How to prepare your business for the end of financial year in Australia?

Introduction:

As the end of the financial year approaches, it's crucial for businesses to start preparing to ensure a smooth transition into the new fiscal year. The end of the financial year (EOFY) brings with it a myriad of responsibilities, tax obligations, and financial considerations that can significantly impact the success of your business.

This blog aims to guide you through the essential steps to prepare your business for the EOFY, helping you navigate through the complexities and maximize your financial position.

Key takeaways

EOFY in Australia concludes on June 30th, requiring businesses and individuals to complete accounting tasks and review finances.

Maintain accurate and comprehensive records of your income, expenses, and transactions for effective financial management and tax preparation.

Seeking expert advice at the end of the financial year optimizes financial decisions, securing a prosperous future.

What is the end of financial year (EOFY)?

The end of the financial year, or EOFY, is a significant event for businesses and individuals. It marks the conclusion of the financial year on June 30th, and the beginning of a new one. During this period, companies are required to complete a range of accounting tasks, such as preparing financial statements and lodging tax returns.

EOFY also provides a chance for people to review their finances and make end of year contributions or adjustments. With many important financial decisions to be made, it is essential to have a good understanding of what EOFY means and the implications it may have for you or your business.

Furthermore, it is worth considering utilizing a professional bookkeeping service during this period. Engaging a bookkeeping service can help ensure that your financial records are accurate and up to date, making the EOFY process smoother and more efficient. They can assist with tasks such as reconciling accounts, organizing financial documents, and preparing the necessary reports for tax purposes.

What are the end of financial year (EOFY) requirements for your business type?

Here are the simplified requirements for different types of businesses when it comes to lodging tax returns:

-

Sole trader:

As a sole trader, you need to include your business income on your personal tax return using a separate business schedule. No separate tax return is required for your business.

-

Partnership:

If you have a partnership, each partner reports their share of the partnership income on their personal tax return. The partnership itself does not need to pay income tax, however, it needs to file a separate partnership tax return.

-

Company:

Companies are separate legal entities. You must file a company tax return and pay taxes on the company's income. If you're a director, you also need to file your own personal tax return.

-

Trust:

A trust has its own Tax File Number and the trustee must lodge a trust income tax return as well as personal tax returns. In case of a corporate trustee, the trust tax return, company tax return of the corporate trustee, and personal tax return for the directors of the corporate trustee must be filed.

What are the tax return submission deadlines for various business structures?

For sole traders and self-employed individuals, the deadline to submit individual tax returns is 31 October. Partnership tax returns should also be filed by the same date.

If you receive any trust distribution in your individual tax return, the trust itself will also be required to lodge a trust return. Both returns are due by 31 October.

The due date for company tax returns is generally 28 February each year.

However, these deadlines might change if you have a registered tax agent helping you. It's a good idea to check the ATO website or talk to a tax professional to make sure you know when your taxes are due and what you need to do.

Expert Bookkeeping at Your Fingertips!

End of financial year checklist

It can be easy to forget the important tasks you need to do at the end of the financial year. To help, here is a simple checklist to make sure all requirements are met:

-

Credit cards:

As the end of the financial year approaches, it's crucial to review credit card statements promptly and ensure all payments are current. Clear outstanding balances to avoid any unnecessary late fees or interest charges.

Also, don’t forget to check for any loyalty points or rewards earned on purchases in the last 12 months. Redeem these rewards before they expire to maximize their value. Lastly, compare various credit card options' features and benefits to identify the one that best suits your needs.

-

Superannuation contributions:

It is crucial to review your superannuation contributions on a yearly basis to ensure they're up to date. Don't miss out on tax deductions available for salary sacrificing or making additional direct contributions to your super fund.

Verify that all paperwork is correctly filled out and that contributions are being deposited into the correct fund. Review any charged fees and check for government incentives or co-contributions you may be entitled to. Doing so will guarantee that your super will continue to provide for your future.

-

Government contributions:

To be eligible for the government super co-contribution in the 2022-23 financial year, you must meet certain criteria. Firstly, your income should be below the higher co-contribution income threshold of $57,016. Secondly, you need to have made one or more eligible non-concessional contributions within the contributions cap. Additionally, your total super balance at the end of June 30 of the previous financial year should be less than $1.7 million.

To qualify, you must have lodged an income tax return for that financial year and derived 10% or more of your total income from employment-related activities or running a business.

