What are the most common GST errors, and how can you avoid them?

Introduction:

Understanding goods and services tax (GST) is essential for businesses, but with so many rules and guidelines, it's easy to get tangled up. Many ask: What are the typical mistakes made when reporting goods and services tax ? And, more importantly, how can we avoid them?

In this blog, we'll delve deep into the most frequent GST blunders that businesses encounter. From minor oversights to more significant miscalculations, we'll break them down individually. But we won't stop there.

Along with identifying these errors, we'll give you practical advice and strategies to ensure your GST reporting is as accurate and hassle-free as possible. So, if you want a better grip on goods and services tax and avoid common pitfalls, read on!

Key takeaways

Understanding goods and services tax is essential for businesses due to its intricate rules.

A GST error involves miscalculations related to tax amounts, credits, or adjustments.

Credit errors result from over-reporting taxes, while debit errors arise from under-reporting.

Common mistakes include incorrect software setup, claiming without receipts, and using the wrong reporting method.

Regular checks, reconciling accounts, and consulting tax agents can prevent errors.

What is a GST error?

A GST error is a miscalculation when determining the net amount on an activity statement. This mistake relates to amounts tied to GST, GST credits, or GST adjustments, not a transaction's gross or GST-inclusive price.

For instance, if a product is sold for $110, including a 10% GST, the GST-inclusive price is $110, while the GST is $10. The error in the calculation would concern the $10 (GST amount) and not the entire $110 (GST-inclusive price).

Additionally, it's important to note that goods and services tax errors don't cover mistakes associated with other taxes like fuel tax credits, wine equalisation tax, or luxury car tax.

Types of GST errors and their implications

Errors in goods and services tax calculations can lead to financial discrepancies for businesses. These mistakes generally fall into two primary categories, each with unique financial consequences. Grasping these categories is crucial for businesses aiming for accurate GST compliance. The specific errors are discussed below:

-

Credit error:

A credit error occurs when a business over-reports its GST, leading to an excessive tax payment. This might happen for various reasons, such as mistakenly reporting a GST sale multiple times or under-claiming a GST credit for purchases. For instance, if a business reports a $1,000 sale twice, it would inadvertently pay an extra $100 in GST. Recognizing and rectifying credit errors ensures businesses don't overpay their tax obligations.

-

Debit error:

A debit error arises when a business under-reports its GST, resulting in an insufficient tax payment. Common causes include neglecting to include GST on a taxable sale or overstating GST credits. For example, if a business mistakenly omits a $1,000 taxable sale from its report, it would underpay its goods and services tax by $100. Identifying and correcting debit errors is vital to avoid penalties and ensure accurate tax reporting.

