Nine types of trusts in Australia – Which structure is right for you?

Introduction:

Across Australia, trusts play an important role in protecting assets, distributing income, and supporting long-term planning for families, businesses, and investors. They offer significant advantages, but with so many different structures available, deciding which one to use is not always easy.

Each trust has its own rules, benefits, and limitations. In this blog, we walk through the nine main types of trusts in Australia and highlight the key considerations that will help you decide which structure is the most suitable for your situation.

Key takeaways

A trust is a legal arrangement where trustees manage assets for beneficiaries under the terms of a deed.

Trusts are recognised by the ATO for tax purposes and must meet annual compliance obligations.

Income from trusts is generally taxed at the beneficiary’s marginal tax rate.

Proper record-keeping is essential, including deeds, minutes, resolutions, and financial statements.

Choosing the right trust depends on purpose, level of control, flexibility, and long-term planning objectives.

What is a trust?

A trust is a legal arrangement where one party, called the trustee, is appointed to hold and manage assets on behalf of another party, known as the beneficiaries. The trust is usually created through a trust deed, which outlines the rules for how the trust must operate, what assets are included, and how income or capital can be distributed.

Key roles in a trust include:

- Settlor- the person who establishes the trust and contributes the initial asset.

- Trustee- the individual or company responsible for managing the trust and ensuring compliance with the trust deed.

- Beneficiaries - the people or organisations entitled to benefit from the trust.

Unlike a company, a trust is not a separate legal entity. However, it is recognised by the Australian Taxation Office (ATO) for tax purposes and must meet specific reporting and compliance obligations. This includes lodging annual financial statements and preparing a tax return to report income and distributions.

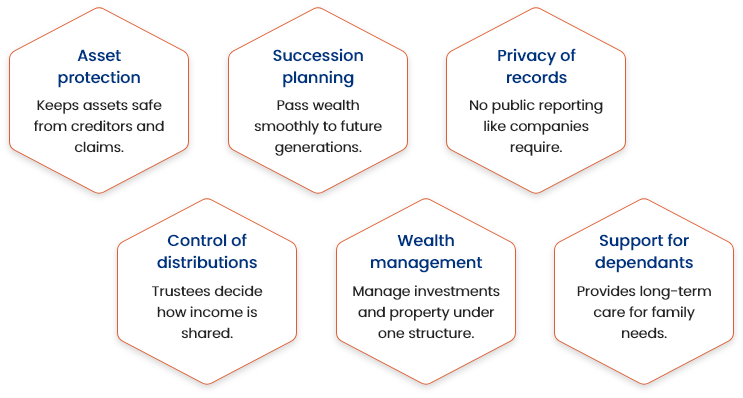

Benefits of setting up different types of trusts

Trusts are widely used by individuals, families, and businesses because they provide a number of advantages:

Keep in mind that assets held in a trust are not covered by your will. You will need to decide who will control the trust after your death to make sure your wishes are followed.

The nine types of trusts in Australia

Here is an overview of the nine types of trusts you may consider when planning a trust set up in Australia.

1. Discretionary trust

A discretionary trust is a structure where a trustee manages assets for beneficiaries and decides how income or capital is distributed each year. It is commonly used in Australia for family businesses, investments, and estate planning.

Advantages- Asset protection: separates ownership from individuals, protecting assets from creditors or legal claims.

- Tax efficiency: trustees can distribute income to beneficiaries on lower tax rates.

- Flexibility: allocations of income or capital can change annually to suit circumstances.

- Succession planning: provides a clear framework for passing wealth to future generations.

- Complex setup: requires a detailed deed, legal advice, and compliance with tax laws.

- Tax efficiency: ongoing legal and accounting fees can be significant.

- Flexibility: beneficiaries rely on trustee decisions and have no guaranteed entitlement.

- Succession planning: poor management may create penalties or limit access to concessions.

Best suited for: Families, business owners, and investors who want asset protection, flexible tax outcomes, and structured wealth transfer to future generations.

If you want to learn more about how this structure works in practice, check out our blog on a discretionary trust set up in Australia.

2. Fixed trust

In a fixed trust, beneficiaries’ rights are clearly set out in the trust deed and cannot be changed. Each beneficiary is entitled to a specific share of the income or capital.

For example, if two siblings each hold 50% in a fixed trust that owns an investment property, both must receive 50% of the income and capital, regardless of individual circumstances.

Advantages- Certainty and transparency: Beneficiaries know exactly what portion of income and capital they will receive each year.

- Fairness in shared ownership: Because entitlements are fixed, all parties are treated equally in line with their shareholding. This makes fixed trusts popular for joint ventures, family property investments, or partnerships where fairness and clarity are critical.

- No flexibility: The trustee cannot adjust distributions for tax planning.

- Rigid structure: Not ideal for families or businesses that want adaptability.

Best suited for: Business partners or investors who want certainty in entitlements.

