Top 6 expense trackers for small businesses in 2024

Introduction:

Sorting receipts is no fun. But the right expense tracker can change all that, transforming a tedious task into a streamlined process that keeps your financial records in order and empowers your business with the clarity and control needed for financial health.

Correctly tracking your expenses means you’re more likely to file an accurate tax return. Plus, if the ATO audits you, providing them with detailed documentation of your expenses will be no sweat. You’ll know exactly where your money goes every month—so you can cut spending where it’s getting out of hand.

In an era where every dollar counts, selecting a tool simplifies expense management becomes crucial. From the user-friendly interfaces of apps like MyOb to the comprehensive capabilities of Hubdoc, the proper expense tracker does more than just organise receipts—it becomes an integral part of your business's strategy for smart financial management.

With this in mind, we’ve assembled a list of the top 6 best business expense trackers to help you track expenses online, ensuring that you have the resources to master your money with confidence and precision.

Key takeaways

Expense tracking tools empower small businesses by ensuring financial stability and tax compliance.

Automation of expense tracking processes enhances efficiency and accuracy in budget management and forecasting.

Effective cash flow management, facilitated by these tools, mitigates the risk of business failure.

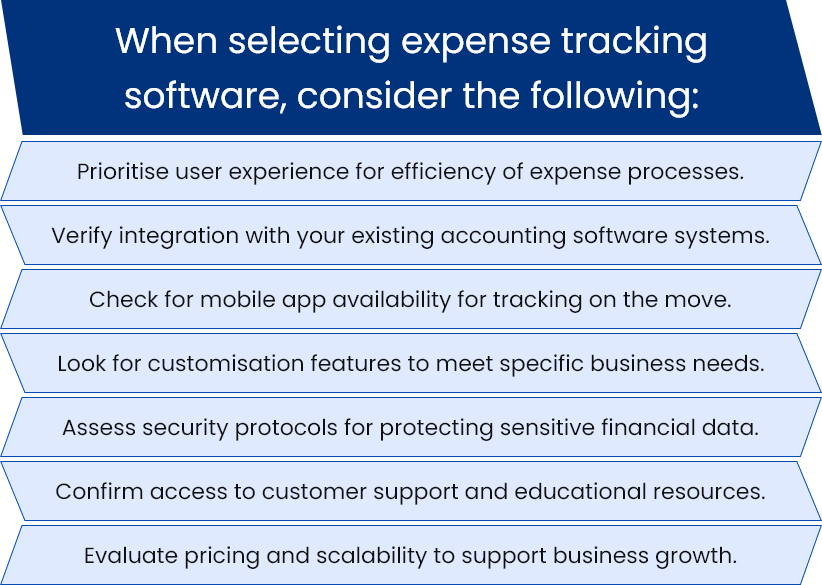

Key considerations like user experience, integration, customisation, and more are vital in choosing expense-tracking software.

What is an expense tracking tool?

Expense tracking tools enable businesses to meticulously monitor their spending, automating the recording, tracking, and managing all expenses over time. These tools are invaluable for budget planning, accounting, and forecasting future costs, thereby enhancing the efficiency of the expense management process and facilitating cost savings.

Maintaining adequate cash flow is a significant challenge for small businesses, The Australian Bureau of Statistics highlights a stark reality: approximately 60% of small businesses fail within the first three years, often due to cash flow issues. By providing a transparent overview of financial inflows and outflows, expense tracking software is crucial in helping businesses stay financially healthy and avoid the pitfalls that lead to failure.

Why opt for expense-tracking software?

Here's a secret formula to solve all your expense management challenges

Small businesses expense tracking tool

Hubdoc

Hubdoc streamlines managing business expenses by effortlessly capturing critical details from your receipts, invoices, and bills so that you can say goodbye to manual data entry.

With its user-friendly mobile app, simply snap a photo of any document and let the software do the rest, from scanning to storing. You can also email documents directly or upload them. This makes it easier you to keep your financial records organised and accessible from anywhere.

After a free 30-day trial, it's just USD 12 per month for unlimited access, support, and integration with major accounting platforms like Xero and QuickBooks Online. Whether on an Apple or Android device, it ensures your financial documentation is neatly organised, securely backed up, and always within reach.

Dext prepare

This innovative tool lets you quickly scan receipts with your smartphone, transforming how businesses manage expenses. Dext Prepare leverages award-winning OCR technology to digitise receipts and analyse, understand, and organise the data in just 30 seconds.

It's an essential asset for accountants, bookkeepers, and small business owners alike, simplifying the expense tracking process by ensuring financial data is accurately captured and seamlessly integrated with accounting software.

While specific pricing details are encouraged to be explored through a free trial, Dext Prepare's versatility across various platforms makes it a valuable tool for efficient business expense management.

Expensify

If you work remotely or regularly have meetings in different parts of the country, you know post-trip expense tracking is a nightmare. Using Expensify can change that, turning a tedious process into a streamlined task.

This tool is designed for anyone who needs to manage expenses, whether you're a freelancer, a small business owner, or part of a larger organization. With features like automatic receipt scanning and direct integration with accounting software like Quickbooks or Xero, Expensify simplifies the expense reporting process.

Starting at $5 per user per month, Expensify offers plans that cater to various needs, ensuring that businesses of all sizes can find a solution that works for them. The platform automates expense tracking and provides detailed insights into spending patterns, helping businesses manage their budgets more effectively.

