How can effective budgeting and forecasting improve cash flow for your construction project and ensure long-term financial stability?

Introduction:

Do you want to ensure the long-term financial stability of your construction project? If so, effective budgeting and forecasting are essential.

Proper financial planning can help manage cash flow, pay bills on time, meet payroll, and invest in future projects. Accurate forecasting of expenses and revenue enables informed decisions about resource allocation and identification of potential financial risks.

This blog explores the benefits of effective budgeting and forecasting in construction projects, including strategies for creating a realistic budget and tips for improving cash flow. The insights shared here can help improve financial management skills and build a solid foundation for long-term success in construction.

Key takeaways

Budgeting and cash flow forecasting in construction are crucial for financial planning and project progress.

Cash flow forecasting in construction projects helps project managers plan and manage their finances efficiently.

Proper budget planning promotes transparency and accountability among stakeholders, enhancing trust and confidence in the project.

Sufficient cash flow is vital for the success of construction projects, ensuring timely payments for labor, materials, and equipment.

What is the construction budget?

A construction budget is a detailed financial plan that outlines the estimated costs of a construction project. It includes all the expenses involved in the construction process, such as labor costs, materials, permits, equipment rental, and other related expenses.

The construction budget is typically created by the project owner or the construction manager in collaboration with the design team and other stakeholders.

The budget helps ensure that the project is financially feasible and that the resources are allocated effectively to complete the construction project within the available funds.

How to plan a construction project budget?

Planning a project budget involves various methods, but categorizing expenses as tangible and intangible is an effective approach.

Tangible expenses are related to the physical construction, such as materials, labor, and permits. These costs are easier to estimate and control since they are fixed expenses that do not fluctuate significantly.

On the other hand, intangible expenses are not directly related to construction, such as legal and accounting fees, permits, and inspections.

Intangible expenses account for about 30% of a construction project's total budget and tend to fluctuate more than tangible expenses making them more challenging to estimate accurately.

Separating expenses into these two categories can help project managers create a more accurate budget, identify any overlooked costs, and apply cost-control measures more effectively.

How does proper budget planning for construction projects improve cash flow?

Have you ever heard the saying, "cash is king"? Well, that's especially true in the world of construction project management. The success of any construction project depends heavily on cash flow - having enough money on hand to pay for labor, materials, and equipment. And, proper construction project budget planning is the key to maintaining a healthy cash flow.

Effective budget planning involves a thorough analysis of project scope, accurate cost estimation, and proactive risk management. By carefully identifying potential cost overruns and taking steps to mitigate them, you can avoid the cash flow problems that often arise from unexpected expenses. This proactive risk management also allows for contingency planning, ensuring that sufficient funds are available to address unforeseen issues.

Moreover, proper budget planning promotes transparency and accountability among stakeholders. By keeping stakeholders informed about the financial status of the project, trust and confidence in the project are enhanced. This can lead to greater investment and profitability. Additionally, proper budget planning helps identify potential opportunities for cost savings, maximizing the return on investment, and ensures long -term financial stability of a project.

Check our easy-to-use calculator to see what is happening with your cash flow forecasts!

Calculate now

What is the construction cash flow forecasting?

Cash flow forecasting is a critical aspect of financial management in construction projects. It involves predicting the expected cash inflows and outflows over a specified period, usually for a 12-month period.

The primary goal of cash flow forecasting is to ensure that the project has sufficient funds to carry out the activities regularly, covering expenses such as labor, equipment rentals, material costs, and other overheads.

In construction projects, cash flow forecasting helps project managers plan and manage their finances efficiently, ensuring timely payments to

- Contractors,

- Vendors and,

- Other stakeholders

It is essential to monitor cash flow regularly, as the projects may have varying durations and scopes, which can lead to changing cash flow requirements.

By forecasting cash flow, project managers can identify potential shortfalls and plan for alternate funding sources, such as loans or investments, to avoid cash flow problems.

Thus, accurate cash flow forecasting in construction projects is critical for efficient financial management, ensuring timely payments and the project's smooth progress.

How to create an effective construction cash flow forecast?

A construction cash flow forecast is a crucial tool for any construction business. It helps you estimate the amount of cash that will be coming in and going out of your business over a specific period. Here are some things to consider when creating an effective construction cash flow forecast:

-

Initiate forecasting with a reconciled cash balance:

Before you can begin to forecast, you need to know your current cash balance. Make sure to reconcile all your financial records to ensure that you have an accurate starting point.

