6 common misconceptions about outsourced tax preparation

Introduction:

Commonly repeated myths about outsourcing have often painted a skewed picture, far from the actual reality of these services. These half-truths tend to ignore or downplay the significant benefits that outsourcing can offer, especially those about tax preparation services. Such outdated misconceptions have led many small businesses to miss out on actual opportunities that could enhance their operations and efficiency.

In this blog, we will address these frequently shared viewpoints on outsourced activities, mainly focusing on tax preparation services. We'll tackle the common myths head-on, providing clarity and insight into how outsourcing can be a beneficial, cost-effective, and secure solution for small businesses. By shedding light on these misconceptions, we aim to present a more accurate and balanced view of what outsourcing truly entails and how it can positively impact your business.

Key takeaways

Outsourcing can significantly boost small business operations and efficiency.

Clear objectives are crucial in the tax preparation outsourcing process.

Selecting a suitable outsourcing firm demands careful market research and knowledge of your business's tax requirements.

Formal agreements and onboarding are key steps in successful outsourcing partnership.

What is outsourced tax preparation?

Outsourced tax preparation refers to the practice of hiring an external company or professional to handle the tax preparation and filing process for an individual or a business. This outsourcing can be to a local firm or to companies that operate in different regions or countries.

Process of outsourcing tax preparation

Here is the step-by-step process of outsourcing tax preparation:

The first step is to understand clearly why your business needs to outsource tax preparation. Whether it's to reduce costs, access skilled expertise, or manage risks, defining your goals helps in creating a focused outsourcing strategy.

Conduct thorough research to find a suitable outsourcing partner. This involves market studies, competitor analysis, and assessing the capabilities of potential providers. It's crucial to choose a partner who understands the specific needs of small businesses and can offer tailored solutions.

Once you've chosen a provider, the next step is to formalise the partnership through a service-level agreement. This agreement should outline the scope of work, expectations, and deliverables. Following this, the onboarding process begins, integrating the provider's team with your business operations.

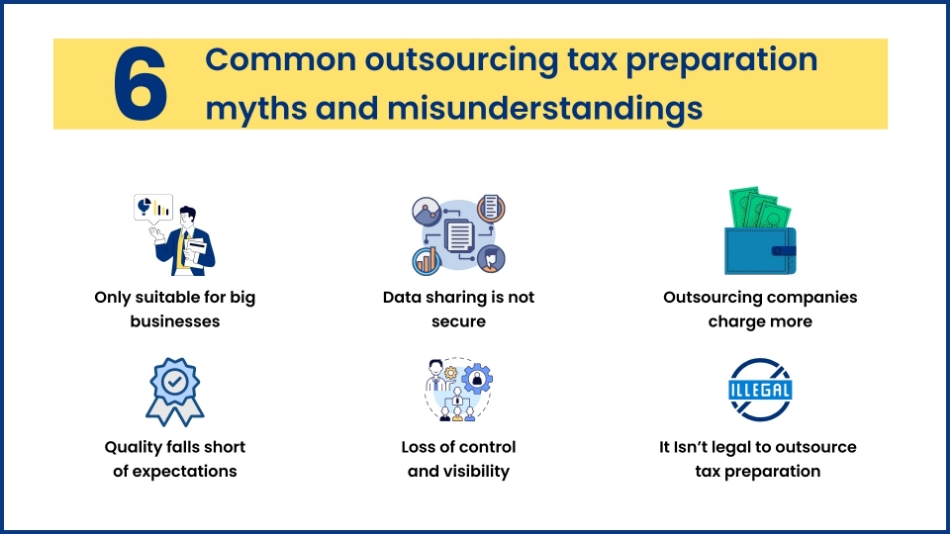

6 Common outsourcing tax preparation myths and misunderstandings

Myth 1: Only suitable for big businesses

Many small and medium-sized businesses mistakenly believe that outsourcing tax services is a luxury only big businesses can afford. However, this is far from the truth. Outsourcing provides an opportunity for smaller businesses to access expert services without the overhead of hiring full-time professionals.

It enables them to expand their service offerings and compete more effectively in the market. By outsourcing, small businesses can focus on their core competencies, such as customer relations and business development, while leaving the complex and time-consuming task of tax preparation to the experts. This approach not only saves time but also ensures accuracy and compliance with tax laws.

