BAS due dates 2025–26: Monthly, quarterly and annual deadlines

Introduction:

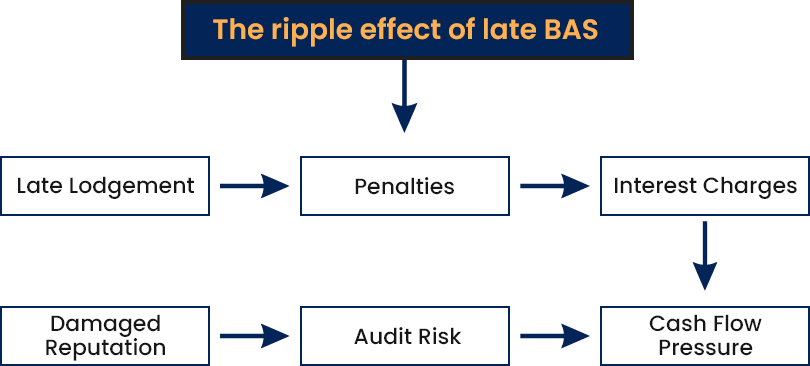

Staying on top of your Business Activity Statement (BAS) lodgement dates is one of the simplest ways to avoid unnecessary stress in the new financial year. The Australian Taxation Office (ATO) sets different deadlines depending on whether you lodge monthly, quarterly, or annually, and missing these dates can lead to penalties, interest charges, and cash flow issues.

For the 2025–26 year, businesses will need to keep track of a few key changes and deadlines that apply from July 2025 through June 2026. This blog post brings together all the important BAS lodgement due dates in one place so you can plan ahead, stay compliant, and focus on running your business.

Key takeaways

BAS due dates vary depending on whether you report monthly, quarterly, or annually.

Monthly BAS lodgements are always due on the 21st of the following month without agent concessions.

Quarterly BAS due dates in 2025–26 are 28 October, 28 February, 28 April, and 28 July, with concessions for some quarters.

Lodging through a registered BAS or tax agent can provide extra time for quarterly submissions.

Late lodgements attract Failure to Lodge penalties, starting at $330 every 28 days and capped at $1,650 for small businesses.

What are BAS due dates?

A BAS due date is the deadline set by the Australian Taxation Office (ATO) for lodging your Business Activity Statement and paying any amounts owed. If the due date falls on a weekend or a public holiday, it automatically moves to the next business day.

Businesses that lodge through a registered BAS or tax agent often gain extra time thanks to the BAS due date tax agent concession, giving owners more breathing room to stay compliant without the stress of last-minute lodgements.

Fixed monthly fee for

a defined scope of services

Many clients appreciate having bookkeeping and tax services under one roof, while also enjoying the predictability of a fixed fee. Below is our indicative fee for a standard scope of work:

Cancel anytime

Cancel anytime

Unlimited support

Unlimited support

Quick onboarding

Quick onboarding

Only Bookkeeping & BAS

Only bookkeeping and BAS (Does not cover tax returns, payroll and super):

$165/month *ex GST

Bookkeeping & Tax combined

For bookkeeping, BAS and tax returns (but no payroll or super included):

$225/month *ex GST

Bookkeeping, Tax & Payroll

All inclusive package: Bookkeeping, BAS, payroll, Super and tax returns:

$280/month *ex GST

BAS due dates 2025-26: Lodgement & payment deadlines

Here are the key BAS due dates for the financial year 2025-26 in Australia based on ATO rules, including the extra concession (extension) if you lodge through a registered BAS/tax agent and electronically under the ATO’s BAS Agent Lodgment Program:

If your business is required or opts to lodge monthly, the BAS due date is the 21st day of the following month after the reporting period closes. This applies to every month. For example, BAS for July 2025 would be due 21 August 2025, August BAS due 21 September, etc.

Note: Monthly BAS lodgements do not generally receive the same extension benefit that agent-lodgers get for quarterly statements. So lodging monthly means you must ensure you are ready by the 21st.

| Monthly BAS due dates 2026 | ||

|---|---|---|

| BAS period | Standard due date | Agent due date |

| January 2026 | February 21, 2026 | February 21, 2026 |

| February 2026 | March 21, 2026 | March 21, 2026 |

| March 2026 | April 21, 2026 | April 21, 2026 |

| April 2026 | May 21, 2026 | May 21, 2026 |

| May 2026 | June 21, 2026 | June 21, 2026 |

| June 2026 | July 21, 2026 | July 21, 2026 |

| July 2026 | August 21, 2026 | August 21, 2026 |

| August 2026 | September 21, 2026 | September 21, 2026 |

| September 2026 | October 21, 2026 | October 21, 2026 |

| October 2026 | November 21, 2026 | November 21, 2026 |

| November 2026 | December 21, 2026 | December 21, 2026 |

| December 2026 | January 21, 2027 | February 21, 2027 (If turnover up to $10 million and lodging via agent) |