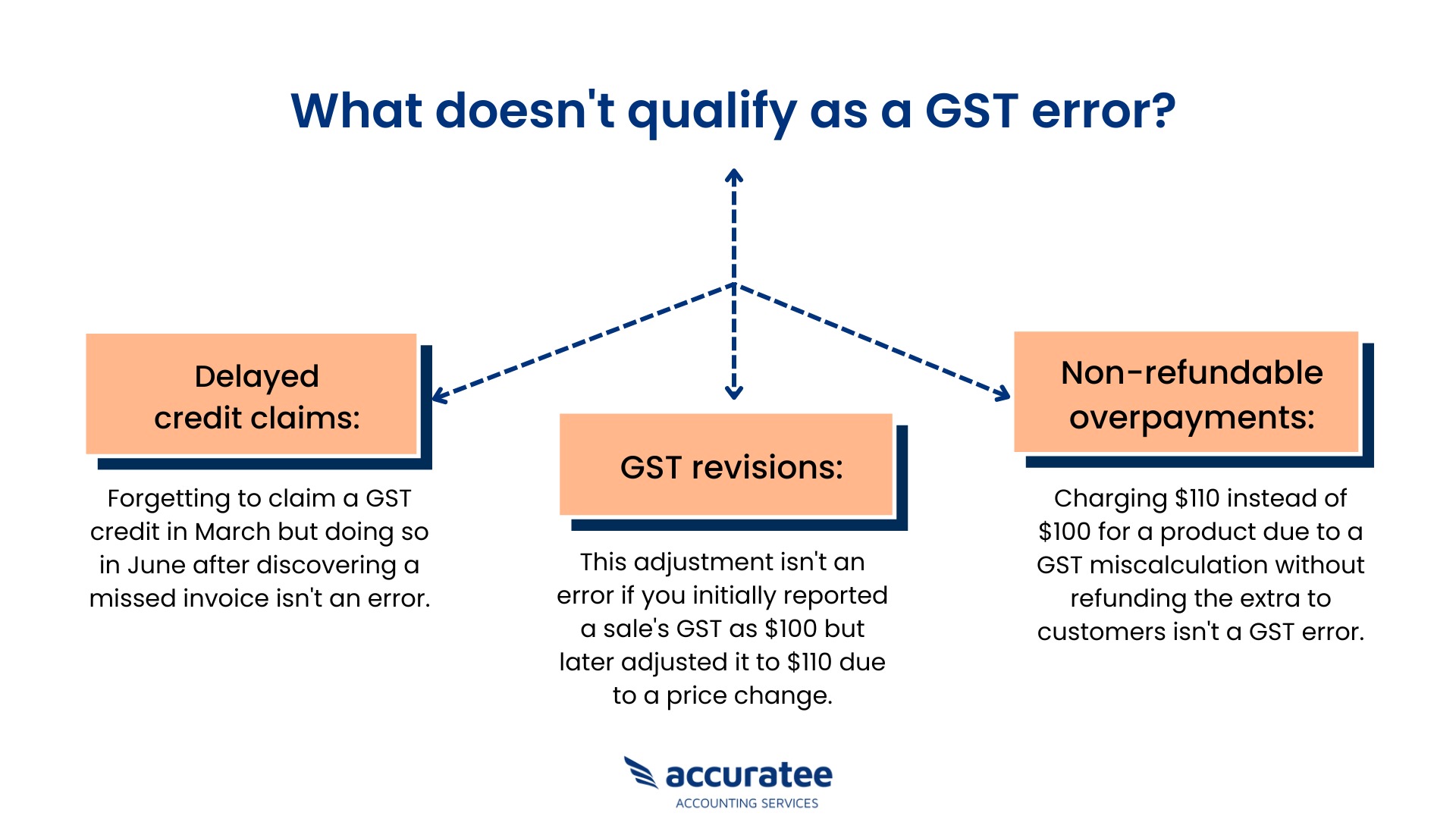

What doesn't qualify as a GST error?

Understanding GST is crucial for businesses, but not every discrepancy in reporting is considered an error. Let's explore what the Australian Taxation Office doesn't classify as a GST mistake:

20 most common GST mistakes when reporting on activity statement

Reporting GST correctly is important for all businesses. However, it's easy to make mistakes without realizing it. Before we list them, let's look at the 20 most common errors in activity statements. This will help you double-check and avoid any slip-ups.

-

Wrong software setup:

Properly setting up accounting software is crucial. An incorrect setup can lead to mistakes in calculating and reporting GST. For instance, if tax codes for certain products or services are not correctly configured, it can result in over or under-reporting GST. Regularly reviewing and updating software settings ensures accurate reporting.

-

Claiming without a receipt:

Claiming GST credits in your GST returns or business activity statements requires the backing of a valid tax invoice. Without proper documentation, there's a risk of claiming the wrong amounts. For businesses aiming to maintain accuracy in claiming GST credits, keeping well-organized records and ensuring every purchase is paired with its respective tax invoice is vital.

-

Using the wrong method:

Cash and accrual are two primary GST reporting methods. The cash method reports GST when payment is received, while the accrual method reports GST when the sale is made. Using the wrong method can lead to timing discrepancies in reporting, affecting cash flow and liabilities.

-

Missing GST on government money:

Some government grants or payments include GST. Failing to recognize and report this GST can lead to under-reporting taxable income. It's essential to thoroughly review the terms of any government payment or grant to ensure GST is reported correctly.

-

Forgetting GST on sold items:

GST must be included in the sale price when selling business assets. Overlooking this can result in not collecting enough money to cover the GST owed on the sale. Regularly reviewing asset sales and ensuring GST is correctly applied helps prevent this oversight.

-

Not splitting business and personal costs:

Expenses used for business and personal purposes must be divided appropriately. For instance, if a vehicle is used half the time for business and half for personal use, only 50% of its expenses should be claimed for GST credits.

-

Bank fee confusion:

Differentiating between bank fees is essential. While general bank fees don't attract GST, merchant fees for payment processing do. Regularly reviewing bank statements and understanding which fees include GST ensures accurate claims.

-

Interest income mistakes:

Interest income, like that from a savings account, is not subject to GST. Including it as taxable income can inflate GST liabilities. Regularly reviewing income sources and ensuring non-taxable income is excluded from GST reports is crucial.

-

Mixing up wages and super:

Wages and superannuation are treated differently for GST purposes. Wages are reported in the BAS, but super payments are not. Ensuring payroll is correctly categorized and reported prevents GST and payroll tax errors.

