How can salary sacrifice benefits enhance your financial situation?

Introduction:

Are you looking to supercharge your financial situation and uncover new avenues for growth? If so, you have come to the right place. In this comprehensive blog, we, at CleanSlate, a leading online accounting and bookkeeping service provider will delve into the world of salary sacrifice benefits and show you how it can enhance your financial well-being.

Imagine having the ability to maximise your income, reduce your tax burden, and access a host of additional benefits that can significantly impact your financial landscape. Salary sacrifice offers precisely that. It is a strategic approach that allows you to optimise your earnings beyond traditional salary packages.

Throughout this article, we will demystify the concept of salary sacrifice, and provide practical insight to make informed decisions. Whether you are an employee seeking to boost your savings or an employer looking to offer attractive incentives to your team, we have got you covered.

Key takeaways

Making salary sacrifice contributions offers benefits like tax deductions, increased disposable income, and boosted savings through additional super contributions.

Consider individual circumstances, including income levels, concessional contribution caps, and potential employment changes, before committing to a salary packaging arrangement.

Maximise the benefits and minimise potential drawbacks of salary sacrificing by seeking professional advice from CleanSlate.

What is salary sacrifice?

Salary sacrifice refers to an arrangement between an employer and an employee where the employee agrees to forgo a portion of their salary in exchange for non-cash benefits. These benefits can include items such as superannuation contributions, cars, laptops, or other goods and services. Salary sacrifice is a flexible and tax-effective way for employees to structure their remuneration package and optimise their overall financial situation.

How does salary sacrifice work?

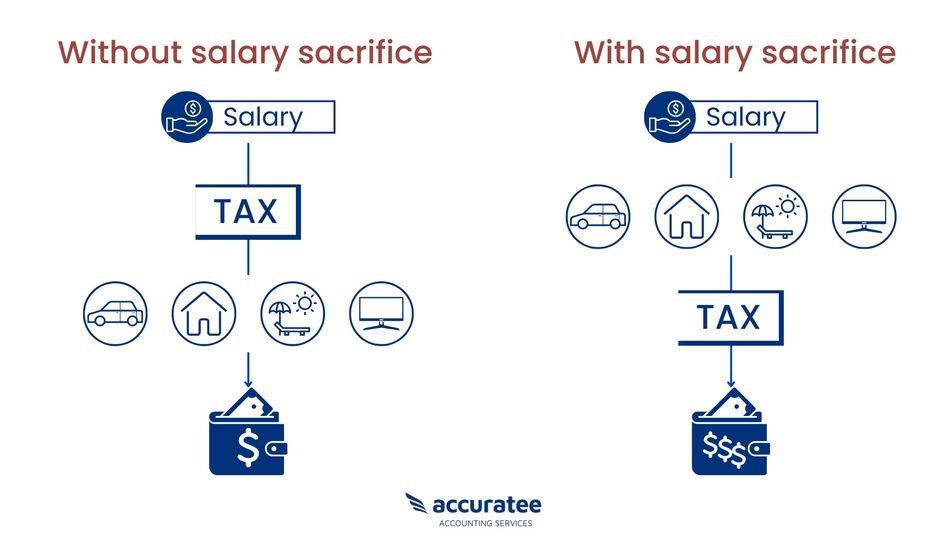

Salary sacrificing works by diverting a portion of an employee's pre-tax income to be allocated towards specific benefits. By doing so, employees can potentially reduce their taxable income, resulting in lower income tax liabilities. This arrangement allows individuals to allocate their income in a way that maximises their financial advantage.

Example

| Without salary sacrifice | With salary sacrifice | |

|---|---|---|

| Total annual wages | $100,000 | $100,000 |

| Salary sacrificed | - | $10,000 |

| Taxable income | $100,000 | $90,000 |

| Tax payable (Based on tax rates) | $24,947 | $20,797 |

| Net income (After tax) | $75,053 | $79,203 |

| Net income difference | - | +$4,150 |

| Percentage increase | - | 5.5% |

What can you salary sacrifice?

The range of benefits you can salary sacrifice depends on your employer's policies. Some common options include contributing to your superannuation fund or using the funds for items such as cars (typically through a novated lease), phones, and laptops. According to the Australian Taxation Office (ATO), there are no restrictions on the types of benefits you can receive through salary sacrifice.

These benefits can be classified into 3 groups:

-

Fringe benefits:

This category includes benefits like property, cars, loan repayments, childcare costs, and school fees. In some cases, your employer may need to pay fringe benefits tax (FBT) on these benefits.

-

Exempt benefits:

These are work-related items such as computer software, portable electronic devices, protective clothing, and tools of trade. If these items are primarily used for work-related purposes, your employer is not required to pay FBT for them.

-

Superannuation:

If you opt to salary sacrifice into your superannuation fund, the amount you sacrifice is not considered a fringe benefit, and it is not subject to FBT.

Understanding how salary sacrifice functions and the range of benefits it offers enables you to make informed decisions to enhance your financial situation and take full advantage of available opportunities.

What is a novated lease?

A novated lease is an arrangement involving three parties: the employee, the employer, and a financier. In this agreement, the employee becomes the owner of a car, and the employer takes on the responsibility of making lease repayments to the financier. Additionally, the employer covers the costs associated with running the vehicle as part of the employment agreement.

One of the key conditions of a novated lease is that the employee must remain employed by the company. If the employment ceases, the rights and obligations of the lease shift back to the employee. This arrangement holds significant benefits for both parties involved. The employee gets to keep the car even after leaving the job, while the employer is relieved of the burden of an extra vehicle and the financial commitment tied to it.

How does salary sacrificing into superannuation contribute to your retirement savings and first home goals?