-

List all income sources:

Include all sources of income, such as earnings from contracts, loans, grants, and startup capital. This will help you determine your expected cash inflow.

-

List all your expenses:

Consider all your expenses, such as labor costs, material costs, vendor payments, equipment and repair costs, and any other operational expenses. This will help you determine your expected cash outflow.

-

Use past projects to estimate future revenues and expenses:

While every construction project is different, looking at historical data from past projects can help you estimate future revenue and expenses.

-

Factor in seasonal or one-time expenses:

Some expenses are seasonal or one-time, such as capital asset purchases or slower work periods. It's important to factor these into your projections.

-

Be cautious when making income projections:

It's better to be cautious when estimating your income. Assume that not all invoices will be paid on time, and make sure to account for this in your forecast.

-

Update your forecast regularly:

Your cash flow may vary seasonally or due to unforeseen circumstances. Regularly updating your forecast will help you stay on top of any changes.

-

Consider modernizing your operations and workflows:

By using digital tools, you can streamline your construction cash flow processes, saving both time and money. Digitization and cloud-based solutions can also make forecasting much easier and more accurate.

By considering these factors, you can create a comprehensive and effective construction cash flow forecast, which will help you to better manage risk, optimize project performance, and achieve long-term financial success.

Expert Bookkeeping at Your Fingertips!

How does accurate cash flow forecasting assist construction project managers in improving the cash flow of their projects?

CleanSlate cash flow forecasting can assist construction project managers in improving the cash flow of their projects in the following ways:

-

Improved budgeting and planning:

Accurate cash flow forecasting helps project managers plan their budgets and resources more effectively, ensuring that all expenses are accounted for. It also allows them to identify potential areas of risk or cost overruns and plan accordingly

-

Avoid delays due to financial issues:

By monitoring the cash flow of a project, project managers can identify potential financing issues before they become major problems. They can then take steps to address any such issues, reducing the likelihood of costly delays due to insufficient funds.

-

Improved cash flow management:

Having an accurate forecast of cash flows allows project managers to manage their finances more effectively and make adjustments as needed. This can help them ensure that the project remains on track and within budget.

-

Reduced financial risks:

Accurate cash flow forecasting enables project managers to anticipate potential issues related to money, such as cash flow shortages, delays in payments and overspending. By predicting these issues ahead of time, they can take steps to avoid or mitigate them , reducing the financial risks associated with the project.

-

Improved profitability:

Accurate cash flow forecasting allows project managers to make smarter decisions that can lead to improved profitability. For example, they can identify areas where cost savings can be made or negotiate better payment terms which could reduce their costs and increase their profits in the long run.