Most small and medium businesses report quarterly. These are the official quarterly BAS due dates 2025–26, with tax agent concessions where available:

| Quarterly BAS due dates 2025–26 | ||

|---|---|---|

| Quarterly | Standard due date |

Agent concession (Electronic lodgement) |

| Q1 2025–26 | 28 October 2025 | 25 November 2025 |

| Q2 2025–26 | 28 February 2026 | Not applicable |

| Q3 2025–26 | 28 April 2026 | 26 May 2026 |

| Q4 2025–26 | 28 July 2026 | 25 August 2026 |

If you are a GST registered business and your annual turnover is below $75,000 (or $150,000 for not-for-profit bodies), you may be eligible to report and pay GST on an annual basis.

- Standard annual BAS due date: 31 October 2026

- If no income tax return is required: 28 February 2027

- Lodging through a BAS agent may provide a different extension

One annual BAS can still disrupt your entire schedule if delayed.

Book a call now

Penalties for missing BAS due dates

Here are the main consequences you need to be aware of if BAS deadlines are missed:

Failure to Lodge (FTL) penalty:

The ATO applies a Failure to Lodge (FTL) penalty when a BAS is submitted late. The penalty increases the longer the statement remains overdue. For small businesses, the charge is $330 for every 28 days (or part thereof), up to a maximum of $1,650.

Medium and large entities are charged at higher multiples, and global entities face significantly larger penalties. Because the process is automated, repeated late lodgements reduce your chances of penalty remission. For more information, you can visit the ATO Failure to Lodge penalties page.

General interest charge (GIC):

The ATO also applies a General Interest Charge to outstanding amounts. This interest compounds daily, so the debt grows continuously until paid. The rate is reviewed quarterly and always set above standard borrowing costs. GIC before 1 July 2025 remains deductible, but amounts from that date onward are not, increasing the financial impact.

Cash flow strain

When GST refunds are withheld, your working capital is reduced straight away. Without access to these funds, it becomes difficult to cover wages, supplier payments, and regular bills.

Many business owners are then forced to borrow, delay obligations, or dip into personal savings to keep operations running. Even short delays in refunds can create disruption, while ongoing delays may place long-term stability at risk.

Is debt pressure affecting your cash flow? Read our blog How to Pay Off Your Business Debt Fast and take back control.

Compliance and audit risk:

Your lodgement behaviour is tracked by the ATO, and repeated delays weaken your compliance record. Once your record is damaged, the risk of an audit or review rises sharply. You may also lose the extra time offered under BAS agent extensions. Over time, this creates a cycle of closer monitoring and stricter treatment.

Business reputation and finance access:

Banks, lenders, and suppliers often request BAS records as proof of financial reliability. Consistent delays raise red flags that can limit access to credit and reduce negotiating power. A poor record also damages trust with partners and stakeholders. Over time, this weakens your reputation and restricts your business growth opportunities.

Best practices to prepare for BAS due dates

Avoiding penalties is much easier when you treat BAS preparation as a structured process rather than a rushed task. Here are tips on how to prepare BAS effectively:

Confirm your reporting cycle early:

Check whether you report monthly, quarterly, or annually, and make sure this matches what the ATO has on record. Align your accounting software settings with the same cycle. Share the timing with your bookkeeper and payroll so everyone works to one calendar. Create a simple year planner that lists each period’s cut-off date.

Get your bookkeeping in order:

Record sales, purchases, and expenses promptly and attach source documents to each transaction. Use detailed descriptions so future reviews make sense at a glance, and always keep business and personal payments separate to avoid messy coding. By maintaining accurate bookkeeping for BAS preparation throughout the year, you will make the activity statement process far less stressful.

Reconcile bank and clearing accounts:

Reconcile bank feeds, merchant accounts, and payroll clearing accounts at least monthly. Investigate any unmatched items and fix them before the period closes. Confirm suspense accounts are cleared to the right codes. A reconciled ledger is the foundation of accurate BAS figures.

Track GST, PAYG withholding, and PAYG instalments:

Check that GST on sales and purchases is recorded correctly and that GST-free or input-taxed items are not overstated. Always make sure PAYG withholding reconciles with the general ledger. Many businesses rely on professional payroll services providers to ensure payroll reports for PAYG withholding align seamlessly with BAS preparation, giving confidence that figures are accurate and fully compliant.

Use accounting software features well:

Tools like Xero, MYOB, or QuickBooks can automate bank feeds, rule-based coding, and document attachments. Turn on user roles and approvals so transactions are reviewed before posting. Run GST summary and exception reports to catch errors early. Set up due date reminders inside the software.