Myth 2: Data sharing is not secure

Data security is a paramount concern for small businesses, especially when it involves sensitive financial information. The fear that outsourcing tax preparation might lead to data breaches is common. However, top outsourcing firms are equipped with robust security measures to protect client data. These measures include secure data transmission protocols, encrypted storage solutions, and strict confidentiality agreements with their staff.

Furthermore, these firms often comply with international data security standards, assuring that your business's financial information is handled with the utmost care and security. By choosing a reputable outsourcing partner, small businesses can actually enhance their data security compared to managing everything in-house.

Myth 3: Outsourcing companies charge more

A common myth among small business owners is that outsourcing tax services is prohibitively expensive and inflexible. In reality, outsourcing can be a cost-effective solution. Unlike maintaining an in-house team, which involves fixed salaries, training costs, and infrastructure expenses, outsourcing allows businesses to pay only for the services they need.

This flexibility is particularly beneficial for small businesses that may not require full-time tax services year-round. During quieter periods, businesses can scale down their services, thereby controlling costs effectively. Additionally, the efficiency and expertise provided by outsourcing firms can lead to cost savings in the long run through accurate tax filing and potential tax savings.

Myth 4: Quality falls short of expectations

The concern that outsourced tax services might result in poor-quality work is a significant barrier for some small businesses. However, this concern is often unfounded. Outsourcing firms specialise in tax services and employ highly skilled professionals who are well-versed in the latest tax laws and practices.

These firms invest in ongoing training and development to ensure their staff are up-to-date with the Australian Taxation Office regulations and standards. As a result, the quality of work is often on par with or superior to in-house tax preparation. Additionally, many outsourcing companies have stringent quality control processes in place to ensure accuracy and compliance.

Myth 5: Loss of control and visibility

Business owners often fear that outsourcing will lead to a loss of control and visibility over their tax preparation process. However, this is not the case. Modern outsourcing firms use advanced software and communication tools to keep clients informed and involved in every step of the process. These tools allow for real-time tracking of the progress of tax filings and accessible communication with the outsourcing team.

This level of transparency ensures that business owners can maintain control over their financial information and make informed decisions. Furthermore, many outsourcing firms are willing to customise their services to fit the specific needs and preferences of their clients, ensuring a partnership that aligns with their business operations.

Myth 6: It Isn’t Legal To Outsource Tax Preparation

A prevalent myth among small business owners is the belief that outsourcing tax preparation is illegal or breaches compliance regulations. This is far from the truth. In Australia, as in many other countries, outsourcing tax preparation is perfectly legal and a common practice. The key is to ensure that the outsourcing partner complies with the Australian Taxation Office (ATO) guidelines and maintains high standards of confidentiality and accuracy.

Why choose CleanSlate for your small business tax needs?

CleanSlate offers a comprehensive range of tax services tailored for small businesses, ensuring a seamless and efficient tax filing experience. Here are a few reasons to partner with CleanSlate.

- We specialise in handling a diverse array of tax requirements, from straightforward individual tax returns to more complex tax scenarios that small businesses often encounter.

- Our commitment to data security is backed by ISO 27001 certification, ensuring the highest standards of data protection.

- Our team's expertise in Australian taxation laws ensures that we provide accurate and strategic tax advice.

- We ensure that tax returns are completed accurately, ethically, and with the utmost integrity, maintaining compliance with laws and regulations.

- We focus on claiming all relevant deductions, rebates, and credits, aiming to maximise your deductions and minimise tax liabilities.

- We take the time to understand each client's unique circumstances, offering specialist advice and support for the best possible tax outcomes.

- We place a strong emphasis on client satisfaction, offering a 30-day money-back guarantee and prioritising client requirements,

Hear from our client, S. Patel of Red Rooster Windsor:

CleanSlate's outsourced tax preparation service was a major help. Simple, efficient, and reliable. Highly recommend for small businesses!

Final Thought

Dispelling these myths about outsourcing taxation services is essential for small businesses, enabling them to harness the full potential of these services. By overcoming these misconceptions, they can make more informed strategic decisions, optimising their in-house resources for better efficiency.

This optimisation leads to a more thoughtful, more responsive operational design, allowing them to offer higher-value services to their clients. As these businesses become more agile, resilient, and flexible, they are better positioned for growth and survival in the competitive business environment.

Partnering with CleanSlate provides the expertise and support needed to navigate tax preparation with confidence. For tailored tax return solutions that align perfectly with your business needs, contact us today.