Bookkeeping as a service for your business

Introduction:

If you are a small business owner, then you know that bookkeeping can be a time-consuming task. Not to mention, it can be difficult to keep track of everything when you are trying to run your business. That is where online or outsourced bookkeeping services for small businesses come in. It is a great way to take the hassle out of bookkeeping for your business.

You can hire an accountant or bookkeeping company to take care of all your bookkeeping needs, and they will do it for a fraction of the cost of hiring someone full-time. So, if you are looking for a way to save time and effort, then online bookkeeping as a service is the solution for you!

Key takeaways

Outsourcing your bookkeeping needs is an excellent way to save costs without missing out on the important aspects of financial management

The costs for outsourced bookkeeping depend on numerous factors including the number and frequency of transactions, the nature of business, the complexity of the process etc.

What is outsourced bookkeeping?

Many entrepreneurs are not aware of the important role that bookkeeping plays in the success of their business. Bookkeeping is the process of tracking and recording all of the financial transactions of a business. This includes income, expenses, assets, liabilities, and equity.

Why do you need bookkeeping services?

Accurate bookkeeping is essential to make sound financial decisions, preparing tax returns, and tracking the financial health of a business. While some entrepreneurs may be able to handle their own bookkeeping, others may find it beneficial to outsource this function to professional bookkeeping services for small businesses.

Online bookkeeping refers to the outsourcing of bookkeeping tasks to a professional service provider. The bookkeeping provider will track and record all of the financial transactions of your business on your behalf. This will include maintaining records of income, expenses, assets, liabilities, and equity.

How does outsourced bookkeeping work?

When you outsource your bookkeeping, you will work with a team of professionals who will take care of all aspects of the task for you. This team will track all of your financial transactions and reconcile them with your bank statements on a regular basis. They will also categorise your transactions so that you can easily see where your fund is being spent.

In addition to tracking and categorising transactions, bookkeepers can also prepare financial reports for you on a monthly or quarterly basis. These reports provide valuable insights into the financial health of your business and can help you make informed decisions about where to allocate your resources.

What are the benefits of online bookkeeping for businesses?

When you are running a business, there are a million and one things to worry about. From managing inventory to keeping up with customer demand, it's easy to let some things fall by the wayside. One of the most important—but often overlooked—aspects of running a successful business is bookkeeping.

Maintaining accurate financial records is crucial to the success of any business, but it can be time-consuming and complicated. That's where outsourced bookkeeping comes in. It is a subscription-based service that offers all the benefits of having a full-time bookkeeper on staff without the hassle or expense.

Here are just a few of the benefits of using a bookkeeping service for your business.

-

Time-saving

One of the biggest benefits of using an outsourced service is the time-saving technology they offer. From cloud-based bookkeeping software to automated invoicing and payment processing, these services make it easy to stay on top of your funds without spending hours doing manual data entry. This leaves you free to focus on other aspects of running your business.

-

Accurate financial reporting

Another benefit of using a bookkeeping service is that you can be confident your financial reports will be accurate. Accurate financial reporting is important because it entails numerous benefits for businesses in the long run. This is because most services use double-entry bookkeeping, which means every transaction is entered twice—once as a debit and once as a credit—to ensure accuracy. This method gives you an accurate picture of your business's financial health.

-

Lower operating costs

When you outsource your bookkeeping needs, you can save funds on operating costs like payroll, insurance, and office space. This is because you're only paying for the services you need when you need them, rather than shelling out for full-time salaries and benefits for an in-house bookkeeper.

In addition, many bookkeeper services offer discounts for bulk services or long-term contracts, so you can save even more by signing up for an annual plan.

Who should use the bookkeeping service?

You have finally understood the different benefits of using a bookkeeping service for your business. But who exactly should use bookkeeping services? Let’s take a look.

-

Small business owners

If you own a small business, chances are you wear a lot of hats. You might be the one in charge of marketing, sales, customer service, and more—and that doesn’t even include producing the product or delivering the service.

With so much on your plate, it can be difficult to find time to keep track of the funds and other aspects of financial management. This is where a professional bookkeeper can help. A bookkeeper can handle all the day-to-day accounting services so you don’t have to, giving you more time to focus on other aspects of your business.

