5 common SMSF tax return mistakes to avoid in 2025

Introduction:

Preparing and submitting a Self-Managed Superannuation Fund (SMSF) tax return can be a complex task that requires careful attention to detail. With the ever-evolving tax laws and regulations, it's crucial for trustees and members of SMSFs to stay informed and avoid common pitfalls.

In this blog, we will explore five prevalent SMSF tax returns mistakes that you should be aware of and, more importantly, take steps to avoid. By understanding these errors and implementing the necessary precautions, you can ensure compliance, minimize the risk of penalties, and optimize the financial outcomes of your SMSF.

So, whether you are a seasoned SMSF trustee or a newcomer to the world of self-managed super funds, this article will equip you with valuable insights to navigate the tax landscape effectively and safeguard your SMSF's financial health in 2025.

Key takeaways

SMSF tax returns are annual filings for self-managed superannuation funds to fulfill tax obligations and regulatory compliance.

Ensure to keep accurate and up-to-date financial records of all contributions, investments, transactions, and distributions for your SMSF.

Finalize the SMSF audit before lodging your SMSF annual return (SAR) to ensure accurate reporting and reduce the risk of errors or omissions.

Lodge your return on time to avoid penalties, and consider professional assistance if necessary.

SMSF tax returns: understanding the basics

An SMSF, or Self-Managed Superannuation Fund, is a type of superannuation fund in Australia that individuals can manage on their own. When it comes to taxation, an SMSF tax return refers to the annual filing that must be submitted for such a fund.

This return, known as the SMSF annual return (NAT 71226), encompasses various aspects, including income tax reporting, regulatory compliance, and member contributions reporting.

It serves as a comprehensive declaration of the fund's financial activities and ensures adherence to taxation laws and regulations. By completing the SMSF return, individuals can fulfill their obligations and maintain compliance for their SMSF.