Build a pre-lodgement checklist:

Include reconciliations, GST exception review, payroll reports, PAYG summaries, and a scan for unusual balances. Tick off each step the same way every period. A short checklist prevents small mistakes from becoming penalties. Save the checklist with the period’s working papers.

Monitor cash flow for upcoming BAS payments:

Forecast the GST and PAYG amounts due so you are not caught short near the BAS deadline. Put aside funds in a tax holding account as the period progresses. If cash is tight, plan early and speak with your adviser about options before the due date arrives.

Set calendar alerts and team reminders:

Add all BAS due dates to a shared calendar and include any agent concessions you receive. Schedule internal cut-offs for coding, reconciliations, and reviews. Remind approvers to sign off on time. Clear internal timelines make the external deadline easy.

Prepare early and close the period:

Aim to finalise coding and reconciliations a week before the BAS lodgement due date. Lock the period in your software once the statement is ready, so no late edits slip in. Early preparation gives you room to fix issues without stress.

Fix errors quickly and document changes:

If you spot an error after lodgement, prepare a clear adjustment in the next BAS or request an amendment as appropriate. Keep notes that explain the issue, the correction, and the supporting documents. Good documentation protects you if questions arise later.

Keep source documentation:

Store tax invoices, receipts, credit notes, payroll reports, and bank statements in one secure location. Use consistent file names and period folders. Good records make BAS preparation easier and support your position during reviews.

Stay informed on ATO updates:

Rules change, thresholds move, and lodgement concessions can be updated. Check ATO guidance each quarter or subscribe to updates. Update your checklist when something changes so your process stays current.

Work with a registered BAS agent for accuracy and extra time:

A registered agent reviews your figures, helps prevent mistakes, and can access extended lodgement time under the ATO agent program when conditions are met.

Create a brief period file for audit trail:

Save the BAS PDF, GST reports, payroll summaries, bank recs, and your signed checklist together. A tidy period file means questions are easy to answer, and future periods are faster to prepare.

Need more detailed steps? Read our blog post how to prepare BAS for small business for extra guidance.

Partner with CleanSlate for stress-free BAS

Managing BAS lodgements shouldn’t take up valuable hours you could spend running your business. At CleanSlate, we provide end-to-end BAS support that keeps you compliant and gives you peace of mind. Our team ensures your reports are accurate, on time, and aligned with ATO requirements no last-minute stress, no unnecessary penalties.

Here’s what we bring to the table:

- Accurate bookkeeping and reconciliations – all sales, purchases, and payroll figures are properly coded and checked before lodgement.

- On-time lodgements every cycle – whether you report monthly, quarterly, or annually, we make sure deadlines are never missed.

- Cash flow planning support – we help you forecast GST and PAYG so you can set aside funds and avoid sudden shortfalls.

- ATO compliance confidence – your BAS is reviewed by professionals who know the latest rules and reporting concessions.

- Extra time with agent concessions – lodging through CleanSlate gives you access to extended deadlines when available.

By working with us, you gain more than just compliance. You gain the freedom to focus on your business growth, knowing your BAS obligations are being handled with precision and care. Get in touch with us today and take the stress out of BAS lodgements.

BAS due dates FAQs

1. How does BAS work with the ATO?

A BAS is used to report and pay GST, PAYG withholding, and PAYG instalments. Businesses submit their activity statement by the due date set by the ATO. The information reconciles with your accounting records, and any net GST or PAYG amounts are either paid to or refunded by the ATO.

2. What is the deadline for the 2025 tax return in Australia?

The standard deadline for lodging your own tax return is 31 October 2025. This applies to individuals, sole traders, partnerships, and trusts that are not using a registered tax agent. For companies, most small entities lodge by 28 February 2026, but if prior returns are outstanding, the deadline is 31 October 2025.

3. Do BAS agents always get extra time?

Yes. Registered BAS or tax agents usually receive extra time for quarterly BAS through the ATO’s lodgement concession program. Monthly BAS lodgements are not extended, and businesses must be in good standing with the ATO to qualify.

4. Is BAS monthly or quarterly?

BAS can be monthly, quarterly, or annual, depending on your business size and GST turnover. Most small and medium businesses lodge quarterly. Larger businesses with GST turnover above $20 million must lodge monthly. Some smaller entities may elect to lodge annually if they meet eligibility thresholds.

5. How do I fix a mistake in a previously lodged BAS?

Many GST or fuel tax credit mistakes can be corrected in your next BAS if they fall within ATO limits. Otherwise, you may need to revise the original BAS. For PAYG withholding errors, you can either revise the earlier BAS or carry the correction forward to the current period, depending on the size and type of error.