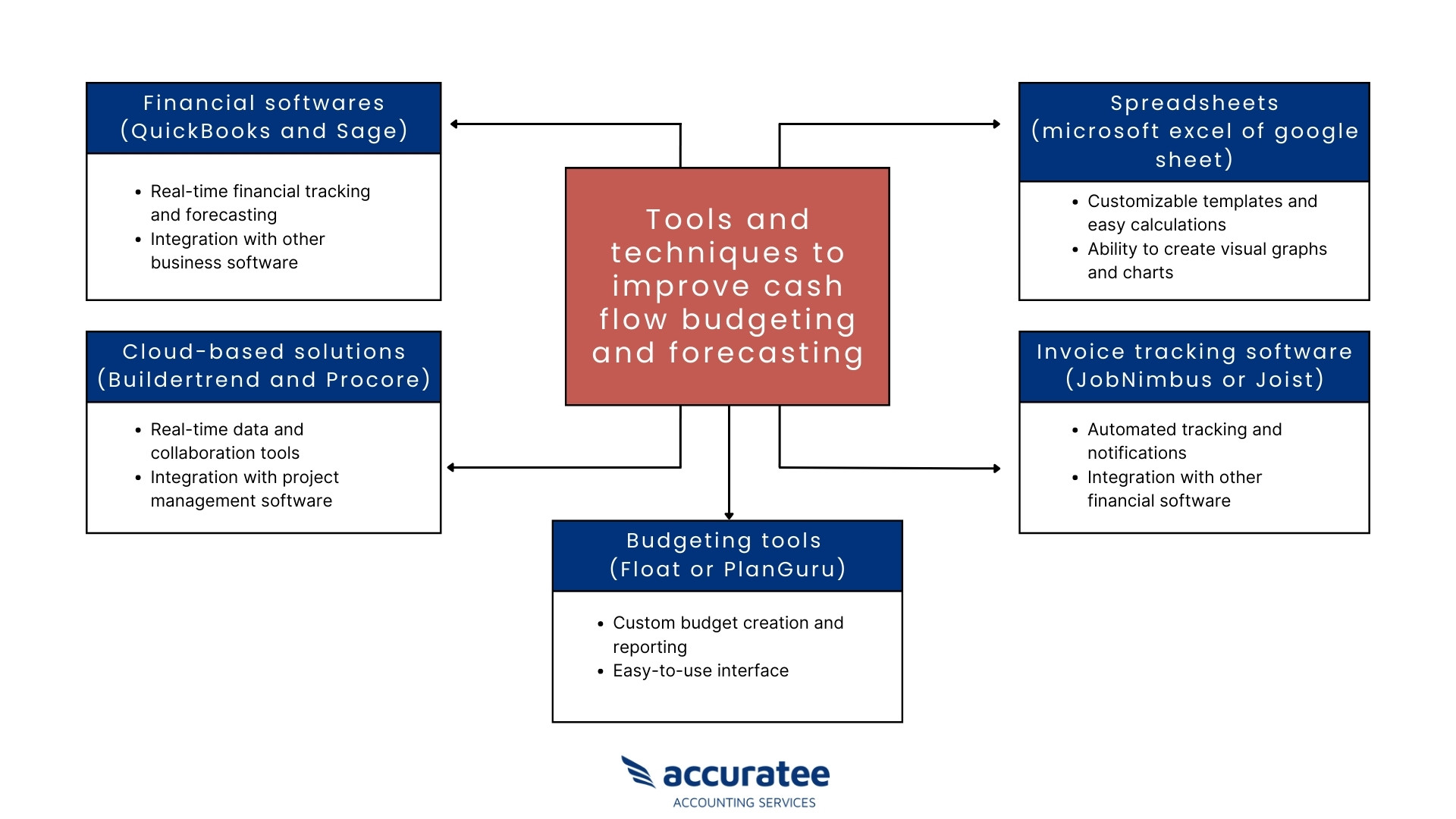

What tools can construction project managers use to improve their cash flow forecasting and budgeting ?

Construction project managers often face the challenge of managing cash flow and ensuring that their projects are completed on time and within budget. To address this challenge, they can use a variety of tools and techniques to improve their cash flow forecasting and budgeting. Here are some of the tools that can be useful in this regard:

By leveraging these tools, construction project managers can make more informed decisions about their finances and improve their cash flow forecasting and budgeting capabilities. This can enable them to reduce the financial risks associated with their projects and increase profitability in the long run.

Strategies to improve cash flows of a construction project other than forecasting and budgeting

In addition to cash flow forecasting and budgeting, construction project managers can take other steps to improve the cash flow of their projects. Here are some strategies that may be useful in this regard:

-

Reduce overhead costs:

By reducing overhead costs, such as inventory or administrative expenses, project managers can improve the profitability of their projects.

-

Negotiate better payment terms:

Project managers can negotiate better payment terms with their suppliers, customers and other stakeholders to ensure a steady stream of cash flow. This may include extending payment deadlines or offering discounts for early payments.

-

Utilize invoice factoring:

Invoice factoring is a process in which a third-party lender pays the invoices of a business upfront and then collects payment from the debtor at a later date. This can be an effective way to improve cash flow, as it provides businesses with immediate access to funds.

-

Improve project management:

Project managers should make sure that their projects are properly planned and managed. This includes making sure the team is working efficiently, tasks are on track, and timelines are adhered to. By improving project management, project managers can maximize productivity and ensure profits are maximized.

-

Invoice promptly:

By invoicing promptly, project managers can ensure that they receive payments in a timely manner. This helps to improve cash flow and keep the business financially stable.

-

Seek alternative financing options:

Project managers can also seek alternative financing options such as lines of credit, business loans and venture capital to improve cash flow. This may be necessary if the project is facing financial difficulties or if additional funds are needed for expansion or other investments.

These are just some of the strategies that project managers can use to improve the cash flow of their projects. By following these strategies, project managers can ensure that their projects are profitable and well-managed.

Conclusion

Effective budgeting and forecasting are vital for construction projects' financial stability. By allocating resources wisely and managing cash flow, profitability and sustainability can be improved.

Embrace these practices to ensure successful project completion.

Ready to take control of your construction project's finances? Partner with CleanSlate's construction accountants for expert guidance and tailored solutions.

Contact us today to optimize your budgeting and forecasting processes and achieve long-term financial stability.