How to set up a family trust in Australia: A 2026 guide

Are you thinking about passing on your wealth and legacy to future generations, but are not sure where to start?

Setting up a family trust could be just what you need, but it’s easy to feel a bit overwhelmed by the process. Don’t worry, we have got you covered!

In this blog post, we walk you through everything you need to know about setting up a family trust in Australia in 2026, including the key benefits and risks, the different types of trusts available, and a step-by-step process to set it up correctly.

By the end of this post, you will have a clear understanding of the whole process of setting up a trust and be ready to move forward with confidence. Let’s get started!

Key takeaways

A family trust is a type of discretionary trust commonly used to manage family assets, income, or a family business.

Setting up a family trust requires a defined purpose and long-term planning, not just a desire to reduce tax.

A trust is only treated as a family trust for tax purposes once a valid Family Trust Election has been made.

The cost of setting up a family trust varies depending on whether an individual trustee or a corporate trustee is used.

Ongoing compliance obligations apply each year, including tax returns, record-keeping, and timely income distributions.

What is a family trust?

A family trust is a specific type of discretionary trust that is set up to manage and hold a family's assets or to run a family business. For a trust to be officially considered a family trust under Australian tax law, a Family Trust Election (FTE) must be made.

This election is a formal declaration by the trustee that the trust is being used as a family trust for tax purposes. Without this election, the trust may not qualify for specific tax treatments or benefits associated with family trusts.

Trust setup and accounting packages

Fees quoted below are GST exclusive

Cancel anytime

Cancel anytime

Unlimited support

Unlimited support

Quick onboarding

Quick onboarding

Trust

accounting

Includes financial statements and return lodgements.

$1,100 *ex GST

The growing appeal of family trusts in Australia: Key benefits you should know

Why are family trusts gaining so much traction in Australia? Here are the top benefits fueling their popularity in 2025:

Income splitting to minimise tax

A major benefit of a family trust is income splitting.

This allows the trustee to distribute income among various family members, each taxed at their own marginal tax rate.

For example, income can be given to adult children, elderly parents, or other low-income relatives to reduce the overall tax burden.

This is particularly useful for high-earning families or profitable small businesses, as it helps avoid paying tax at the top marginal rate of 47%.

Access to franking credits

When a family trust receives franked dividends from Australian shares, those franking credits can be passed on to beneficiaries.

Depending on each beneficiary’s tax position, they may be able to claim a refund or use the credits to offset tax.

This makes it possible to receive dividend income in a highly tax-effective way. To access this benefit, the trust must meet certain ATO rules, and the trust deed must allow for it.

Asset protection

A properly structured family trust offers asset protection by separating personal ownership from legal ownership.

Assets owned by the trust are usually protected from personal creditors, lawsuits, or claims arising from divorce.

This is especially important for business owners, who may want to protect personal and family assets from business risks or insolvency.

Capital gains tax (CGT) efficiency

Family trusts also provide an efficient way to manage capital gains from the sale of assets like property or shares. Gains can be distributed to beneficiaries with lower tax rates, which reduces the overall tax liability.

Additionally, if assets are held in the trust for more than 12 months, the trust may be eligible for the 50% CGT discount. This flexibility helps families time and structure asset sales in a way that minimises tax.

Keen to know more about the CGT discount for trusts?

Intergenerational wealth transfer and estate planning

Family trusts are widely used for estate planning.

They allow a family to control how wealth is passed on to future generations. Through the trust deed, conditions can be set for when and how beneficiaries receive income or assets.

Unlike a will, a trust can continue operating after death without going through probate, avoiding delays and extra legal costs. This gives families greater flexibility and long-term control.

Support for low-income family members

Trusts can also be used to support low-income relatives in a tax-effective way.

Distributions can be made to adult children studying at university, retired parents, or other dependents, helping them cover expenses without triggering high tax bills.

However, it’s important to note that income distributions to minors under 18 are heavily taxed above a small threshold, currently $416.

Investment structuring flexibility

Family trusts offer flexibility in how investments are held and managed. A trust can own various assets, including rental properties, shares, managed funds, and even operating businesses.

The income and capital growth from these investments can be allocated based on each beneficiary’s needs and tax situation. This centralised structure helps families manage their assets in one place, with a long-term strategy in mind.

Efficiency in tax planning

A family trust usually does not pay income tax itself. Instead, the trust’s income is allocated to beneficiaries before 30 June, and those beneficiaries pay tax at their own individual tax rates.

This often helps with tax planning as the profit distribution per year is under the discretion of the trustee . If the income is not allocated, the trust can be taxed at the highest tax rate.

With proper planning, a family trust helps ensure income is taxed in the most efficient way.