-

Secondhand goods confusion:

GST rules for secondhand goods differ based on the seller. Buying from a GST-registered business allows for full GST credits, but buying from a private seller has different rules. Understanding these nuances ensures correct GST claims on used items.

-

Not double-checking:

Before finalising GST reports, a thorough review is essential. Small errors or oversights can lead to larger GST liabilities or penalties. Regularly reviewing and double-checking all figures before submission helps catch and correct mistakes.

-

Forgetting to update your details:

Keeping business details updated is essential for clear communication with the ATO. Changes in address, business structure, or other key details should be promptly updated to ensure accurate record-keeping and compliance.

-

Missing GST-free sales:

Some products or services are GST-free. Accidentally charging GST on these can lead to over-reporting of taxable sales. Regularly reviewing product and service listings and ensuring GST-free items are correctly categorized prevents this mistake.

-

Refund mistakes:

Incorrectly claiming GST refunds can lead to discrepancies in reported figures. Understanding the conditions and eligibility for GST refunds ensures that claims are valid and accurate.

-

Not considering international sales:

International trade has different GST rules. Not being aware of these can lead to mistakes in calculations and reporting. Taking the time to understand GST obligations for all international transactions helps ensure accurate GST reporting.

-

Missing small sales:

All sales, regardless of size, should be reported for GST. Small sales can add up over time, and missing them can lead to under-reporting taxable income. Regularly reviewing all sales records, big and small, ensures comprehensive GST reporting.

-

Selling under the wrong ABN:

Businesses must ensure they trade under the right ABN to avoid GST and other tax issues. Failing to register or update details with the ATO can lead to incorrect reporting of GST liabilities.

-

Not knowing the GST limits:

There are thresholds for GST registration and reporting. Not being aware of these can lead to non-compliance. Regularly reviewing business income and understanding the GST thresholds ensures timely and accurate registration and reporting.

-

A mismatch between reports and statements:

GST reports should mirror your other financial records. For example, if a financial statement lists a $1,100 sale but your GST report shows $1,000, there's a $10 GST discrepancy. Always cross-check to ensure both documents align.

-

Not knowing special rules:

Some industries or businesses have specific GST rules. Not being aware of these can lead to non-compliance. Regularly reviewing industry-specific guidelines and ensuring compliance is essential for accurate reporting.

Need help with your BAS lodgement?

Additional tips to avoid GST error

Handling GST can be tricky, and small mistakes can lead to bigger issues. To make things smoother, it's essential to know the common pitfalls. Here are some handy tips to ensure your GST reporting is spot-on and error-free every time.

- Ensure you register for GST if your annual turnover exceeds the threshold. Failing to register can lead to penalties and interest charges.

- Continuously educate yourself about GST. The ATO's official website is a great resource.

- Consistently evaluate your GST procedures to spot and rectify any potential discrepancies.

- Opt for actual numbers over approximations to maintain accuracy in your GST documentation.

- Pay your taxes promptly to steer clear of any penalties or additional charges from the ATO.

- Consult a registered tax agent or accountant if unsure about certain transactions or GST treatments. They can provide guidance and ensure you're reporting correctly.

GST errors you cannot correct on a later statement

Some mistakes can't be fixed in your next report, especially if they're big or done intentionally. Knowing which ones are important so you don't get into trouble. Let's look at these mistakes more closely:

- If the error is related to a matter currently under compliance activity or was made in a reporting period that is under compliance activity.

- If you've already corrected the error in another reporting period.

- If you're revising a previously lodged activity statement to correct an error from an earlier reporting period.

- You cannot correct a debit error if the error results from recklessness or intentional disregard of a GST law. Recklessness is behaviour that significantly falls short of the standard of care expected, while intentional disregard means the person understood the law's effect and chose to ignore it.

Ending note

GST errors can be tricky to manage, and avoiding them is necessary. The GST regulations in Australia are vast and complex, and errors can potentially cause costly complications. Our blog post collected a range of invaluable advice for avoiding the most common GST errors. Working with a professional tax agent such as cleanslate can provide additional support in understanding eligibility requirements, correctly registering for GST, understanding changes between clients' tax codes, and more.

We encourage those who need further support in finding the right GST solutions to reach out to CleanSlate. Our dedicated team is well-versed in the nuances of GST compliance and is committed to guiding businesses through every step of the process.

With our expertise, you can confidently navigate GST's complexities, ensuring that your business remains compliant and avoids any unnecessary financial setbacks. Whether you're just starting or have been in business for years, our experts are always available to support and simplify your GST journey.