3. Unit trust (a type of fixed trust)

A unit trust divides ownership into units, like shares in a company. The number of units held determines each beneficiary’s share of income and assets.

For example, if a property development is held in a unit trust, investors can each purchase units, and profits are distributed based on their holdings.

Advantages- Defined ownership structure: Each unit directly represents a proportionate entitlement to income and capital.

- Scalable model: New investors can be brought in by issuing additional units.

- Attractive for investors: Commonly used in property investment syndicates and joint ventures.

- Taxed on entitlement: Beneficiaries are taxed on their share of income, whether or not it is distributed.

- Limited flexibility: Less adaptable than discretionary trusts when adjusting income flows.

Best suited for: Property syndicates, joint ventures, and pooled investments where proportional ownership is essential. We have also written a detailed blog on a unit trust set up in Australia if you’d like to understand the process and compliance steps.

4. Hybrid trust

Hybrid trusts combine elements of discretionary and unit trusts. Some beneficiaries may hold fixed entitlements via units, while the trustee retains discretion over how to distribute other income or capital. For example, investors might receive a guaranteed fixed percentage of profits, while family members can receive discretionary distributions.

Advantages- Combines certainty with flexibility: Satisfies investors while allowing tax planning.

- Customisable structure: Can be tailored for complex family or business situations.

- Complex to manage: Requires careful drafting and ongoing administration.

- Potential disputes: If expectations of fixed and discretionary beneficiaries clash.

Best suited for: Families with business investors, or businesses needing both guaranteed returns and flexible tax planning.

5. Testamentary trust

A testamentary trust is established through a person’s will and only comes into effect after their death. The trustee then manages the assets on behalf of beneficiaries, such as children, dependents, or even future generations.

For example, parents may direct that their estate be placed into a testamentary trust so that children under 18 receive financial support without having unrestricted access to the money.

Advantages- Favourable tax treatment for minors: Unlike ordinary trusts, income paid to children is taxed at adult rates, which can significantly reduce tax liabilities.

- Greater control over inheritance: The will-maker can set conditions, such as restricting access until a child reaches a certain age, ensuring assets are not misused.

- Asset protection: Inherited wealth held in a testamentary trust is generally shielded from claims by creditors, ex-spouses in divorce proceedings, or bankruptcy.

- Intergenerational planning: Allows assets to be managed for the benefit of future generations while preserving the original capital.

- Limited to post-death planning: It cannot be established or used during the will-maker’s lifetime.

- Legal and administrative costs: Setting up through a will requires careful drafting, and trustees face ongoing obligations and compliance requirements.

- Complexity: Conditions attached to the trust may make administration more complicated for trustees, particularly when beneficiaries have differing needs.

Best suited for: Families who want to ensure minors or vulnerable beneficiaries are supported, individuals seeking tax-efficient inheritance structures, and those wanting to protect assets for multiple generations.

6. Special disability trust

A special disability trust is designed to provide financial support for individuals with severe disabilities while preserving their eligibility for government benefits. For example, parents of a child with a disability may establish this trust to ensure long-term financial care.

Advantages- Social security concessions: Contributions are not counted against Centrelink means testing up to certain limits.

- Secures long-term care: Provides certainty for the disabled person’s future.

- Strict rules: Funds can only be used for specific expenses.

- Eligibility requirements: Only available for beneficiaries meeting defined disability criteria.

Best suited for: Families wanting to safeguard the future of a severely disabled relative.

7. Public unit trust (Listed)

Listed public unit trusts are widely held and traded on stock exchanges. Investors buy and sell units much like company shares.

Advantages- Liquidity: Units can be easily sold on the market.

- Transparency: Subject to strict regulation and disclosure requirements.

- Complex compliance: Suitable only for large-scale investments

- Public exposure: Less privacy compared to private trusts.

Best suited for: Large investment projects accessible to the public.

8. Public unit Trust (Unlisted)

An unlisted public unit trust operates similarly to a listed trust, but its units are not traded on a stock exchange. Instead, investors deal directly with the trust to buy or redeem units. These structures are commonly used in managed funds that focus on real estate, infrastructure, or private investment projects.

Advantages- Access to large-scale investments: Enables individuals to pool funds and participate in projects that would otherwise be out of reach.

- Regulated structure: Even without being listed, unlisted trusts are still subject to rules designed to protect investors and ensure accountability.

- Potential for stable returns: Often linked to long-term assets like property or infrastructure that generate consistent income.

- Lower liquidity: Investors cannot sell units on the open market, which means funds are tied up for longer periods.

- Higher costs: Management fees and compliance expenses can reduce overall returns.

- Valuation delays: Unlike listed trusts, unit values may not be updated frequently, making it harder to assess performance at any given time.

Best suited for: Investors interested in managed funds with exposure to property, infrastructure, or other long-term private investment opportunities.

