Navigating the ATO's DATA Matching Program: Tips for businesses

Introduction:

Do you need clarification about the ATO Data Matching Program? You're not the only one! As the tax season approaches, it's crucial to understand the program's workings and how it affects you. This blog is a complete guide to assist you in understanding the ATO program.

We will delve into the program's details, including the matched data, how the ATO employs the information gathered, and most importantly, how it impacts you as a taxpayer. The ATO Data Matching Program has far-reaching consequences, from identifying potential discrepancies to detecting instances of tax fraud.

Whether you are an individual taxpayer, a small business owner, or a tax professional, this blog will provide you with valuable insights into the program and how you can guarantee compliance.

Key takeaways

ATO Data Matching Program gathers information to ensure tax compliance.

It detects fraudulent activities and recovers debts owed to the government.

Inconsistencies in taxpayers' records are flagged for investigation.

Specific data-matching programs target businesses operating outside the system.

The benefits of ATO’ matching program benefits include fair treatment, compliance, and revenue recovery.

What is ATO data matching?

ATO data matching is a sophisticated tool that enables the Australian Taxation Office (ATO) to gather and analyze data from various external sources to ensure compliance with tax laws.

By compiling and validating information from third-party sources, such as banks, financial institutions and other government agencies, the ATO data matching detects individuals and businesses outside the tax system, identifies fraudulent activities against the Commonwealth, and recovers debts owed to the government.

Not only does it aid in detecting non-compliant taxpayers, but it also helps honest taxpayers easily lodge their tax returns. The data match pre-fill tax returns, saving time and effort for taxpayers and ensuring that they claim offsets and benefits accurately.

It serves as an essential tool to protect the integrity of Australia's tax system. Promoting compliance and detecting non-compliance reassures the community that honest tax-paying businesses are protected from unfair competition.

How does the ATO data matching work?

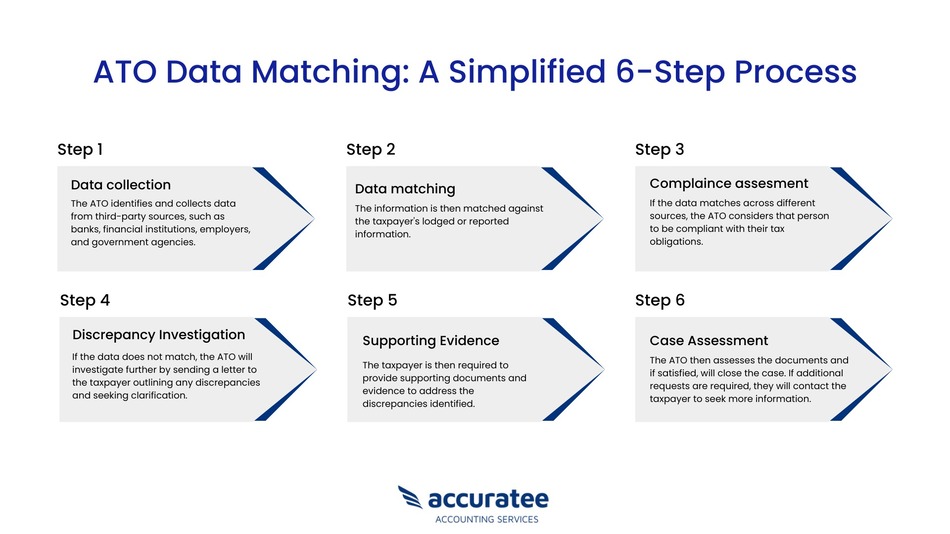

The Australian Taxation Office (ATO) uses data matching to ensure lodgers comply with tax obligations. It involves comparing information from various sources to pinpoint discrepancies in the lodger's reported income, deductions, and other tax-related information.

Here's how it works:

It's important to note that ATO data matching is a routine process, and not all flagged records indicate tax evasion or wrongdoing. However, if you receive a notice from the ATO regarding a discrepancy in your tax return, it's crucial to respond promptly and provide any requested information or documentation.

What are ATO's specific data matching programs?

The ATO's specific data-matching programs help expose businesses that may need to report all their income or operate outside the system, ensuring that everyone pays their fair share of taxes. Here are a few ATO's programs:

-

Credit and debit cards:

The ATO collects data from banks and financial institutions to detect Australian businesses' total credit and debit card payments. By doing so, they can check that businesses report all their income and that individuals are not avoiding taxes by using cash transactions.

-

Specialized payment systems:

The ATO gathers information on electronic payments made through specialized payment systems to Australian businesses. They combine this data with information gathered through credit and debit cards to verify a business's income further.

-

Online selling:

The ATO collects details of online sellers selling goods and services worth $12,000. This data is obtained from online selling sites governed by Australian law and helps them expose businesses underreporting their income from online sales.