Drawbacks of setting up family trusts in Australia

Family trusts, as discussed above, provide many advantages, yet they also carry serious risks that must be understood.

ATO scrutiny and compliance risk

The Australian Tax Office is closely monitoring how family trusts are used. They are especially focused on wealthy families and long-standing business structures.

Common issues include poor record-keeping, unclear trust deeds, and distributions to people or companies not allowed under the trust. These problems can lead to audits, denied tax benefits, and penalties.

Reduced flexibility after making a family trust election

A family trust election allows access to some tax benefits, such as using losses, but it also locks the trust into distributing income only within a defined group. This limits flexibility in future years, especially if the family group changes or grows.

Risk of resettlement when changing the deed

Making changes to the trust deed without proper advice can trigger a resettlement. This means the trust is treated as if it started again.

That can lead to new tax bills, including capital gains tax and stamp duty. Always seek legal advice before making major changes to the trust deed.

Errors with beneficiaries

Many people think they can distribute income to anyone in the family or even to outside entities, but that is not always true. Trusts can only distribute income to beneficiaries listed in the trust deed or included in a valid family trust election.

Once the main person (called the test individual) dies, the list of eligible family members cannot be changed. Spouses of children or unrelated companies are often not included unless clearly stated in the deed.

Trusts must end eventually

Most trusts in Australia have a maximum lifespan of 80 years. When this time is up, all assets must be distributed. If those assets have increased in value, there may be a capital gains tax bill at that time.

Poor succession planning

Many family trusts are not clear about what happens when the original trustee or decision-maker dies. If no plan is in place, disputes can arise, control of the trust can fall into the wrong hands, and income distributions may become invalid. Choosing the right people to manage the trust in the future is essential.

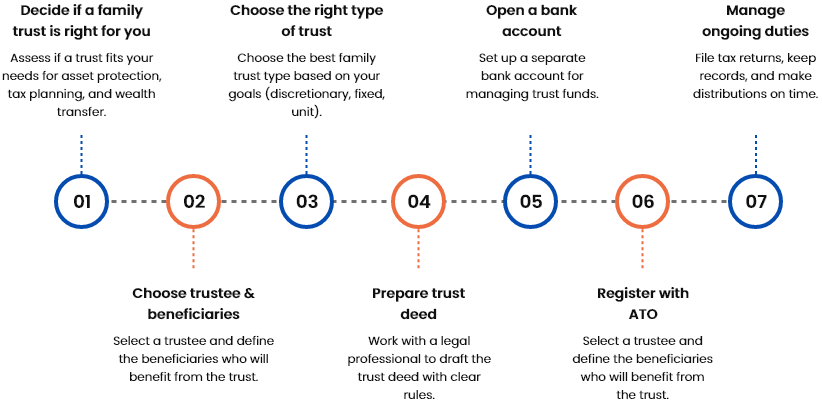

Steps to set up a family trust in Australia

Here are the steps you should follow to set one up in Australia:

Here’s a detailed breakdown of each step discussed above:

Step 1: Decide if a family trust is right for you

The first step in setting up a family trust is deciding whether it’s the right structure for your circumstances.

A trust isn’t something you create just because you heard it’s a good way to save on taxes. It needs to serve a clear, strategic purpose in your overall financial plan.

At CleanSlate, we start by asking the right questions to uncover whether a family trust fits your needs:

- Are you running a business or earning income that could benefit from income splitting?

- Do you own assets you’d like to protect from personal or business risks?

- Are you planning to pass wealth to your children or future generations?

- Do you want more control over how family members access income or capital?

If the answer to one or more of these is yes, a trust could be a strong fit. But if not, we’ll help you consider other structures that may suit you better, such as a company or individual investment setup.

This initial decision sets the foundation for everything that follows, which is why we take it seriously. Our job is to give you clarity, not confusion.

Step 2: Choose your trustee and identify the beneficiaries

After confirming that a family trust suits your needs, the next step is to choose who will manage the trust and who will benefit from it.

The trustee is legally responsible for running the trust. They control the assets, make financial decisions, and distribute income to beneficiaries. You can appoint either:

- An individual, such as yourself or a trusted family member

- A corporate trustee, which is a company (often one you own) set up solely to act as trustee

While both options are valid, a corporate trustee is often preferred. It provides better asset protection, separates personal and trust liabilities, and is generally easier to manage for succession planning or future changes.

Next, you will define the beneficiaries. These are the people or entities who may receive income or capital from the trust.

In most family trusts, this includes your spouse, children, and other relatives, and can also include related companies or trusts.

The trustee has discretion over how much income each beneficiary receives, which makes this structure flexible for tax planning.

