Understanding Division 7A and its impact on small business owners in Australia

Introduction:

As a small business owner, understanding the tax laws and regulations that apply to your business can be daunting. But fear not, because in this blog, we will break down Division 7A and its impact in a simple and engaging way.

In the words of the Australian Taxation Office, "Division 7A is designed to prevent private companies from making tax-free distributions of profits or assets to shareholders and their associates." This means that if you are a shareholder or associate of a private company, the ATO has rules in place to ensure that any distributions made to you are appropriately taxed.

But how does this impact small business owners? Well, Division 7A can have significant implications for how you manage your finances and structure your business. So, let's dive in and explore the ins and outs of Division 7A and what you need to know to ensure your small business is compliant with the regulations.

Key takeaways

Division 7A is a set of Australian tax rules that apply to transactions between private companies and their shareholders or associates.

The rules prevent tax-free access to company assets by treating certain transactions as deemed dividends and taxing them accordingly.

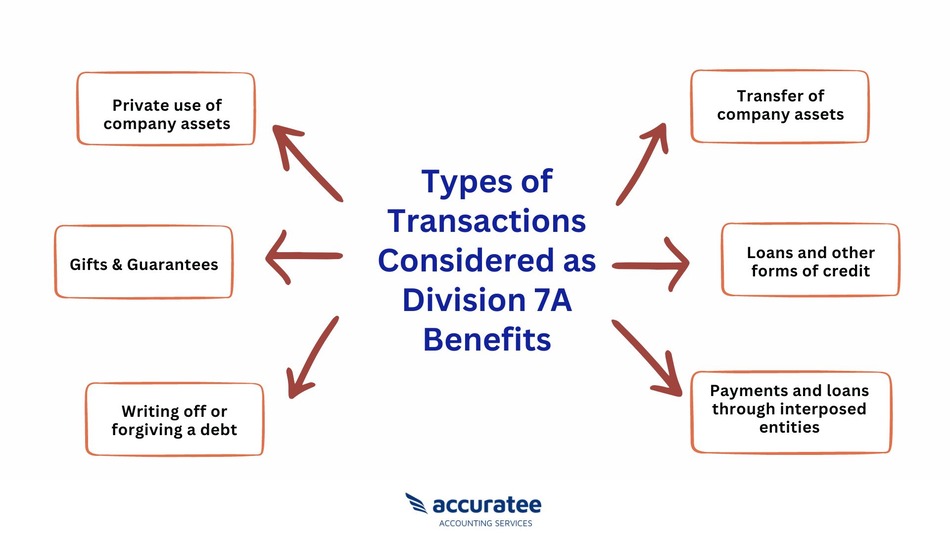

The division covers a broad range of transactions, including loans, payments, and debt forgiveness, and sets minimum interest rates and maximum loan terms.

Small businesses must maintain detailed records of payments and loans to comply with Division 7A rules and avoid legal and financial issues.

Compliance with Division 7A regulations can significantly impact small business finances and structure, and professional assistance is recommended.

What is Division 7A?

The introduction of Division 7A of Part III of the Income Tax Assessment Act 1936 (ITAA 1936) aims to prevent private companies from distributing profits to their shareholders or associates tax-free, effectively reducing the company’s taxable income. The purpose of Division 7A is to ensure that individuals cannot use private companies as a means of avoiding paying personal income tax or to obtain personal financial benefits.

Division 7A applies to a wide range of transactions that involve private companies and their shareholders, associates, or related parties. These transactions include loans, payments, and debt forgiveness. For example, if a private company lends money to one of its shareholders without charging any interest, this loan would be deemed a dividend and would be subject to tax.

.jpg)

What are Division 7A rules?

Division 7A is a set of Australian tax rules that apply to transactions between private companies and their shareholders or associates. The rules aim to prevent shareholders or associates from accessing company assets tax-free or at a lower tax rate. Some of the key tax rules in Division 7A include:

- Treating certain transactions, such as loans, payments, and debt forgiveness, as deemed dividends and taxing them accordingly.

- Imposing minimum interest rates and maximum loan terms for loans between private companies and their shareholders or associates.