-

Ride-sourcing:

The ATO obtains data from ride-sourcing facilitators in Australia and their financial institutions to identify ride-sourcing drivers. This information helps them ensure drivers understand their tax obligations and meet their reporting and payment requirements.

-

Motor vehicle registries:

The ATO obtains data from state and territory motor vehicle registering bodies to disclose all motor vehicles sold, transferred or newly registered where the transfer or market value is $10,000 or more. This helps them identify people who may be avoiding taxes on their vehicle transactions.

-

Cryptocurrency:

The ATO obtains data from Australian cryptocurrency designated service providers (DSPs) to verify that individuals trading in cryptocurrency are paying the correct amount of tax. This helps them track and verify transactions in the digital currency market.

Calculate GST quickly and accurately with our GST Calculator. Input the relevant data points to determine the GST amount for your trust.

Calculate now

What are the benefits of data matching programs?

Data match programs have several benefits, including:

- Keeping the community's trust in the taxation and superannuation systems by ensuring that everyone is treated fairly and equally. This program also helps people feel confident that the ATO is administering these systems correctly.

- Making sure that people are complying with their tax and superannuation obligations. Some people deliberately refrain from paying what they owe, which is not fair to everyone else. This program helps the ATO to identify these cases and take action.

- Helping the ATO to enforce compliance and recover revenue. Without this program, there is a risk that revenue is not being collected as it should be. This program assures that ATO's taxation and superannuation systems are functioning well and that revenue is collected fairly.

What are the risks associated with data matching programs?

ATO's data match programs can pose certain risks, including:

-

Inaccurate information:

Data matching relies on precise and up-to-date information to be effective. If the ATO obtains incorrect or outdated information, it could lead to errors in the program which might not be corrected in time.

-

Privacy issues:

The ATO must ensure that data collected and used in the program is protected and managed securely to maintain individuals' privacy. If not, it could lead to serious breaches of privacy.

-

Discrimination:

ATO's matching programs do not consider an individual's circumstances, which could lead to decisions that are perceived as discriminatory. To avoid this, the ATO must carefully interpret and use the data collected.

-

Incorrect assumptions:

The program may conclude that the data are simply wrong or based on incorrect assumptions. This can lead to false accusations and unnecessary investigations, which could be damaging for all parties involved.

-

Costs:

The costs associated with programs can be significant regarding the resources required to set up and maintain the program and any penalties or fines imposed on lodgers. This could potentially lead to financial hardship for those affected by the program.

Turn Your Bookkeeping into a Breeze!

How can taxpayers avoid risks associated with data matching programs?

Tax Paying individuals can take certain steps to help ensure they are not at risk of being caught up in ATO's program. These include:

- Making sure their tax and superannuation records are accurate and up to date. This means staying on top of any changes to their income or circumstances that could affect their tax and superannuation obligations.

- Ensuring all information provided to the ATO is correct. This includes accurately reporting income, capital gains, and other deductions from any taxable investments or activities.

- Being mindful of any transactions they make that exceed the $10,000 threshold. Many transactions must be reported to the ATO when they exceed this amount, and failure to do so can attract fines or avoid penalties.

- Taking steps to secure their online accounts and protecting their personal information from identity theft. This is important for all lodgers, particularly those more likely to be targeted in a program.

Tips for staying compliant with ATO's data-matching programs

To stay compliant with ATO's programs, lodgers:

- Regularly update their records with the ATO to ensure all relevant information is current and accurate.

- Ensure that all transactions are reported correctly and promptly, paying particular attention to any transfers of assets or significant changes in income.

- Keep records of all transactions for at least five years, including receipts and invoices where applicable.

- Ensure that all claims for deductions are valid and substantiated with evidence.

- Be aware of their tax and other legal obligations and seek professional help where needed.

- Be proactive in addressing any disputes or errors which may arise as a result of the program.

Conclusion

The Australian Tax Office has been utilizing the Data Matching Program for over a decade now, and it's clear that the program has significantly impacted discrepancies in taxpayer records. With the constant advances in technology, it's likely that the program will continue to become more sophisticated and useful.

Compliance is essential when dealing with ATO's data matching program, as any mistakes could lead to costly fines incurred by taxpayers. That's why seeking professional advice and support is key to ensuring the smooth integration of this system into your tax processes and avoiding any inexactitudes.

At CleanSlate, we have a team of experienced tax professionals, bookkeepers, and accountants who can assist you with all aspects of taxation and ensure compliance with the ATO's regulations.

Our team has a thorough understanding of complex tax laws and can guide you in maintaining accurate records. We can also answer any taxation-related queries and provide support in preparing and filing your tax returns. Trust us to provide you with efficient and reliable taxation services. Contact us today to learn more.