What happens if you miss a BAS lodgement due date?

Introduction:

Missing your BAS lodgement deadline, like the crucial October 31 date, can be stressful. If you've missed your BAS lodgement, the Australian Taxation Office (ATO) may impose penalties and interest charges. The good news is you can still take action to minimise these costs.

At CleanSlate, we specialise in helping businesses get back on track quickly. Our expert BAS lodgement support ensures your BAS is lodged as soon as possible, helping you avoid additional penalties. For just $165 per month, we take the stress out of the process, handle all necessary communications with the ATO, and ensure you remain compliant moving forward.

Keep reading to learn about the potential penalties for missing your BAS deadline, how they are calculated, and how our team can help you navigate these challenges.

Key takeaways

Penalties increase the longer you delay your BAS lodgement.

Penalty units are calculated based on your business size and delay.

You can request remission for penalties by explaining your situation.

Safe Harbour protection can help if delays were caused by your agent.

Consider setting up a BAS payment plan if you owe money.

Stay on top of future deadlines with automated reminders and regular checks.

BAS lodgement deadlines for 2025–26

Your lodgement frequency depends on your annual GST turnover, and businesses using a registered tax agent are eligible for an extended time to lodge under the ATO’s agent program. Not registered for GST yet? We help with the registration process, making compliance and BAS filing much simpler."

Below is a table outlining all BAS reporting types, their standard due dates, and the extended lodgement deadlines available for the 2025–26 financial year:

| BAS lodgement deadlines 2025–26 | ||||

|---|---|---|---|---|

| Reporting type | Who does it apply to? | Lodgement frequency | Standard due date | Different dates if lodged through a registered tax or BAS agent |

| Monthly | Businesses with an annual GST turnover of over $20 million | Every month | 21st of the following month | No extension |

| Quarterly | Businesses with an annual GST turnover of over $20 million | Every quarter | 28 days after each quarter ends | Up to 28 days extra (e.g., Dec quarter due 28 February 2026) |

| Annually |

Businesses or non-profits with GST turnover below $75,000 (profit) or $150,000 (non-profit) |

Once per year (for the period 1 July 2025 – 30 June 2026) |

31 October 2026 (if required to lodge a

tax return) 28 February 2027 (if not required to lodge a tax return) |

Different dates may apply when lodged through a registered tax or BAS agent |

Exact BAS due dates for each reporting cycle (2025–26)

If you prefer to see the exact BAS due dates for your reporting frequency, use the sections below. Whether your business reports monthly, quarterly or annually, we’ve broken down the specific 2025–26 dates to make your lodgement planning easier.

| Monthly BAS due dates 2026 | ||

|---|---|---|

| BAS period | Standard due date | Agent due date |

| January 2026 | February 21, 2026 | February 21, 2026 |

| February 2026 | March 21, 2026 | March 21, 2026 |

| March 2026 | April 21, 2026 | April 21, 2026 |

| April 2026 | May 21, 2026 | May 21, 2026 |

| May 2026 | June 21, 2026 | June 21, 2026 |

| June 2026 | July 21, 2026 | July 21, 2026 |

| July 2026 | August 21, 2026 | August 21, 2026 |

| August 2026 | September 21, 2026 | September 21, 2026 |

| September 2026 | October 21, 2026 | October 21, 2026 |

| October 2026 | November 21, 2026 | November 21, 2026 |

| November 2026 | December 21, 2026 | December 21, 2026 |

| December 2026 | January 21, 2027 | February 21, 2027 (If turnover up to $10 million and lodging via agent) |

| Quarterly BAS due dates 2025–26 | ||

|---|---|---|

| Quarterly | Standard due date |

Agent concession (Electronic lodgement) |

| Q1 2025–26 | 28 October 2025 | 25 November 2025 |

| Q2 2025–26 | 28 February 2026 | Not applicable |

| Q3 2025–26 | 28 April 2026 | 26 May 2026 |

| Q4 2025–26 | 28 July 2026 | 25 August 2026 |

If you are a GST registered business and your annual turnover is below $75,000 (or $150,000 for not-for-profit bodies), you may be eligible to report and pay GST on an annual basis.

- Standard annual BAS due date: 31 October 2026

- If no income tax return is required: 28 February 2027

- Lodging through a BAS agent may provide a different extension

Fixed monthly fee for

a defined scope of services

Many clients appreciate having bookkeeping and tax services under one roof, while also enjoying the predictability of a fixed fee. Below is our indicative fee for a standard scope of work:

Cancel anytime

Cancel anytime

Unlimited support

Unlimited support

Quick onboarding

Quick onboarding

Only Bookkeeping & BAS

Only bookkeeping and BAS (Does not cover tax returns, payroll and super):

$165/month *ex GST

Bookkeeping & Tax combined

For bookkeeping, BAS and tax returns (but no payroll or super included):

$225/month *ex GST

Bookkeeping, Tax & Payroll

All inclusive package: Bookkeeping, BAS, payroll, Super and tax returns:

$280/month *ex GST

What happens if you miss the BAS October 31 deadline?