Salary sacrificing into superannuation can be a valuable strategy for increasing your savings or saving for your first home. By choosing to salary sacrifice, a portion of your pre-tax income is directed towards your super account.

Unlike personal super contributions, salary sacrificing is considered employer contributions and is typically taxed at a concessional rate of 15%, which is generally lower than your marginal income tax rate.

It is important to note that salary sacrificed contributions are made in addition to the compulsory super contributions made by your employer, which currently stand at 10.5% of your salary and will increase to 11% from 1 July 2023.

While there is no specific limit on the amount you can salary sacrifice into super, it is crucial to be mindful of the concessional contributions cap. Currently set at $27,500 per financial year, exceeding this limit may result in additional tax implications. However, unused amounts from previous years can be carried forward, potentially allowing for a higher personal contributions limit.

For first-home buyers, salary sacrificing into super can also play a role in saving for your initial property purchase. Through the government's first home super saver scheme (FHSS), eligible individuals can access up to $50,000 of voluntary super contributions to assist with buying their first home. It is essential to familiarise yourself with the eligibility criteria and regulations associated with accessing your super for this purpose.

What are the salary sacrifice benefits for the employee?

The benefits for employees are multifold:

-

Tax savings:

By redirecting a portion of your income into salary sacrifice benefits, you can avail tax deduction. This can lead to significant tax savings as the sacrificed amount is taxed at a concessional rate, often lower than your marginal tax rate. It effectively lowers your overall tax liability.

-

Superannuation growth:

Salary sacrificing into your super account allows you to accelerate your savings. The additional contributions, made before taxes, can benefit from the power of compounding over time. This can result in a larger retirement investment and more financial security in your post-work years.

-

Lower taxable income:

By reducing your taxable income through salary sacrifice, you may find yourself in a lower tax bracket. This means you pay less income tax overall, resulting in more disposable income in your pocket. It can improve your financial situation and give you more flexibility to manage your expenses and savings.

-

Access to employer benefits:

Salary sacrifice arrangements often provide access to additional employer benefits. These can include employer super contributions, which not only grow your retirement savings but may also be complemented by employer matching contributions. Other benefits might include options like novated leases for vehicles, which can offer potential savings on car expenses.

-

Customisation and flexibility:

Salary sacrifice arrangements can be tailored to suit your specific financial goals and circumstances. You have the flexibility to choose the benefits that align with your needs, such as contributing more to superannuation, funding work-related expenses, or even assisting with specific financial goals like saving for a home.

What are the disadvantages of salary sacrifice?

While salary sacrifice can offer several benefits, it's essential to consider potential disadvantages as well, such as:

-

Reduced take-home pay:

By diverting a portion of your pre-tax salary towards salary sacrifice benefits, your take-home pay will be lower. It is important to carefully evaluate your budget and ensure that you can manage your living expenses comfortably with reduced income.

-

Impact on government entitlements:

Lowering your taxable income through salary sacrifice can potentially affect certain government entitlements and benefits that are income-tested. This includes benefits such as the Family Tax Benefit, Child Care Subsidy, or government support payments. It is advisable to review the eligibility criteria and assess how salary sacrifice may impact your entitlements.

-

Restricted access to funds:

Once salary is sacrificed, the funds are generally committed to specific purposes, such as superannuation contributions or eligible expenses. This reduces your access to the money for other immediate needs or unexpected expenses. Consider your financial goals and short-term liquidity requirements before committing to salary sacrifice arrangements.

-

Superannuation preservation:

Salary sacrifice contributions into your superannuation account are subject to preservation rules, meaning you typically cannot access the funds until you reach preservation age and meet specific conditions of release, such as retirement or reaching a certain age. This restricts your ability to use the money for other purposes until you meet the necessary criteria.

-

Changing employer policies:

Your employer's salary sacrifice policies may change over time, which can impact the benefits available to you. It is necessary to stay informed about any updates or revisions to ensure you make informed decisions and assess the ongoing viability of your salary sacrifice arrangements.

Expert Bookkeeping at Your Fingertips!

What are the key considerations to keep in mind before committing to a salary sacrifice arrangement?

-

Income thresholds:

Salary sacrificing tends to be more advantageous for middle to high-income earners. It can be particularly tax-effective for those earning above $37,000 annually. However, if you earn $37,000 or less, you may be eligible for the low-income superannuation tax offset (LISTO), which can provide up to $500 per year.

-

Concessional contributions cap:

Be mindful that salary-sacrificed super contributions could push you over the concessional contributions cap set by the ATO. If this happens, you may be subject to additional taxes.

-

Superannuation accessibility:

Once you contribute salary-sacrificed funds to your superannuation account, they generally cannot be accessed until retirement. While there are limited exceptions, such as the First Home Super Saver Scheme, it is essential to understand that the money is typically intended for your retirement savings.

-

Administration fees:

If a third-party company facilitates the salary sacrifice arrangement, they may charge an administration fee. This fee is typically deducted from your pre-tax dollars. Additionally, specific benefits like a novated lease might have additional charges associated with them.

Wrapping up

As a leading online accounting and bookkeeping service provider, CleanSlate can accurately and precisely handle all the calculations, payments, and deductions related to salary sacrifice for small and medium businesses. Our team of experts is dedicated to ensuring that your financial processes are streamlined and error-free, allowing you to focus on confidently running your business.

With our meticulous attention to detail and extensive knowledge in accounting and bookkeeping, you can trust CleanSlate to provide reliable and efficient services that will help you optimise the benefits of salary sacrifice for your employees. Partner with us and experience peace of mind knowing that your financial matters are in capable hands.