- Requiring loans to be repaid within a certain timeframe or converted to a dividend.

- Requiring companies to declare dividends to their shareholders by the end of the financial year and to pay tax on those dividends.

- Imposing penalties for non-compliance with Division 7A, including additional tax and interest charges.

When Division 7A may apply?

In Australia, Division 7A rules come into effect when a private company makes a payment or loan to a shareholder, associate or related party, and the payment or loan is not repaid within a certain timeframe, or when a private company provides a benefit or advantage to a shareholder, associate or related party.

The rules also apply when a private company forgives a debt owed by a shareholder, associate or related party, or when a private company transfers an asset to a shareholder, associate or related party for less than its market value.

Note: If Division 7A is applicable to a loan, then the loan will be considered an unfranked dividend, similar to if the company had distributed the amount to the shareholder as a dividend. As a result, the shareholder may be required to report the amount in their personal income tax return and pay tax on it at their individual tax rate.

If you are uncertain about the application of Division 7A on your private company's trust entitlements, it is recommended that you seek assistance from a professional accountant or tax consultant.

Such experts specialize in offering tax and accounting services to private companies and trusts, and can help you navigate the intricate rules and regulations related to Division 7A.

Need help navigating the complex rules of Division 7A? Look no further! The tax accountants at CleanSlate can provide accurate guidance and support to ensure your private company remains compliant with the relevant laws and regulations.

How Division 7A impacts small businesses?

Here are some of the ways Division 7A can impact small businesses:

- Division 7A impacts small businesses by limiting the amount of money that can be distributed to shareholders or associates as loans or payments. The aim is to prevent companies from giving out excessive payments or loans to avoid paying tax. This can affect small businesses that rely on these payments or loans to cover their living expenses or invest in their business. Small business owners need to ensure that any payments or loans made to shareholders or associates are in line with the Division 7A rules to avoid any penalties or fines.

- Division 7A impacts small businesses by requiring them to keep detailed records of all payments and loans made to shareholders or associates. This is to ensure that any payments or loans made are not excessive and are made in accordance with the Division 7A rules. Keeping accurate records can be time-consuming and can add to the administrative burden of small business owners. However, it's essential to keep these records to avoid any legal and financial issues in the future.

- Division 7A impacts small businesses by requiring them to pay tax on any loans or payments made to shareholders or associates. If the loans or payments are not made in accordance with the Division 7A rules, they will be treated as dividends and taxed accordingly. This can have a significant impact on small businesses, as they may need to pay additional tax on top of their regular tax obligations. Small business owners need to ensure that any payments or loans made are in line with the Division 7A rules to avoid any additional tax liabilities.

- Division 7A impacts small businesses by restricting the use of assets owned by the company by shareholders or associates. This is to prevent companies from using their assets to benefit their shareholders or associates unfairly. Small business owners need to be aware of these restrictions to avoid any legal and financial issues in the future.

- Division 7A impacts small businesses by imposing strict penalties and fines for non-compliance. Small business owners who fail to comply with the Division 7A rules can face penalties and fines, which can have a significant impact on their business's financial health. It's essential for small business owners to understand the Division 7A rules and comply with them to avoid any legal and financial issues in the future.

What is the common way to pay shareholders under Division 7A rules?

The most common way to pay shareholders in accordance with the Division 7A rules is through a loan agreement. A loan agreement requires shareholders to sign and agree to repay any loans or payments made by the company within a specified period of time. The repayment terms of the loan need to be clearly defined, including the rate of interest and any other terms. Any loan or payment made to shareholders must comply with Division 7A rules to avoid any penalties or fines.

Note: There are two types of Division 7A loan agreements that comply with the regulations:

- An unsecured loan that has a maximum term of 7 years.

- A secured loan that has a maximum term of 25 years. However, this type of loan must be secured by a mortgage over real property.

Another way for small businesses to pay their shareholders is to declare a dividend. However, dividends are subject to taxation and must be declared in accordance with Division 7A rules. It’s important for small businesses to understand the requirements of Division 7A before declaring any dividends.