-

Entrepreneurs

Entrepreneurs are always looking for ways to save time and increase efficiency, and using a bookkeeping service is a great way to do both. Rather than letting receipts and invoices pile up, a bookkeeper can help you stay organised from the start. This not only saves you time in the long run, but it can also help you maximize your deductions during tax time.

-

Firms with rapid growth

If your business is experiencing rapid growth, chances are your current bookkeeping system isn’t going to cut it much longer. Rather than trying to keep up with the extra paperwork yourself, it might be time to consider outsourcing your bookkeeping needs.

A dedicated bookkeeper can help you keep tabs on everything as your business grows, ensuring that nothing falls through the cracks.

How to get started with online bookkeeping services?

Here's a quick overview of what you need to do to get started with outsourced or online bookkeeping services.

-

Determine your needs

The first step is to sit down and figure out exactly what kind of bookkeeping services you need. Do you need someone to reconcile your accounts every month? Do you need someone to maintain your books on a daily or weekly basis?

Once you know exactly what kind of accounting requirements you need, you'll be able to find a company that specializes in that area.

-

Research different companies

Once you know what kind of bookkeeping services you need, it's time to start looking for an experienced bookkeeper that can provide those services.

There are plenty of bookkeeping services online, so take your time and find the one that fits your needs and your budget. Be sure to read reviews and compare prices before making your final decision.

-

Set up a meeting

After you've narrowed down your options, it's time to set up a meeting with the company or companies you are interested in working with. This is your chance to ask questions and make sure they are a good fit for your business.

Once you've found a company you are happy with, it's time to get started on outsourcing your bookkeeping needs.

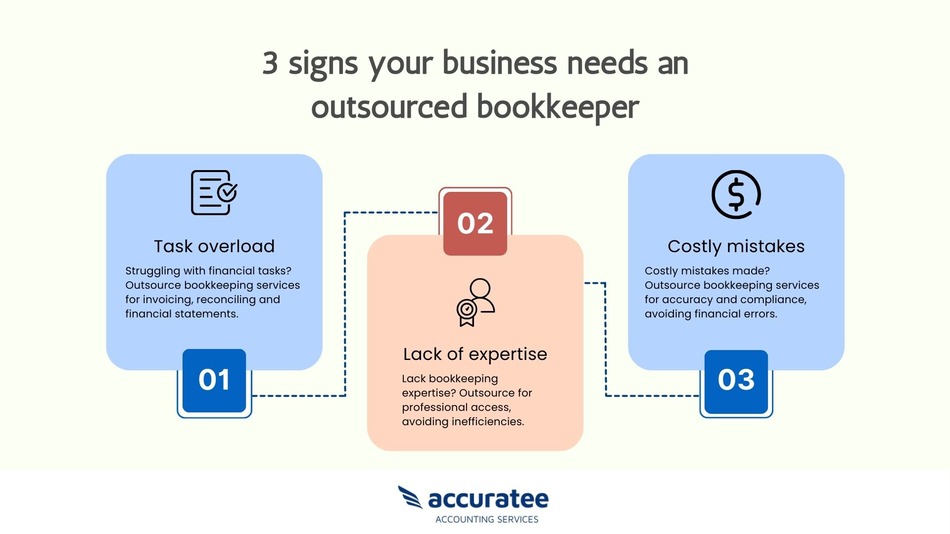

What are some of the challenges firms face when it comes to bookkeeping, and how can a service like this help overcome them?

Let's next discuss some of the most common challenges organisations face when it comes to bookkeeping.

-

Lack of organisation

One of the biggest challenges firms face when it comes to bookkeeping is staying organised. When you're busy running your business, it is easy to let paperwork pile up or forget to enter transactions into your accounting software. However, if you don't have a system in place for storing and organizing your financial records, it will be very difficult to keep track of everything.

-

Incorrect data entry

Another common challenge firms face is incorrect data entry. When manually entering data into your accounting software, it is easy to make mistakes—especially if you're rushed or not paying close attention.

Incorrect data entry can lead to serious problems down the road, so it's important to take your time and double-check your work before hitting "save."

-

Missing receipts and records

Another common issue firms run into is missing receipts and records. It's not uncommon for receipts or invoices to get lost in the shuffle, which can make it difficult to track expenses or reconcile accounts.

