Do trusts qualify for the 50% CGT discount?

If you are managing a trust and thinking about selling an asset, the question on your mind might be: “Can we access the 50% CGT discount?” After all, this tax break can make a big difference when it comes to reducing the capital gains tax on your sale.

But, like most things tax-related, it’s not as simple as it sounds. In this post, we will explore how the CGT discount works for trusts, who is eligible, and what rules you need to know to make sure you are not leaving money on the table.

What is the 50% CGT discount, and how does it benefit trusts?

Yes, Australian trusts can access the CGT discount

Australian resident trusts, including discretionary trusts (family trusts), unit trusts, and other types of trusts, can indeed benefit from the 50% CGT discount, provided they meet certain requirements.

Let’s take a deeper look at the conditions under which a trust can qualify for the CGT discount.

Do Australian trusts benefit from the 50% CGT discount?

Yes, Australian trusts can access the CGT discount

Australian resident trusts, including discretionary trusts (family trusts) set up, unit trusts set up, and other types of trusts, can indeed benefit from the 50% CGT discount, provided they meet certain requirements.

Let’s take a deeper look at the conditions under which a trust can qualify for the CGT discount.

Eligibility requirements for trusts to qualify for the CGT discount

For your trust to qualify for the 50% CGT discount, it must meet the following key conditions:

1. The 12-month ownership requirement

To apply the CGT discount, the trust must have owned the asset for at least 12 months before the CGT event happens. The CGT event is the sale, transfer, or disposal of the asset. This rule applies to all types of assets, from property to shares.

When does the CGT event occur?

- Sale or transfer: The CGT event is triggered at the point of sale or when the contract is signed, not at settlement.

- Loss or destruction: If the asset is lost or destroyed, the CGT event occurs when compensation or insurance is received.

- Inheritance: If the trust acquired the asset through a deceased estate or a relationship breakdown, the previous owner's holding period may count toward the 12-month requirement.

2. Trust must be an Australian resident Trust

The second condition for eligibility is that the beneficiary must be an Australian resident for tax purposes during the ownership period of the asset. This requirement ensures that the CGT discount is available only to individuals who are subject to Australian tax laws.

The Australian Tax Office (ATO) defines Australian tax residency based on a series of factors, including where the person lives, their employment, and their personal and economic ties to Australia.

If the beneficiary was a foreign resident for tax purposes at any point during the ownership of the asset, they would not be eligible for the full 50% CGT discount. In such cases, the discount may be apportioned based on the period of time the beneficiary was an Australian resident during the ownership.

For example, if a beneficiary was an Australian resident for only 6 months during the 12-month ownership of an asset, they would receive a pro-rata CGT discount, which may be less than the full 50%.

Good record-keeping supports this process because reconciliations, transaction coding and compliance entries need to be accurate when determining eligibility and calculating the discount. If you prefer ongoing help with this work, our professional online bookkeepers help you in maintaining your trust reporting requirements.

3. Entitlement to the capital gain

The third and final condition is that the beneficiary must be entitled to the capital gain. This typically means that the capital gain is streamed to specific beneficiaries, who are then taxed on the gain in their own name.

For example, if a trust earns a capital gain of $100,000 from selling an asset, the trustee may decide to stream $50,000 to one beneficiary and the remaining $50,000 to another. Both beneficiaries would then be eligible for the CGT discount on their respective portions, provided they meet the other eligibility requirements.

Curious if your trust qualifies for the CGT discount?

Book a call now

Trustee’s election to be taxed on capital gains

If no beneficiary is entitled to the capital gain, the trustee may choose to pay tax on the capital gain. However, if the trustee chooses to be taxed on the capital gain, they cannot apply the 50% CGT discount.

In situations where the trust’s net income includes a capital gain, but the beneficiary does not benefit from the gain immediately, the trustee can opt to pay tax on behalf of the beneficiary. This allows the trustee to apply the CGT discount if the capital gain has not been allocated to the beneficiary during the year or within two months of the end of the income year.

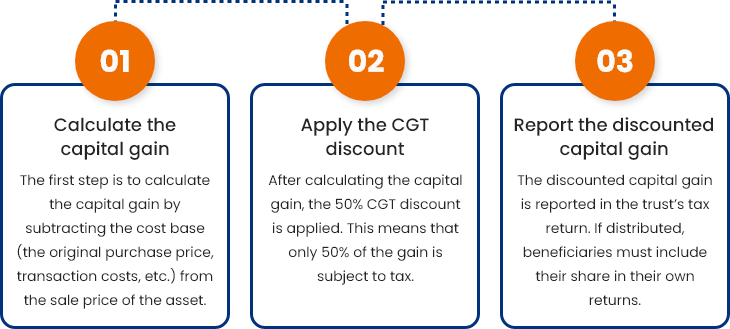

How does the 50% CGT discount work for trusts?

Once your trust qualifies for the CGT discount, here’s how it works:

Exclusions that prevent trusts from claiming the 50% CGT discount

While many Australian resident trusts can qualify for the 50% CGT discount, there are certain exclusions that may prevent a trust from using the discount. Here are the key scenarios where the CGT discount does not apply:

1. Home first used for rental or business

If your trust’s home was first used for rental or business purposes less than 12 months before selling, the CGT discount cannot be applied. In this case, the trust must use the indexation method to calculate the capital gain.

2. Trust splitting

If the trust undergoes a trust split, where separate trustees are appointed over different assets, the CGT discount may not apply. This is because a trust split is treated as a CGT event, triggering tax liabilities on the assets.