Finally, some small businesses may be eligible to pay their shareholders through a non-commercial loan agreement if certain conditions are met. Non-commercial loans require the shareholder to repay the loan in full within seven years of its inception and must not exceed certain amounts annually.

No matter which method of payment is chosen, it’s important for small businesses to abide by the rules of Division 7A.

Turn Your Bookkeeping into a Breeze!

Common mistakes made by small business owners in relation to Division 7A

Here are some common mistakes that small business owners make in relation to Division 7A:

-

Not keeping accurate records:

Division 7A requires businesses to keep detailed records of all transactions between the company and its shareholders or associates. Failure to keep accurate records can lead to penalties and fines.

-

Using company funds for personal expenses:

Business owners may be tempted to use company funds for personal expenses, such as paying for a holiday or buying a car. However, this can result in a deemed dividend under Division 7A, which means the business owner will need to pay tax on the amount.

-

Failing to pay back loans:

If a business owner borrows money from their company, they must ensure they pay it back within the required timeframe, which is typically seven years. Failure to do so can result in a deemed dividend.

-

Not seeking professional advice:

Division 7A is a complex area of tax law, and small business owners should seek professional advice to ensure they are complying with the rules. Failure to do so can result in costly mistakes.

-

Ignoring changes to the law:

Division 7A is subject to frequent changes, and small business owners should stay up to date with any changes to ensure they are complying with the latest requirements.

How can small businesses stay compliant with Division 7A?

Small businesses can stay compliant with Division 7A by following these guidelines:

-

Loan agreements:

If the company is making a loan to a shareholder or associate, it is essential to have a written loan agreement in place. The loan agreement should specify the terms of the loan, including the repayment schedule, interest rate, and any security or collateral provided.

-

Minimum loan repayments:

Ensure that the minimum loan repayment requirements are met each year. The minimum repayment amount is set by the ATO and is based on the balance of the loan at the start of the income year.

-

Interest rate:

The interest rate charged on any loans should be at the prevailing commercial rate for similar loans at the time the loan is made.

-

Loans to associates:

Loans to associates, such as family members, should be treated with the same level of scrutiny as loans to shareholders. Ensure that any loans to associates are made on commercial terms and that the minimum repayment requirements are met.

-

Regularly review loans:

It is important to regularly review any loans made by the company to its shareholders or associates. This can help to identify any loans that may be in breach of Division 7A and take corrective action.

-

Consider alternative financing options:

There may be alternative financing options available to the company that can help to avoid the need for loans to shareholders or associates. For example, the company could consider raising capital through equity funding or accessing a line of credit.

-

Keep up-to-date with changes:

It is important to keep up-to-date with any changes to Division 7A rules and regulations. This can help to ensure that the company remains compliant with any new requirements or obligations.

-

Train staff:

It is important to ensure that all staff members who are involved in financial transactions are aware of the Division 7A rules and regulations. This can help to ensure that all transactions are conducted in accordance with the rules and that any potential breaches are identified and addressed.

Consequences of Non-Compliance with Division 7A

The consequences of non-compliance with Division 7A can be severe. If a company fails to comply with the Division 7A rules, penalty taxes and additional interest charges may be imposed. These penalty taxes can be as high as 78% of the loan or benefit provided. Non-compliance can also result in the company and its shareholders losing the tax benefits associated with dividends and franking credits.

In addition to the financial consequences, non-compliance with Division 7A can also result in reputational damage to the company and its directors. Non-compliance can be seen as a breach of the director's duties, which can result in legal action being taken against them.

Conclusion

Understanding Division 7A is extremely important for small business owners in Australia. It can have a huge impact on your financial planning, and it’s essential to stay compliant with the rules. As such, it's important to make sure you're up to date on when this legislation applies and how to pay shareholders under Division 7A guidelines.

While there are numerous common mistakes made by small businesses related to Division 7A, catching potential issues early helps avoid any ramifications and preserve the worth of your business.

To ensure that you comply with all legislative guidelines regarding Division 7A and its impact on small businesses in Australia, the best thing to do is contact the experienced tax experts at CleanSlate. They will help guide you through the process step-by-step and ensure that your business is compliant and remains profitable.