employee’s ordinary time earnings (OTE) into their chosen super fund.

Currently, these Superannuation Guarantee (SG) contributions can be paid quarterly, with employers allowed up to 28 days after the end of each quarter to make the transfer. Under Payday Superannuation, this will change:

- Contributions must be paid every payday: Whether employees are paid weekly, fortnightly, or monthly, super must be processed at the same time.

- Funds must receive the money within seven days: Employers will have a maximum of seven calendar days after payday for contributions to arrive in an employee’s account.

- New employees – Super contributions for wages earned in the first two weeks of a new employee’s job do not need to be paid immediately. Instead, employers can wait until after the two-week period before making the payment.

- Irregular one-off payments – If an employee receives a payment outside their usual pay cycle (such as a bonus or allowance), the super contribution for that amount can be delayed until the next regular payday.

In all other cases, employers will be required to pay super alongside wages, giving employees faster contributions, greater visibility of their entitlements, and better retirement outcomes.

Affordable monthly packages for bookkeeping, BAS, tax & payroll

Many clients prefer having their bookkeeping, BAS, tax, and payroll handled together, with the certainty of a fixed monthly fee. Below is our pricing for a customised service solution that fits your needs.

Only Bookkeeping & BAS

Only bookkeeping and BAS (Does not cover tax returns, payroll and super):

$165/month *ex GST

Bookkeeping & Tax combined

For bookkeeping, BAS and tax returns (but no payroll or super included):

$225/month *ex GST

Bookkeeping, Tax & Payroll

All inclusive package: Bookkeeping, BAS, payroll, Super and tax returns:

$280/month *ex GST

Why is payday superannuation being introduced, and what problems does it solve?

The reform was announced in the 2023–24 Federal Budget as part of the Securing Australians’ Superannuation Package. Its primary purpose is to remove the long delay between when wages are paid and when contributions are credited to employees’ super accounts.

Under the quarterly system, contributions can be held for up to four months. This has left workers at risk when businesses collapse, mismanage cash flow, or fail to meet obligations. The ATO estimates that billions of dollars in superannuation go unpaid each year, directly reducing retirement balances.

The change also forms part of a broader reform agenda, which includes:

- Raising the Superannuation Guarantee (SG) rate to 12% from 1 July 2025.

- Adding superannuation to government-funded paid parental leave.

- Introducing stricter penalties for deliberate non-payment.

Together, these measures are designed to improve fairness, accountability, and long-term retirement outcomes for Australians.

New to superannuation? Learn how to pay super for employees and meet your employer obligations under Australian superannuation laws.

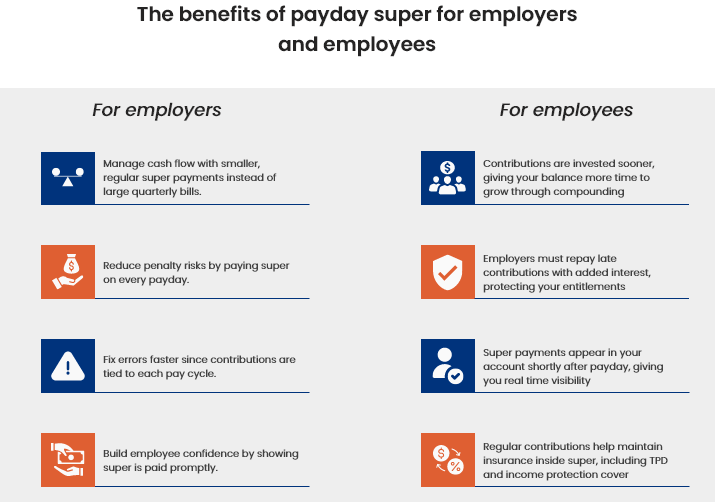

How does payday superannuation benefit employers and employees in 2026?

Payday Super goes beyond protecting workers. It also gives employers a more efficient way to manage payments while ensuring employees see real and timely growth in their retirement savings. Below are the key benefits for each group.

What role will the ATO play in enforcing payday superannuation?

The Australian Taxation Office (ATO) will play a central role in monitoring and enforcing Payday Superannuation.

Through Single Touch Payroll (STP) reporting, the ATO will receive information about OTE and super liabilities each pay cycle. At the same time, super funds will report when contributions are received. By matching these data sets, the ATO can quickly identify missed or delayed payments.

Employers who repeatedly fail to comply risk maximum penalties, but voluntary disclosure of errors will be encouraged and attract reduced charges. This proactive compliance model ensures problems are caught earlier, before they escalate.