If you meet these requirements, the government may contribute up to $500 tax-free to your superannuation. The maximum co-contribution of $500 is paid if you have added $1,000 to your super and earn under $42,016 for the 2022-23 financial year. The maximum co-contribution gradually reduces as your income increases, up to a maximum income threshold of $57,016 for the same financial year.

-

Deferred income:

As you approach the end of the financial year, it's crucial to review your income for potential tax-saving opportunities. Postponing portions of your income can help to lower your taxable income, especially if you anticipate being in a higher tax bracket for the upcoming year.

Deferred income may also work in your favor if you are planning to invest in stocks, properties, or other investments that are subject to capital gains tax. But before making any final decisions, consult with your accountant since guidelines and regulations governing deferred income can differ based on your individual circumstances. Take advantage of this strategy to optimize your financial gains.

-

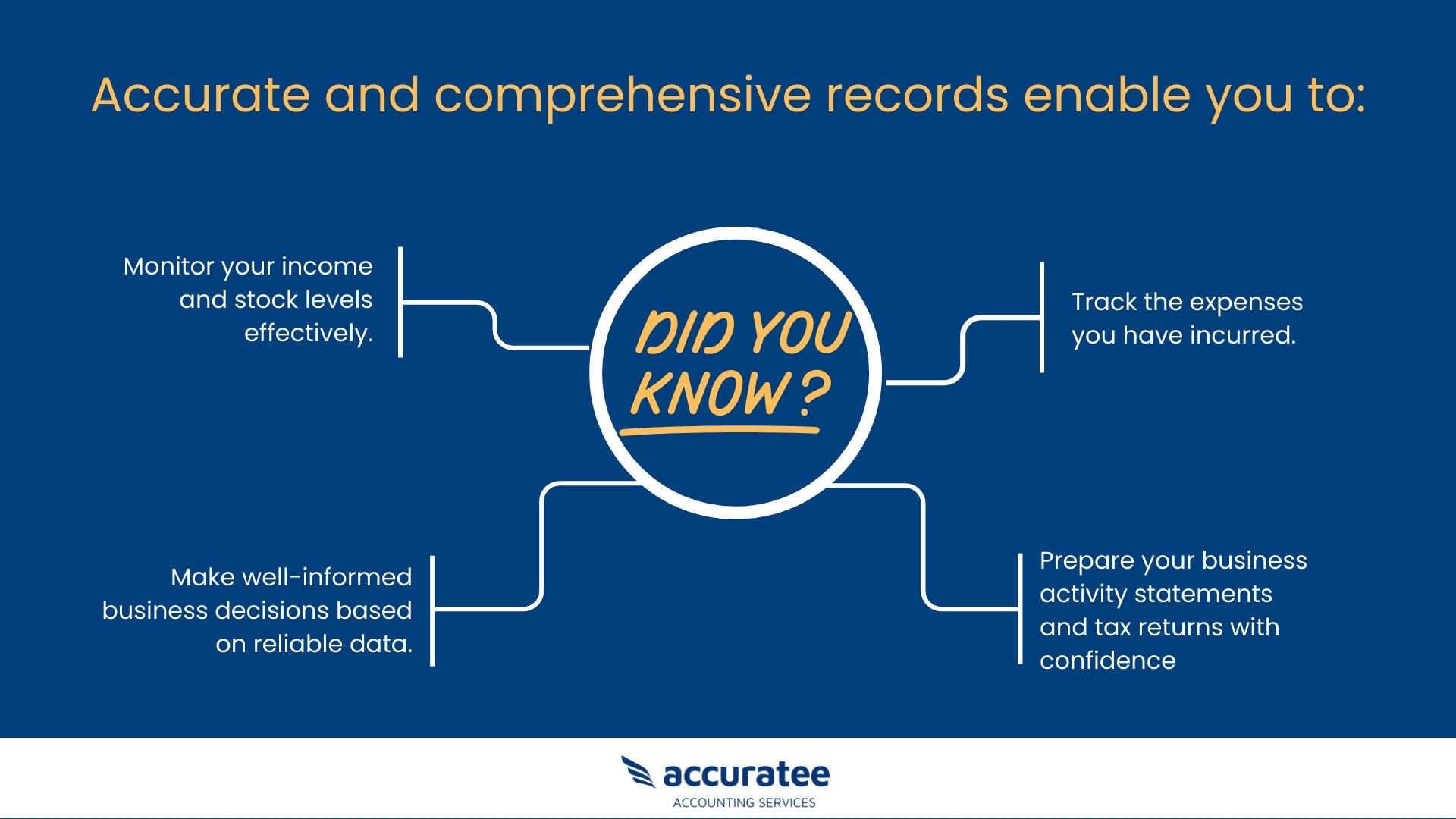

Record keeping:

For a seamless financial year-end, ensure that you review and update your records. Collect all invoices, receipts, bank statements, and other related documents regarding both income and expenses and create an organized system for easy access for future reference.