5 most common SMSF tax return mistakes to avoid in 2025

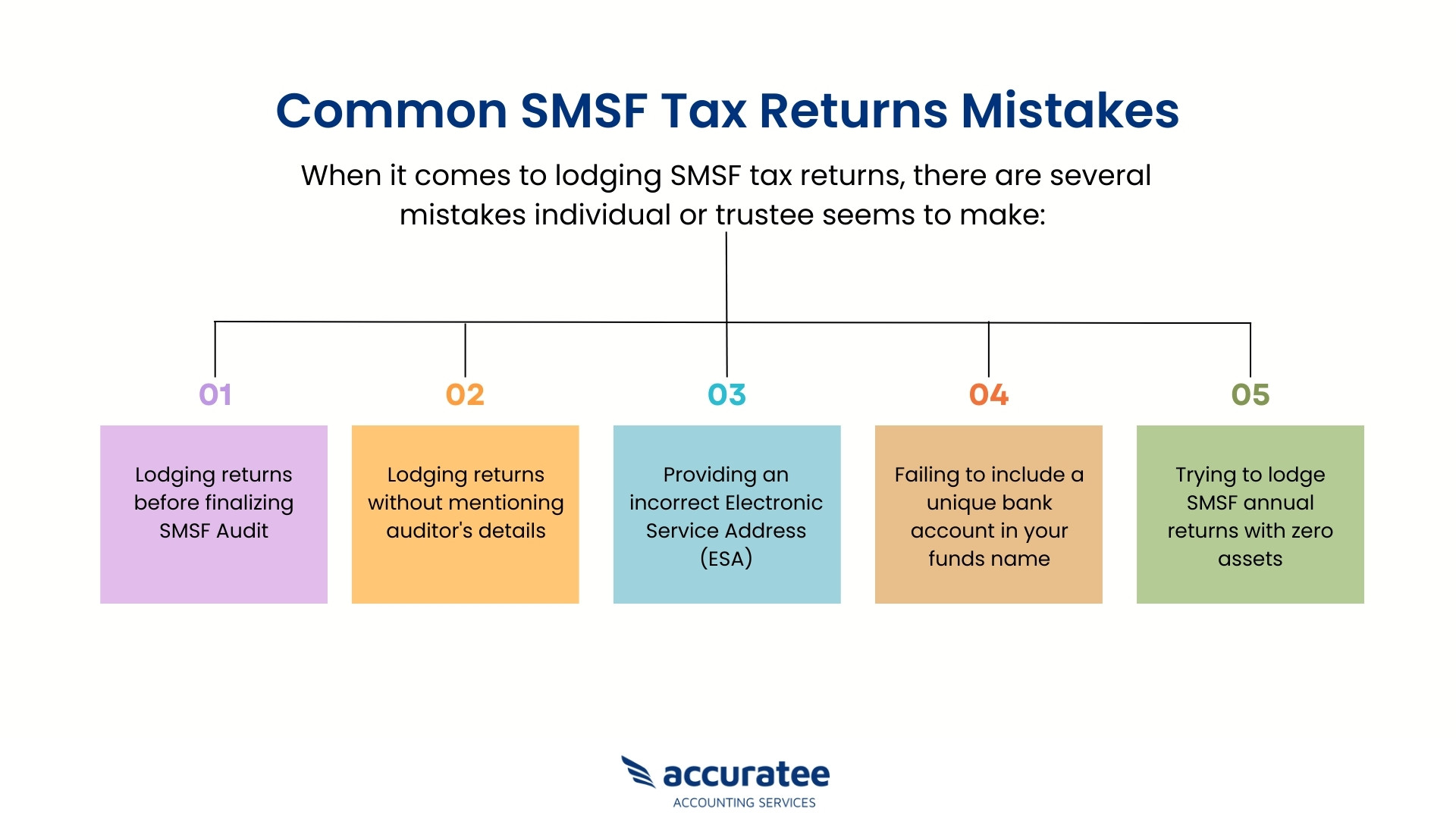

As we have now discussed the basics of SMSF tax returns, it is important to understand common mistakes that can be avoided in 2025. Here are five key errors SMSF owners should look out for when lodging their returns:

-

Lodging returns before finalizing SMSF audit

When it comes to filing your SMSF annual returns (SAR) in 2025, one crucial mistake to avoid is lodging your returns before finalizing the SMSF audit. Before you submit your SMSF returns, it is essential that the audit for your SMSF is completed and finalized. This is because you will require certain information from the audit report to accurately complete your SAR.

The audit report provides important details about the financial transactions and compliance of your SMSF, ensuring its adherence to the regulatory requirements. By finalizing the audit before lodging your SAR, you can ensure that all the necessary information is available, reducing the risk of errors or omissions in your returns.

-

Lodging returns without mentioning auditor's details

Another common mistake when lodging an SMSF return is not including the details of the external auditor. it is imperative to appoint an approved SMSF auditor well in advance, at least 45 days before the SAR lodgment deadline. The appointed auditor plays a pivotal role in auditing your SMSF's financial statements and ensuring compliance with superannuation laws.

When completing your SAR, it is of utmost importance to provide accurate and complete information about the auditor. This includes their SMSF auditor number, name, and the date when the audit was finalized.

Failure to include accurate auditor details can have severe repercussions. Your SAR may be suspended, leading to non-recognition of your lodgment and potentially affecting your fund's compliance status. Moreover, providing false or misleading auditor information can result in penalties.

To ensure a smooth and compliant SMSF annual return process, it is vital to diligently report the precise and up-to-date auditor details in your SAR. This will help you avoid unnecessary complications and maintain the integrity of your SMSF.

-

Providing an incorrect Electronic Service Address (ESA)

Providing an incorrect Electronic Service Address (ESA) when lodging SMSF returns can have severe consequences. The ESA serves as a vital identifier for electronic communication across the super network.

Using the wrong ESA can result in failed or misdirected transactions, leading to delayed or missing contributions from external employers. This can disrupt the flow of funds into the SMSF and potentially cause compliance issues.

Additionally, it may lead to non-compliance with SuperStream, the national data standard for superannuation contributions. Non-compliance can result in penalties, loss of entitlements, and difficulties in reconciling contributions. Therefore, ensuring the accurate and up-to-date ESA is used is crucial for the smooth operation and compliance of an SMSF.