-

Complex transactions

Another challenge businesses sometimes face is dealing with complex transactions. Some transactions—such as sales with multiple payment terms or expenses that need to be allocated across multiple accounts—can be tricky to record accurately in your books.

If you're not careful, complex transactions can lead to errors that are difficult (and time-consuming) to fix later on.

-

Keeping up with changes

Finally, one of the ongoing challenges businesses face is keeping up with changes—both in the law and in their own financial situation. Tax laws change frequently, so it's important to stay up-to-date on the latest regulations (or work with an accountant who can ensure compliance).

Additionally, as your business grows and changes over time, you'll need to adapt your bookkeeping system accordingly so it remains accurate and effective on the business finances.

Online bookkeeping services help to mitigate the challenges mentioned above. They help to overcome bookkeeping challenges and help you stay organised on finances. If your finances are in order, you have nothing else to worry about.

Turn Your Bookkeeping into a Breeze!

How much does outsourced bookkeeping cost, and what are some of the associated expenses businesses can expect?

Bookkeeping is essential to any successful big or small business, providing valuable insights into financial performance and helping managers make decisions based on accurate and up-to-date data. However, many small businesses find it difficult or expensive to hire in-house bookkeepers, especially since they typically require extensive training and specialised skills.

As a result, many companies opt to outsource their bookkeeping needs, hiring third-party service providers to take care of this important task. The cost of these services will vary depending on a number of factors, including the size and complexity of the company's operations as well as the level of expertise required for the job. Ultimately, the best way to get an accurate estimate for your specific needs is to consult with a qualified bookkeeping provider.

But in general, you can expect to pay a significant amount for the services of a professional bookkeeper. Whether it's worth it will depend on your company's particular situation, but for most businesses, it is a good investment that will pay off in both the short and long term.

-

Associated expenses of bookkeeping services

When businesses outsource their bookkeeping services, there can be several associated expenses that they need to consider. First and foremost, there is typically an initial setup fee to hire a bookkeeper or accounting firm to take over these important functions. In addition, outsourcing often requires paying for ongoing software or database subscriptions for bookkeeping software, as well as for additional training on new systems and processes.

There may also be costs associated with transferring data from the company's internal technology systems to the new outsourced services. And finally, some outsourcing arrangements involve paying per-use fees or charging a percentage markup on transactions in order to cover administrative costs.

Overall, outsourcing bookkeeping as a service offers significant benefits in terms of time and efficiency savings. It is important to carefully consider all the potential associated costs so that businesses can make an informed decision about this vital business function.

What are some of the key things to keep in mind when choosing online bookkeeping services?

When you are running a business, it's important to have a firm handle on your finances. After all, finance is the lifeblood of any organisation. That's why choosing a bookkeeping service provider is such an important decision.

Not all providers are created equal, however, here are four key considerations to keep in mind when making your selection.

-

Consideration #1: Price

Of course, price is always going to be a factor when making any kind of purchase for your business. However, it's important to remember that you get what you pay for. Cheaper providers may save you money in the short term, but they may also provide inferior service. When it comes to something as important as your company's finances, you don't want to cut corners.

-

Consideration #2: Experience

When looking for a bookkeeping service provider, you'll want to prioritize firms with significant experience in the industry. After all, handling finances is a complicated and delicate task. You'll sleep better at night knowing that your money is in good hands.

-

Consideration #3: Reputation

In addition to experience, you'll also want to consider a provider's reputation within the business community. Talk to other entrepreneurs and see who they recommend. Read online reviews and see what people are saying about different firms. The last thing you want is to partner with a company that has a history of poor customer service or shoddy workmanship.

-

Consideration #4: Services offered

Not all bookkeeping service providers offer the same services. Some may specialize in specific areas or different industries, while others may offer a more comprehensive suite of financial services.

It's important to assess your needs and find a provider that can offer everything you are looking for under one roof. By doing your homework upfront, you can avoid headaches down the road that come with hidden costs.

End note

Undoubtedly, outsourced bookkeeping can be very beneficial to businesses, especially small businesses and sole traders. It can save the business owner time and money, and it can also help them avoid penalties from the ATO.

If you are thinking about outsourcing your bookkeeping, consider CleanSlate, the registered BAS agent. We offer affordable, comprehensive bookkeeping services that will save you time and money. Contact us today to learn more about our services or to get started!