If your Business Activity Statement (BAS) was due on 31 October 2025 and you have not yet lodged it, you may now face late lodgement penalties from the Australian Taxation Office (ATO).

The ATO issues a Failure to Lodge (FTL) on time penalty to encourage businesses to meet their BAS reporting obligations on time. The longer the delay, the higher the penalty. The total amount depends on how late your BAS is and the size of your business. The ATO calculates the penalty in 28-day periods after the due date, as shown below.

| Missed BAS deadline penalty rates by business size (2025–26) | |

|---|---|

| Entity type | Calculation method |

| Small entities (GST turnover under $1 million) | 1 penalty unit for every 28 days (or part thereof) the BAS is overdue, up to a maximum of 5 units |

| Medium entities (GST turnover between $1 million and $20 million) | Multiply the base penalty by 2 |

| Large entities (GST turnover of $20 million or more) | Multiply the base penalty by 5 |

| Significant global entities | Multiply the base penalty by 200 |

Note: penalty unit is valued at $330 from 1 July 2025.

If a penalty applies, the ATO will send you a written notice explaining:

- Why was the penalty charged

- The total amount payable

- The payment due date (at least 14 days from the notice date)

In most cases, the ATO does not issue penalties for a single or first-time late lodgement, especially if your BAS results in a refund or a nil balance. However, ongoing or repeated delays can lead to higher penalties, interest charges, and possible compliance action.

If you have missed the October 31 BAS deadline, the first step is to lodge your BAS as soon as possible or get in touch with our BAS experts who manage the submission for you and prepare a remission request if penalties have already been applied.

If you are concerned about mounting ATO debt, explore our business tax debt management strategies to stay compliant and reduce the risk of further charges.

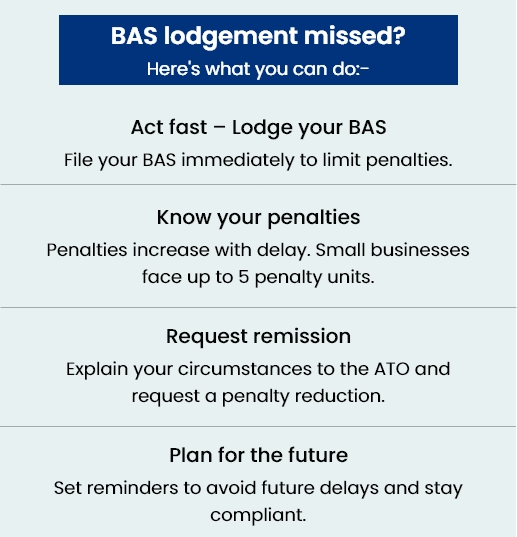

BAS lodgement missed? Here's what you can do

A missed BAS deadline doesn’t need to cause major stress. The image below gives you a quick snapshot of the actions that help you get back on track.

Steps to take if you miss your BAS lodgement deadline

If you have missed the 31 October BAS lodgement deadline, there is still time to get everything back on track. Acting quickly reduces the risk of penalties and stops the issue from escalating. The ATO often reviews your circumstances before applying additional charges, so taking the right actions now makes a meaningful difference.

At CleanSlate, we guide you through each step, handle the ATO requirements on your behalf, and help you stabilise your reporting as quickly as possible.

Here is how we help you manage a missed BAS lodgement:

Step 1: Lodge your BAS immediately

Our team begins by lodging your outstanding BAS straight away, even if you are not ready to pay the full amount. Prompt lodgement helps prevent further ATO penalties and shows that the issue is already being addressed.

Once your BAS is submitted, we confirm the lodgement with the ATO and review any balance, interest, or payment details listed in their notice. If you want to avoid future delays and keep your records accurate throughout the year, our bookkeeping services for small businesses ensure everything stays organised and up to date.

Step 2: Handle all ATO communication

Our tax accountant takes over all communication with the ATO, so you don’t have to. We contact the ATO on your behalf to:

- Confirm your current lodgement status

- Request additional time for submission if available

- Discuss payment plan options or extensions

- Clarify any penalty or interest details applied

Because we are a registered BAS agent, you also receive extended ATO lodgement timeframes that are not available to businesses lodging on their own.

Step 3: Request penalty remission if applicable

If the ATO has already applied a Failure to Lodge penalty, our team reviews your circumstances and prepares a well-supported remission request on your behalf. We outline genuine reasons for the delay, whether it relates to illness, technical issues or factors outside your control, and lodge the request through the correct ATO channels.

Our focus is to reduce or remove the penalty wherever possible so your ATO account is stabilised and you can move forward with confidence. We also keep you updated throughout the process so you always know the status of your remission request.