3. Foreign or temporary residents

Foreign and temporary residents are not entitled to the full CGT discount. However, if the trust was a resident for part of the ownership period, it may qualify for a pro-rata discount.

4. Conversion of income assets

If an income-producing asset (such as shares or bonds) is converted into a capital asset for the sole purpose of applying the CGT discount, the discount will be denied.

Stay compliant with trust tax deadlines

Additional benefits of the CGT discount for trusts

Trusts can also benefit from an extra tax break when the asset is used for affordable rental housing. In addition to the standard 50% CGT discount, trusts may be eligible for up to an additional 10% discount, bringing the total CGT discount to 60%.

This extra benefit encourages investment in affordable housing, helping reduce tax liabilities while supporting the community. To qualify for this additional discount, the following conditions must be met:

- The property must be rented to low or moderate-income tenants under an approved affordable housing scheme.

- The trust must meet all requirements set by the Australian Tax Office (ATO) for affordable rental housing.

- The beneficiary claiming the discount must be an Australian resident for tax purposes.

- The trust must have held the asset for at least 12 months before the CGT event occurs.

This extra 10% discount is designed to support the provision of affordable housing while reducing the tax impact for eligible trust owners when the property is sold

Confused About CGT? Book a call with our experts today

If you're uncertain about your trust's CGT eligibility, need help with capital gains tax, or require professional assistance with trust tax returns, our team of expert accountants is here to guide you every step of the way. Here’s how we can help:

- Expert CGT guidance: We will help you understand if your trust qualifies for the 50% CGT discount and how to apply it to minimize your tax liabilities.

- Maximised tax savings: Our team offers strategies to reduce your tax burden, protecting your assets and improving your financial position.

- Accurate trust tax returns: We ensure your trust’s tax filings are in line with the latest regulations, taking full advantage of available tax benefits.

Don’t risk costly tax mistakes. Contact us today to discuss how we can help with your trust’s CGT strategy or tax returns. Our team is ready to provide personalised solutions that protect your assets and minimise your tax liabilities.

CGT discount FAQs

1. Can a trust choose to be taxed on capital gains?

Yes, in some cases, the trustee of a resident trust can choose to be taxed on a capital gain instead of passing it on to the beneficiaries. This option is available if no beneficiary is specifically entitled to the gain, or if the capital gain has not been paid or allocated to a beneficiary within 2 months of the end of the income year. However, if the trustee chooses to pay tax on the capital gain, they cannot apply the CGT discount.

2. How do beneficiaries determine their share of a capital gain?

A beneficiary’s share of a trust’s capital gain depends on their entitlement to the trust’s income or capital. For example, if the trust generates a $500 capital gain, the trustee may allocate $200 of that gain to one beneficiary and $300 to another.

Each beneficiary will report their share of the capital gain, and any available CGT discounts or concessions (like the small business 50% active asset reduction) will be applied based on the beneficiary’s individual circumstances.

3. How do trusts report CGT to beneficiaries?

Trustees must issue a statement of distribution or a tax statement to each beneficiary, detailing their share of the capital gains and other income. This statement will include information on the net capital gain, the method used to calculate the gain, and any applicable CGT discounts. Beneficiaries should then report their share of the capital gain on their personal income tax return.

4. Can a trust distribute capital gains from a property sale without triggering CGT?

No. If a trust sells an asset and realises a capital gain, the gain is subject to CGT unless specific exclusions apply. However, if a beneficiary is specifically entitled to the capital gain, the gain may be distributed to them, and they will pay the CGT based on their portion of the gain.

If no beneficiary is entitled to the gain, the trustee will pay the CGT on behalf of the trust. The 50% CGT discount may still apply to the capital gain if the beneficiary meets the holding period and other conditions.

5. What happens if a beneficiary is not "specifically entitled" to a capital gain?

If a beneficiary is not specifically entitled to a capital gain, then the gain will be included in the trust's net income. The capital gain will then be allocated proportionally to beneficiaries based on their present entitlement to the trust’s income. In this case, the CGT discount will not apply to the beneficiaries unless the capital gain is streamed to them. Instead, the trustee may be taxed on the gain.

6. Are trust distributions to foreign residents subject to CGT?

Foreign residents are subject to different rules when it comes to CGT. If a trust distributes a capital gain to a foreign resident beneficiary, the beneficiary may be subject to Australian withholding tax on the distributed amount.

The capital gain will also be subject to the CGT provisions as if the beneficiary were an Australian resident, but the foreign beneficiary may need to apply for any applicable relief or exemptions under Australia's tax treaties with their country of residence.

7. Can a trust distribute franked dividends, and how are they taxed?

Yes, a trust can distribute franked dividends to its beneficiaries. When a trust receives a franked dividend, it may pass on the franking credits to the beneficiaries, allowing them to use these credits to offset their own tax liabilities.

If the capital gains of the trust are streamed to the beneficiaries, the franking credits are typically passed on in the same way. For capital gains, the CGT discount may apply if the capital gain qualifies for the discount.

Final thoughts

Understanding the 50% CGT discount and its eligibility criteria is important for trustees looking to minimize tax liabilities on asset sales. If your trust meets the requirements, this discount can significantly reduce the capital gains tax payable, providing substantial savings. However, the eligibility criteria can be complex, and mistakes can be costly.

If you are unsure about your trust's eligibility for the CGT discount or need assistance with your trust's tax return, our expert team is here to help. We offer tailored advice to ensure your trust maximizes available tax benefits while staying compliant with all regulations. Book a free consultation with our experts today to get clarity and save on taxes.