At CleanSlate, we help you decide who should act as trustee based on your goals and risk profile. We also make sure your beneficiary class is correctly set up in the trust deed so you can distribute income legally and flexibly, without running into compliance issues later on.

Explore these helpful reads

Step 3: Choose the right type of trust

Not all family trusts work the same way, and the structure you choose plays a key role in how the trust operates. That decision influences how income is distributed, the level of control you retain, and how flexible the trust remains as your personal or business circumstances evolve over time.

In our latest blog, we break down the different types of trusts, explaining how each structure works and where it is typically used. While understanding these options on paper is important, the right structure is not about ticking boxes. It comes down to how those rules apply to your specific situation, goals, and future plans.

This is where our trust experts can help. We take the time to understand your circumstances, explain how each structure would work in practice, and guide you toward a setup that supports both your current needs and long-term objectives.

Step 4: Prepare the trust deed

Once you have decided on the structure of your trust, the next step is to get the trust deed prepared. This is the legal document that sets out how the trust will work.

It covers things like who the trustee is, who the beneficiaries are, how income can be distributed, and what rules the trustee needs to follow.

Think of the deed as the instruction manual for your trust. Every decision made by the trustee needs to follow what’s written in this document. That’s why it’s so important to make sure it’s drafted properly from the start.

This isn’t something you want to copy from a template or rush through. The deed should be written by a qualified legal professional who can tailor it to your trust’s purpose and make sure it meets all legal requirements.

Once the deed is complete and signed, your trust is officially established and ready for the next step.

Step 5: Register the trust with the ATO

With the trust deed signed and the trust legally established, the next step is to register the trust with the Australian Taxation Office so it can operate correctly from day one. This registration formally recognises the trust for tax purposes and allows it to meet its ongoing compliance obligations.

As part of this process, the trust will need to apply for a Tax File Number (TFN). The TFN is essential because it allows the trust to lodge annual tax returns and report income earned during the financial year.

Depending on how the trust will be used, you may also need to apply for an Australian Business Number (ABN). This is generally required if the trust will be running a business, earning business income, or registering for GST.

If the trust’s turnover is expected to exceed the GST threshold, GST registration will also need to be completed at this stage. Making sure these registrations are done correctly from the start helps avoid delays, penalties, or reporting issues later on.

This step involves providing accurate details about the trust structure, trustee, and intended activities, which is why it’s important to get it right the first time.

Step 6: Set up a bank account for the trust

Since a trust is treated as a separate legal entity, it must have its own bank account to operate correctly. This account becomes the central place where all trust income is received and all trust expenses are paid, which keeps trust activity clearly separated from personal or business finances.

Keeping this separation is important for both legal protection and tax compliance, as it ensures the trust’s records remain clear, accurate, and easy to report. To reflect this structure, the bank account is opened in the name of the trustee acting on behalf of the trust.

For example, the account name might be “Green Pty Ltd as trustee for The Green Family Trust,” which shows who controls the account and confirms that they are acting for the trust rather than in a personal capacity.

When opening the account, the bank will usually request a certified copy of the trust deed along with identification for the trustee. In some cases, the bank may also ask for the trust’s TFN or ABN, depending on how the trust operates.

At CleanSlate, we guide you through this step by helping you prepare the required documents and explaining exactly what the bank will ask for. This avoids delays and unnecessary back and forth during the account setup process.

Once the bank account is in place, the trust is ready to manage its income and expenses properly and move forward with the remaining setup steps.

Step 7: Understand your ongoing responsibilities

Setting up the trust is just the beginning. To keep it compliant and working the way it should, there are a few ongoing responsibilities the trustee needs to manage each year.

Here’s what that usually involves:

- Keeping accurate books of accounts for all trust income and expenses

- Preparing and lodging the trust’s annual tax return with the ATO

- Making income distribution decisions before 30 June each year

- Documenting those decisions in formal distribution minutes

- Staying on top of any legal or structural changes that might require updates to the trust deed.

Missing any of these steps can lead to penalties, tax issues, or even losing the trust’s tax benefits.

At CleanSlate, we stay involved long after the trust is set up. We help manage your trust’s yearly obligations, prepare all required documents, and ensure everything is handled correctly and on time.

If anything in your financial situation changes, we’re here to review and adjust the trust so it continues to serve you well.

A well-run trust doesn’t just protect your wealth — it gives you confidence and peace of mind moving forward.

Ready to set up your family trust with Cleanslate?

Costs involved in establishing and maintaining a trust

If you are considering setting up a family trust with CleanSlate Accounting, the cost will depend on the trustee structure you choose.

If individual trustees are used, the one-off setup fee is $650 ex GST. If you choose a corporate trustee, the setup cost is $1,550 ex GST. A corporate trustee is often used for better asset protection and long-term planning, and we manage the entire setup process for you.