9. Managed investment trust (MIT)

A Managed Investment Trust (MIT) is a type of unit trust where members of the public invest collectively in passive income activities such as property, shares, or fixed interest assets. To qualify as an MIT, the trust must meet specific eligibility requirements set by the Australian Taxation Office (ATO).

Advantages- ATO tax concessions: MITs may access concessional tax treatment, making them attractive for both Australian and overseas investors.

- Professional oversight funds are managed by qualified investment managers, giving investors access to institutional-grade opportunities.

- Diversification: pooled funds allow investment across property, shares, and other assets.

- Scalability often used for large-scale projects such as commercial property portfolios.

- No investor control: decisions are made by fund managers, not individual investors.

- Management fees costs can reduce net returns.

- Complex compliance MITs must satisfy strict ATO eligibility and reporting requirements.

Best suited for: Retail and wholesale investors seeking exposure to large-scale managed funds, professional investment management, and the benefit of ATO-approved tax concessions.

Ready to move forward?

Book a call now

Key factors when choosing the right trust structure

Selecting the right trust structure requires balancing your current goals with the future needs of your family, business, or investments. The following points will help guide the decision.

- Purpose of the trust: Begin by asking why you want to set up a trust. Common reasons include tax minimisation, protecting assets, pooling investments, providing long-term support for a dependant, or directing funds to a charitable cause. The purpose will guide you toward the most appropriate structure.

- Beneficiaries: Consider who will benefit from the trust. Some trusts are designed for family members, others for investors, the wider public, or individuals with special needs. Knowing who the trust is meant to serve will help in choosing the right type.

- Control and flexibility: Certain trusts, such as discretionary or family trusts, allow the trustee to decide how income is distributed each year. Others, like fixed or unit trusts, give beneficiaries set entitlements that cannot be changed. The level of control you want the trustee to have should influence your decision.

- Future planning: Think about how the trust will work in the long run. Testamentary trusts can ensure inheritances are managed responsibly for children or dependents, while other structures may be designed to protect wealth for multiple generations.

Common mistakes to avoid

A trust can only deliver its benefits if it is administered correctly. Oversights in management often create tax complications, compliance breaches, or disputes between beneficiaries. Here are some of the most frequent mistakes and how to avoid them:

Distributing outside the deed: Making allocations that the trust deed does not permit can invalidate distributions and trigger penalties.

How to avoid it: Always review the trust deed before making a resolution and seek advice if uncertain about allowable distributions.

Missing the 30 June resolution: If trustees fail to sign and record distribution resolutions by 30 June, income may be taxed at the top marginal rate.

How to avoid it: Set a compliance calendar reminder well before year-end and prepare resolutions in writing, signed and dated on time.

Mixing assets: Treating trust property as personal assets, such as using a trust bank account for personal expenses, can breach trustee duties and weaken asset protection.

How to avoid it: Maintain separate bank accounts, accurate records, and never use trust funds for personal transactions.

FAQs

What is the difference between control and beneficial ownership in a trust?

Control refers to the trustee’s legal authority to manage the trust and make decisions in line with the deed. Beneficial ownership refers to the beneficiaries’ right to benefit from the income and capital. Trustees control but do not personally own the assets, while beneficiaries enjoy the benefits without holding legal title.

Can I be both trustee and beneficiary?

Yes, it is possible to be both, but safeguards are needed. For example, a sole trustee cannot be the sole beneficiary, as this collapses the trust. Having co-trustees or multiple beneficiaries ensures the structure remains valid.

Do I need a company as a trustee, or can individuals act?

Both are possible. Individual trustees are simpler and cheaper to set up, but may expose personal assets to liability. A corporate trustee offers stronger asset separation, easier succession planning, and is generally recommended for long-term structures.

How are losses treated in a trust?

Trust losses cannot be distributed to beneficiaries. They must be carried forward within the trust and offset against future trust income, provided the trust satisfies continuity and pattern of distribution tests.

Can a trust get an ABN and register for GST?

Yes. If the trust carries on an enterprise, it can apply for an Australian Business Number (ABN) Tax File Number (TFN), and register for GST with the ATO if turnover exceeds the threshold (currently $75,000 for most businesses).

What records should a trustee keep each year?

Trustees should maintain:

- A copy of the trust deed and any variations

- Minutes of trustee meetings and resolutions

- Annual distribution resolutions

- Beneficiary statements and notices

- Financial statements and tax returns

- Records of loans, unpaid entitlements, and related-party dealings

Final thoughts

So, you have now gained a brief overview of the nine types of trusts in Australia and how each one serves a different purpose. This is the point where you can start to consider which type of trust might suit your own circumstances. It is not always easy to weigh up the options, and seeking the right advice can make the decision simpler.

At CleanSlate we take the time to understand your goals and provide personalised guidance that fits your situation. From the initial set-up through to compliance and ongoing management, our team is here to help. Contact us today to schedule a consultation with our trust specialists and explore the structure that works best for your needs.