Step 4: Assess eligibility for safe harbour protection

If the delay occurred while your BAS was being prepared by a previous registered agent, you may qualify for safe harbour protection. This protection means you will not be held responsible for penalties if:

- You provided all information on time, and

- The delay was caused by your agent, not you

Our specialists assess whether your case meets these criteria and then request safe harbour cancellation directly through the ATO Online Services for Agents portal.

Step 5: Set up a BAS payment plan

If you have a payable amount and need more time to pay, we organise a structured ATO payment plan that suits your cash flow.

Our team negotiates on your behalf to:

- Make a small initial payment (usually around 20%)

- Spread the remaining balance over 3 to 12 months

- Arrange automatic direct debit payments through ATO Online Services

This approach helps you remain compliant without affecting your day-to-day operations.

Step 6: Help you stay on schedule for future BAS lodgements

Once your BAS lodgements are up to date, we help you establish a simple and reliable process to stay compliant every quarter. We:

- Set automated reminders for all future BAS due dates

- Manage monthly or quarterly reconciliations to keep figures accurate

- Prepare and review every BAS well before the due date

- Maintain record-keeping for faster ATO review or audit situations

- Provide regular updates on any BAS-related ATO changes that could affect your reporting

With these systems in place, you stay ahead of deadlines, avoid late penalties, and maintain full confidence in your reporting while we handle the heavy lifting. If you want extra support staying organised throughout the year, take a look at how an online bookkeeper for small businesses helps streamline tax time and ongoing compliance.

Don’t wait for penalties to grow.

Book a call now

Why choose CleanSlate for your BAS lodgement needs?

If you’re worried about missing your BAS lodgement deadline or facing penalties for late submission, we can help you navigate these challenges. At CleanSlate, our expert team ensures your BAS is lodged on time, accurately, and in full compliance with Australian Taxation Office (ATO) requirements, so you can avoid unnecessary penalties and interest charges.

Here’s how we can help you:

- Accurate and on-time BAS lodgement: Reducing the risk of penalties and interest charges.

- Transparent fixed pricing: Starting at $165 per month, with no hidden fees.

- Stress-free process: Ensuring your BAS is filed correctly without hassle.

- Ongoing support: Helping you stay compliant with timely reminders for future deadlines.

Don’t let BAS lodgement stress impact your business. With CleanSlate, you will never miss a deadline again. We take care of everything, so you can focus on growing your business. Book a call with us today to simplify your BAS lodgement process.

BAS Lodgement Deadline FAQs

What is a BAS lodgement?

A BAS lodgement is a formal submission to the ATO that reports on a business's sales, GST, and other tax-related details. It’s a vital requirement for businesses registered for GST. BAS helps the ATO track GST payments, PAYG withholding, and other business taxes.

What are the BAS lodgement dates?

The BAS lodgement dates depend on your GST reporting frequency:

- Monthly BAS: Due on the 21st of the following month

- Quarterly BAS: Due 28 days after the end of each quarter

- Annual BAS: Due on 31 October for the financial year, or 28 February if you are not lodging a tax return

Be sure to check the exact due dates, as penalties apply for late lodgements.

How often do I need to lodge a BAS report?

You need to lodge a BAS based on your business's GST turnover:

- Monthly: If your turnover is $20 million or more

- Quarterly: If your turnover is less than $20 million

- Annually: If you are voluntarily registered for GST and your turnover is under $75,000 (or $150,000 for non-profits)

The frequency of your lodgement is tied to your GST reporting obligations.

What happens if I lodge my tax return after October 31?

If you lodge your tax return after October 31, you may face penalties and interest for late submission. The ATO usually applies an FTL penalty for late returns, depending on how late the lodgement is. If you're working with a registered tax agent, they may be able to help extend your deadline.

Is a BAS the same as a tax return?

No, BAS and tax returns are different:

- BAS: Used to report on GST, PAYG, and other business-related taxes.

- Tax return: Used by individuals or businesses to report income, calculate taxes owed, and claim deductions.

Both are important, but they serve different purposes in your tax obligations.

How do I lodge BAS by myself through myGov?

To lodge your BAS yourself using myGov, first sign in and link your myGov account to the ATO. Once linked, navigate to the Tax section and select Activity Statements. From there, you can either submit a new BAS by clicking Lodge Activity Statement or view and make revisions to a previous lodgement by selecting View or Revise Activity Statements. It’s a simple process that can be completed in just a few minutes.

How much does it cost to lodge a BAS?

The cost of lodging a BAS depends on whether you do it yourself or use a BAS agent. Self-lodging via myGov is free. At CleanSlate Accounting, we offer fixed monthly fees starting from $165/month (ex GST) for BAS services. This provides a cost-effective solution to ensure your BAS is lodged accurately and on time, without the risk of penalties.