As part of the family trust setup with CleanSlate Accounting, the following is included:

- Australian Company Number (ACN) registration for the trustee entity to ensure it is correctly established and recognised

- ASIC Certificate of Incorporation confirming that the company has been formally registered

- Tax registrations, including Australian Business Number (ABN), Tax File Number (TFN), Pay As You Go (PAYG) withholding, and Goods and Services Tax (GST).

- Phone, chat, and email support throughout the setup process to ensure you're informed every step of the way

Once the trust is established, many clients continue working with us for their ongoing bookkeeping needs. Our professional bookkeeping services packages start from $225 per month, helping you stay organised and compliant as the trust operates.

Key points to keep in mind when setting up a family trust in Australia

Setting up a family trust involves careful consideration. Here are the essential factors to keep in mind during the process to ensure the trust meets your needs and goals:

Consider the ‘expiry date’ of trusts

Under Australian law, trusts generally cannot last forever due to the "Rule against Perpetuity." This rule requires that trusts must terminate within a set period, usually 80 years.

When the trust expires, assets are distributed, and this can trigger capital gains tax. Planning for the trust’s expiry is crucial, especially for long-term wealth building.

Weigh the costs and benefits of asset protection

Family trusts are commonly used to protect assets from risks, such as lawsuits or bankruptcy. However, it's important to assess the likelihood of such risks occurring and whether a trust is the most cost-effective way to protect assets.

While trusts offer some protection, they may not fully shield assets, and the costs of setting up and maintaining the trust should be weighed against the potential benefits.

Understand the tax implications of PSI

Income generated by personal services (such as from employment or contracts) placed under the control of a family trust may be classified as Personal Services Income (PSI).

Under current tax laws, PSI is subject to anti-tax avoidance measures, and income will be taxed as if the individual were an employee. This means it won’t benefit from the same tax reduction advantages as other types of income.

Understand how losses are handled

Losses incurred by the trust cannot be distributed to beneficiaries and are "trapped" within the trust. This means that they cannot be offset against personal income or other capital gains.

If you are relying on negative gearing for tax relief, placing negatively geared properties in a family trust could lead to lost tax benefits.

Family Trust FAQs

Can any trust be considered a family trust?

No, not all trusts are automatically considered family trusts. For a trust to be regarded as a family trust for tax purposes, the trustee must make a formal Family Trust Election (FTE).

If the election is not made, the trust is not eligible for the tax benefits associated with family trusts, even if it has "family trust" in its name.

How long must a family trust keep records for tax purposes?

Trustees of a family trust must keep all relevant records, such as trust deeds, resolutions, asset statements, and distribution records, for at least five years from the date they were prepared, obtained, or completed.

If the trust incurs tax losses or is involved in capital gains events, records must be kept longer until the amendment period for those events lapses.

Electronic records are acceptable if they are accessible and understandable by the ATO. For comprehensive details on the record-keeping responsibilities of family trusts, visit the ATO’s official webpage.

Can a family trust be amended or revoked?

Yes, a family trust can be amended or revoked under certain circumstances, such as changes in family circumstances or when it no longer meets the tax benefit requirements. However, these changes must comply with the rules set out in the trust deed.

Can a family trust hold assets overseas?

Yes, a family trust can hold assets overseas, such as real estate, investments, or other types of property.

However, the trustee must maintain detailed records of the overseas assets, including their location, nature, and any income or capital gains generated from these assets.

These overseas transactions must be reported in the trust’s tax return, and the trust may be subject to additional reporting requirements, such as completing the International Dealings Schedule if applicable.

Conclusion

Setting up a family trust in Australia is a valuable step in securing your family's financial future, offering benefits like tax efficiency, asset protection, and intergenerational wealth transfer.

While the process may seem complex, with proper guidance and a well-structured trust deed, it can provide long-term advantages.

If you are ready to set up a family trust or need expert assistance in navigating the process, CleanSlate Accounting is here to help.

Our team of professionals ensures that your trust is structured correctly, legally compliant, and tailored to your needs. Contact us today to get started on securing your family's financial legacy.

Disclaimer

This article is provided for general information and educational purposes only. It does not take into account your personal objectives, financial situation, or legal circumstances.

The decision to establish a trust (including the type of trust, trustee structure, and beneficiaries) should only be made after obtaining independent legal and/or financial advice appropriate to your circumstances.

We are a registered tax agent and provide advice only on tax and compliance matters within the scope of our registration. Any fees quoted by us relate solely to entity setup and ongoing accounting and tax compliance services. These fees do not include the cost of legal advice or financial product advice.