Don't forget to audit any open accounts and confirm all payments are up to date to keep your finances in check. Finally, review your current record-keeping software and systems, assess for any necessary updates or changes to avoid any mishaps while preparing your tax return. Stay ahead of the curve by keeping your records up to date!

-

Gift and donations:

It is crucial to meticulously review any gifts or donations made during the financial year, and retain all pertinent receipts for tax purposes. Take the opportunity to confirm if there are any tax deductions applicable to the gifts or donations.

Certain charities may provide tax-deductible certificates, attesting that the gift was indeed made. It is also wise to explore alternative routes of backing your preferred charity or cause, which don't necessitate making financial contributions. Doing so will guarantee that your donations are maximized to their fullest potential.

-

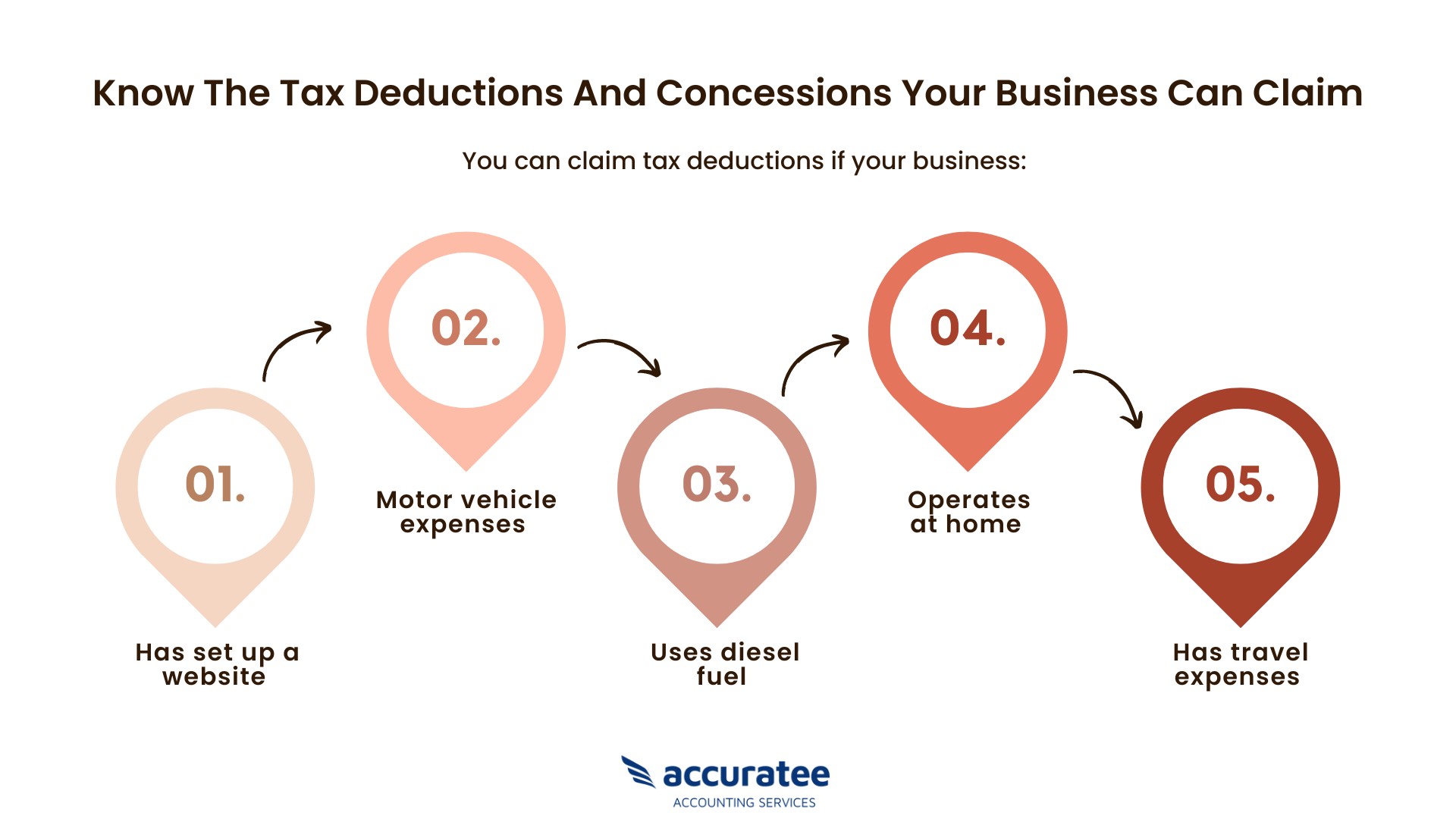

Tax planning:

Effective tax planning is crucial for ensuring financial stability and minimizing tax payments at year-end. Take a proactive approach by assessing your eligibility for potential deductions and credits, and devising strategies to reduce your tax burden.

Identify opportunities to increase savings or investments that could lower your taxable income. Most importantly, be prepared and organized with all the required information and documentation while filing your tax return. This diligent approach will facilitate timely and accurate payment of taxes.

-

Estate planning:

As the year draws to a close, it's crucial to inspect your estate plan and confirm that all paperwork is current. Take a careful look at your wills and power of attorney documents to make certain they align with your present intentions, and revise any trusts that require updating.

Furthermore, examine your insurance policies to identify and modify any areas in need of attention. Finally, ponder the tax ramifications of bequeathing an inheritance or giving cash to kin. Plan ahead to limit these taxes whenever feasible, which will result in your finances being well-organized in the event of your passing.

-

Professional advice:

Seeking professional advice can help you make more informed decisions about your finances, and ensure that all the necessary steps are taken to set you up for a secure financial future.

A qualified financial advisor or accountant can review your situation and provide tailored advice on how best to manage your money during the end of the financial year. They will also be able to give guidance on any government benefits you may be eligible for, as well as potential tax savings.

What's new in your 2023 individual tax return?

Here are some new initiatives incorporated in this year's Individual tax return instructions:

-

Removal of the self-education expenses threshold:

Starting from the 2022-23 income year, the $250 non-deductible threshold for work-related self-education expenses has been eliminated. You no longer need to reduce your deductions by $250 when calculating your allowable expenses. This change also applies to the Fringe Benefits Tax (FBT) year starting on 1 April 2023.

-

Updated method for working from home deductions:

The fixed rate method for calculating deductions for working from home expenses has been revised. As of 1 July 2022, the revised fixed rate is $0.67 per work hour. The changes include an increased rate per work hour, modifications to the expenses covered by the revised fixed rate method, revised record-keeping requirements, and the removal of the need for a designated home office.

You can now separately claim deductions for the work-related use of depreciating assets such as office furniture and technology. The previous shortcut method is no longer available.

-

Discontinuation of the low and middle income tax offset (LMITO):

The low and middle income tax offset, which provided tax relief for individuals with low to middle incomes, expired on 30 June 2022. It is no longer applicable for the 2022-23 income year.

Additional tax planning strategies for small businesses

- To reduce tax burdens, strategically schedule invoices to defer income until the next fiscal year. It's important to comply with deferred income recognition rules, so it's recommended to consult with an accountant or tax expert.

- Plan ahead and take advantage of immediate tax deductions for prepaid business expenses, such as insurance premiums, telephone and internet services, subscriptions, rent or leasing charges, and bookings for seminars or business trips.

- Convert debts owed to your business into tax deductions by writing them off. Ensure that the debt has been included in assessable income and maintain proper documentation.

- Stay up to date with superannuation contribution payments for employees, as paying them by 30 June can accelerate tax deductions.

- Take advantage of schemes like the Temporary Full Expensing (TFE) scheme before it ends on 30 June 2023. This scheme allows businesses to deduct the full cost of eligible capital assets in the current year, without depreciation. However, assets must be in use by 30 June 2023 and eligibility criteria based on aggregated turnover apply.

Ending note

The End of the Financial Year (EOFY) can be a hectic and stressful experience for small business owners. It is important to ensure that you have completed the appropriate requirements accurately, or else your business might deal with penalties and other legal repercussions. With an understanding of the EOFY basics and an accurate checklist for preparing accordingly, small business owners can stay ahead of deadlines and protect their bottom line.

Furthermore, implementing additional tax planning strategies into your financial process is also essential to ensuring a successful EOFY season. Armed with these tools, entrepreneurs can tackle the EOFY head-on and prepare confidently for the new financial season.

So don't wait until you take action today! Act now to master your EOFY tasks with CleanSlate's timely and reliable solutions that will ease your stress and help you prepare your business for next financial year. Contact us today to know more