What are the penalties for late or missed payday superannuation payments?

From 1 July 2026, any employer who does not pay superannuation in full and on time will be required to pay the updated Superannuation Guarantee (SG) charge. This charge is not just the unpaid super itself — it includes several additional costs designed to cover the impact on employees and the administration involved in recovering the money.

Here is what the charge involves:

Unpaid super contributions: The full amount of super that should have been paid still needs to be paid. This is worked out on the employee’s ordinary time earnings, so the worker is placed in the same position as if the payment had been made correctly in the first place.

Daily interest on the shortfall: Interest begins the day after the payment is due and is applied on a compounding basis. The rate is tied to the ATO’s general interest charge, which is 10.38 % per annum for the July–September 2025 quarter. This interest is there to make up for the lost investment growth that the employee’s super fund would have earned.

Administrative uplift: An additional amount of up to 60% of the unpaid super can be added. This uplift reflects the cost of enforcement and is applied on top of the shortfall and interest. If an employer voluntarily discloses the issue and fixes it quickly, the uplift will be reduced. This provides a clear reason to act promptly rather than waiting until the ATO becomes involved.

Ongoing interest if the ATO issues an assessment: If the ATO issues an assessment because the payment has not been made, interest will keep building each day until the debt is cleared. This includes interest on the original shortfall, on notional earnings, and on any uplift amounts that remain unpaid.

Penalty for late payment after assessment: If the SG charge is still not paid within 28 days of the ATO’s notice, another penalty of up to 50% of the unpaid charge can be applied. This is on top of the shortfall, interest, and uplift already owed.

Tax treatment: The SG charge itself is tax-deductible, meaning businesses can claim it as a cost. However, any penalties and additional interest applied after an ATO assessment are not deductible, which makes delays more expensive for employers.

- A payment that is only a few days late may add a small amount of interest.

- A payment that is weeks or months late can quickly build significant compounding costs.

- If the ATO becomes involved, extra charges and late payment penalties are added on top of the unpaid contribution.

To avoid these financial setbacks, businesses should act early and report any issues as soon as they arise. Investing in ATO-ready tax preparation ensures you stay ahead of obligations, minimise costs, and respond proactively before penalties stack up.

Get ready for payday super with CleanSlate

Book a call now

What support is available to help businesses transition to payday super?

To make the shift to Payday Superannuation more manageable, the government is introducing a series of improvements to payroll systems, fund processes, and onboarding requirements. These changes are designed to reduce delays, improve accuracy, and give businesses the tools they need to stay compliant.

Faster allocation of contributions: Super funds will need to allocate or return contributions within three business days, down from the current 20. This means employees will see contributions in their accounts more quickly, and employers will know sooner if a payment has failed.

Upgraded SuperStream standards: The SuperStream framework, which standardises superannuation reporting and payments, will be updated. Contributions will be able to flow through the New Payments Platform (NPP), enabling near real-time processing. Error messages will also be clearer, allowing payroll staff to quickly correct mistakes within the seven-day deadline.

Error messages will also be clearer, allowing payroll staff to quickly correct mistakes within the seven-day deadline.

Closing of the ATO small business clearing house: The ATO Small Business Superannuation Clearing House will be retired from 1 July 2026. Employers will need to switch to modern payroll software with built-in super payment features or a commercial clearing house. Planning this transition in advance will avoid last-minute disruptions.

Improved onboarding with stapled funds: When a new employee starts, employers will be able to confirm whether the worker already has a stapled superannuation fund that carries over from previous jobs. Using the existing account avoids creating duplicate funds, which can reduce retirement savings by spreading them across multiple accounts and adding extra fees.

Limits on super product advertising: To ensure employees are only presented with quality products, advertising during onboarding will be restricted to MySuper funds that pass the annual performance test. This gives workers confidence that their default options meet minimum performance standards.

7 actionable steps to get our business ready for the payday superannuation

Here are the key steps to help small businesses prepare for the shift, manage payroll changes smoothly, and stay compliant when the new rules begin in July 2026.

Review payroll systems

To meet the new Payday Super obligations, your payroll system must be able to calculate and process superannuation with every pay cycle, not just quarterly. It also needs to send contributions fast enough to reach employee super funds within seven calendar days.

Plan for cash flow changes

Quarterly lump-sum payments will be replaced by smaller but more frequent super payments. Review budgets and forecasts now so you know how this will affect working capital. Consider keeping a buffer aside to cover payroll and super during slower trading months.