-

Failing to include a unique bank account in your funds name

Another common mistake is not including a bank account in your fund's name. This refers to failing to open a dedicated account specifically for the self-managed super fund (SMSF).

This mistake can have serious consequences as it violates the requirement of maintaining the fund's assets and transactions separate from the individual trustees' and related employers' bank accounts. By not having a unique bank account, the member's retirement benefits may be at risk since the funds may not be adequately protected.

To avoid this mistake, it is crucial for SMSF trustees to open an account solely in the name of the fund. Additionally, this account should be used to manage the fund's operations, accept contributions and rollovers, and receive income from investments.

By keeping the SMSF's bank account separate and distinct from other accounts, trustees can ensure compliance with regulations and protect the members' retirement savings.

-

Trying to lodge SMSF annual returns with zero assets

Trying to lodge an SMSF return with zero assets can lead to significant complications and potential rejection by the ATO. It's important to understand that an SMSF is only considered legally established when it has assets specifically set aside for the benefit of its members. This means that attempting to lodge a return for an SMSF without any assets goes against the fundamental requirements for maintaining such a fund.

The ATO's systems are designed to identify and prevent the submission of annual returns for SMSFs that lack assets or closing member account balances, unless the return is for the year in which the fund is being wound up. This ensures that the SMSF operates in compliance with the relevant regulations and demonstrates a genuine commitment to providing benefits to its members.

Therefore, it is crucial to avoid the mistake of attempting to lodge an SMSF return with zero SMSF assets, as it can lead to complications, potential penalties, and rejection by the ATO. Instead, ensure that your SMSF has appropriate assets and member account balances before proceeding with the lodgment process.

Expert Bookkeeping at Your Fingertips!

Tips to avoid common SMSF tax return mistakes

-

Ensure you have the right records

Keep accurate and up-to-date financial records of all contributions, investments, transactions, and distributions for your SMSF. This will help ensure that your annual return is complete and correct when it’s time to lodge it.

-

Record all contributions

Ensure that you have recorded all contributions made by members, including salary sacrifice and personal contribution. This will help avoid issues with the ATO down the line.

-

Be aware of current rules and regulations

SMSFs are subject to a number of laws and regulations, so make sure you understand them before lodging your return.

-

Track all income and expenses

Make sure that you keep track of every single cent your SMSF earns or spends throughout the financial year. This includes any interest, dividends, rental income, and other sources of income, as well as expenses such as management fees and bank charges.

-

Be aware of tax offsets

Make sure you understand the different tax offsets available, such as the super co-contribution, spouse contribution offset and low income tax offset.

-

Double-check all information

Before you lodge your SMSF annual returns, double check all figures to make sure they’re accurate. This includes ensuring that contributions made by members have been reported correctly and that any other income or expenses have been accounted for.

-

Accurate asset valuation

Accurately valuing SMSF assets is important to ensure your SMSF retains its complying fund status. The ATO requires that the fund’s assets are valued at their current market value, so be sure to factor in any changes in asset prices throughout the year when lodging your returns.

-

Double check everything

Before you lodge your SMSF annual return, double check all figures to make sure they’re accurate. This includes ensuring that contributions made by members have been reported correctly and that any other income or expenses have been accounted for.

-

Lodge on time

Make sure to prioritize the timely lodgement of your SMSF's annual return to avoid potential penalties imposed by the ATO. Seeking assistance from a professional tax agent is highly recommended to ensure accurate and on-time lodgement.

Conclusion

Avoiding mistakes when preparing and filing your SMSF l return can be tricky. To ensure that your SMSF investments are operating according to Australian tax law, as well as keeping track of your taxable transactions, it is important to stay on top of the necessary paperwork. This blog post has outlined a few common mistakes to avoid in 2025 when filing your SMSF returns.

If you want to guarantee accuracy and peace of mind when it comes to lodging your SMSF annual returns, then contact CleanSlate and let one of our experienced tax accountants help you. At CleanSlate, we specialize in lodging SMSF returns and can provide the expertise to ensure that your return is lodged correctly and compliantly. Contact us today for more information!