Quickbooks

Running a small design business means watching every penny you spend closely. QuickBooks offers a simple way to help you track your business expenses. With its super-user-friendly design, you can easily import and categorise expenses, ensuring that every transaction is accounted for and that there is no missed tax deduction. This software automates expense management, saving you approximately 11 hours per week that can be redirected towards more creative endeavors.

QuickBooks is versatile, supporting various platforms to ensure accessibility at the office or on the go. It connects to your bank accounts and credit cards for automatic importation and categorisation of expenses. The mobile app enhances this functionality by allowing you to take photos of your receipts and attach them to what you spent money on. This makes preparing for taxes simpler.

Pricing for QuickBooks starts at just $1 per month for the first three months, offering a cost-effective way to manage your business finances. Whether a solo entrepreneur or managing a team, QuickBooks adapts to your needs, providing insights and reports that help you make informed decisions about your business's financial health.

Overburdened by manual bookkeeping?

Learn how automation can simplify your process in our e-book.

Zoho expense

Zoho expense streamlines business expense tracking with a blend of automation and user-friendly features. With Zoho, managing receipts, expenses, and mileage is hassle-free. Features like auto-scan receipts, bulk import, and integration with cloud applications ensure that no receipt goes untracked. Expenses can be uploaded in any currency, itemised, split, or consolidated, offering flexibility and control. Mileage tracking is accurate and supports various methods, including mobile and wearable devices.

Zoho Expense also automates expense report creation and submission, reducing manual work. It integrates with corporate cards for easy reconciliation and supports custom approval workflows, ensuring compliance and efficient auditing.

Available on multiple platforms, including Android, iPhone, and Apple Watch, it caters to the needs of diverse business environments. While specific pricing details require a direct visit due to the personalised nature of Zoho's offerings, the promise of a 14-day free trial highlights Zoho's confidence in their solution

Freshbooks

In the quest to escape the clutches of cumbersome spreadsheets and the never-ending pile of receipts, FreshBooks offers a seamless solution for managing business expenses. By automatically syncing with your bank account or credit card, it eliminates the need for manual data entry, ensuring that your financial records are always up to date.

The mobile app facilitates the easy capture and storage of receipts, so you can forget about losing them. FreshBooks simplifies tax preparation through straightforward expense categorization, which is a relief for you and your accountant. The platform also allows clients to be directly billed for expenses and streamlines invoicing.

Available on Android, iPhone, and web browsers, the software provides accessibility from virtually anywhere. With packages starting at $15 a month, it includes features ranging from unlimited invoicing to project management tools, all aimed at keeping your business's financials orderly.

Things to consider while picking the right Expense Tracking Software

What is the best approach to managing your business expenses?

Once you have selected the expense tracker that best fits your needs, it's time to begin managing your business expenses. Here are four simple steps to get started.

Digitise your receipts

Start by scanning or taking photos of your receipts. This step ensures that you have digital records of all transactions. It's crucial for maintaining clear and accessible documentation of your expenses. Digital records can be stored in an expense tracking app or on your computer. Regular backups are recommended to prevent data loss.

Open a business account

Opening a business account is a crucial step for any business owner. It keeps your personal and work-related transactions separate, making it easier to see what you're spending on your business. This is helpful when doing your taxes because you can easily find all your business expenses in one place. Plus, having a business account is good for building a credit history for your business, which can help you get loans or credit cards later on.

Automate expense tracking with bank integration

Linking your bank accounts to your accounting software simplifies expense management. This connection makes downloading and categorising transactions automatic, which reduces manual work. It also makes bank statement reconciliation easier and allows direct banking operations within the software. This saves time and ensures every transaction is accurately recorded.

Review your business expenses regularly

Using expense tracking tools lightens the load of financial management. Still, it's vital to check your expenses regularly. Allocate time each week to review and categorise them. This practice guarantees accurate classification of transactions and ensures precise reporting. Regularly assessing your expense management helps spot overspending. This way, you can adjust your spending to match your financial earnings.

How can CleanSlate help?

Don’t have time to track expenses? CleanSlate can take it off your hands. We specialise in managing all your bookkeeping needs, from importing and categorising transactions to reviewing your expenses every month. With us, you gain a partner who handles your bookkeeping tasks meticulously, ensuring your financial data is always up-to-date and accurate.

But our services extend beyond just tracking expenses. We also prepare your financial reports monthly, giving you insights into your financial health and helping you make informed decisions.

Recognising the complexities of tax season, we offer a streamlined approach by allowing you to delegate your tax return preparation to us. Our team of tax professionals is dedicated to managing your tax filings with precision, ensuring compliance, and maximising your benefits.

And if you still have questions, our team is just a quick call away. With CleanSlate, comprehensive support is guaranteed. We keep your finances in check and your tax obligations met with precision.

Wrap-Up

Managing business expenses is a crucial aspect of running a successful business. You can simplify this process with the right tools and approach, saving time and money. Consider incorporating expense tracking software such as FreshBooks or Zoho into your business operations and follow the above steps to manage your expenses efficiently.

And if you need additional support, remember that CleanSlate is here to help. With our expertise and efficient services, we make managing expenses a breeze. So why wait? Take the first step towards effective expense management today