Update onboarding processes

From 2026, when you hire a new employee, you will need to check whether they already have a stapled super fund that follows them from previous jobs. Show this option during onboarding so they can either keep using their existing fund or nominate a different one. Always collect fund details at the start of employment and keep your records current to avoid creating duplicate accounts that reduce savings.

Train payroll and HR staff

Your payroll and HR teams need to understand the new deadlines and the limited exceptions for new employees and irregular payments. Training staff ahead of time will reduce errors once Payday Super starts.

Communicate with employees

Let your team know that super will be paid more often and appear in their accounts soon after payday. This builds confidence and shows staff that their entitlements are being managed correctly.

Seek professional advice

Accountants, bookkeepers, or payroll specialists can guide you through compliance requirements, cash flow adjustments, and software upgrades. Seeking advice now ensures you are ready well before the rules come into effect.

How CleanSlate helps you stay compliant with payday superannuation

Change can be tough, but our payroll specialists make it easier. At CleanSlate, we understand that moving from quarterly to payday super contributions means more than just updating software. It requires accurate processing, cash flow planning, and ongoing compliance oversight.

Here is how we can support your business:

- Review payroll systems to confirm they are ready for the payday super

- Set up super contributions so they are processed on time every pay cycle

- Monitor payments to ensure funds are received within seven days

- Help plan for cash flow changes created by more frequent payments

- Provide ongoing compliance checks to reduce the risk of ATO penalties

With our support, your payroll and superannuation obligations will be managed correctly and aligned with the new rules. Contact CleanSlate today to start preparing for Payday Superannuation.

Payday superannuation FAQs

1. What are the new superannuation rules for 2026 in Australia?

From 1 July 2026, employers must pay superannuation contributions to employees’ super funds on payday, rather than quarterly. These contributions must be received by the fund within seven business days of the payday. The contributions will be calculated as 12 percent of an employee’s qualifying earnings, which includes ordinary time earnings (OTE), salary sacrifice, and other eligible payments. Employers will also need to report both qualifying earnings and super liability through Single Touch Payroll (STP).

2. What is the superannuation rate from 1 July 2026?

From 1 July 2026, the Superannuation Guarantee rate will remain at 12 percent. This applies to qualifying earnings, a broader category than the current ordinary time earnings. Employers must apply the 12 percent rate to all payments defined under qualifying earnings and ensure payments are made on time to avoid penalties.

3. What is the Superannuation Guarantee Charge Amendment Bill 2025?

The Superannuation Guarantee Charge Amendment Bill 2025 introduces legislative changes that require employers to pay superannuation contributions on payday. The bill also updates how late payments are assessed. From 1 July 2026, the Superannuation Guarantee Charge (SGC) will apply if super is not received within seven business days of payday. The SGC will include interest compounded daily, and an administrative uplift may apply depending on an employer’s compliance history.

4. What is the superannuation guarantee cap for 2026?

The maximum superannuation contribution base, also known as the super guarantee cap, limits the amount of earnings on which employers must calculate super contributions. The cap is indexed annually, and the exact amount for the 2026–27 financial year will be published by the ATO before 1 July 2026. Employers are only required to pay super on earnings up to this threshold per quarter per employee.

4. What are qualifying earnings under Payday Super?

From 1 July 2026, superannuation contributions must be calculated using qualifying earnings (QE) instead of ordinary time earnings (OTE). Qualifying earnings include OTE as well as salary sacrifice amounts and other eligible components that currently form part of an employee’s salary or wages. Employers must ensure that their payroll systems correctly calculate super at 12 percent of QE and report this through Single Touch Payroll.

5. What happens to the Small Business Superannuation Clearing House in 2026?

The Small Business Superannuation Clearing House (SBSCH) closed to new users on 1 October 2025. Existing users can continue to access the system until 30 June 2026. From 1 July 2026, the SBSCH will be permanently decommissioned. All employers will need to transition to alternative super payment methods, such as payroll-integrated clearing houses or commercial platforms, to meet the new Payday Super payment deadlines.

Final thoughts on payday superannuation

Payday Superannuation is bringing major changes to how super must be paid in Australia. From 1 July 2026, employers will need to pay super at the same time as wages and ensure contributions reach employee funds within seven business days.

To stay compliant and avoid penalties, it's important to act early. That means reviewing your payroll systems, planning for cash flow changes, and updating your processes ahead of time.

At CleanSlate, we help businesses like yours prepare for Payday Super with tailored payroll solutions, real-time contribution tracking, and expert support every step of the way.

Book a free consultation with our payroll experts and let’s make sure you’re ready before the new rules take effect.