Protecting profits: 7 key strategies to prevent bookkeeping fraud

Introduction:

Trust is a fundamental element in the fabric of small businesses. Still, it can also be a vulnerability regarding bookkeeping fraud. This blog will explore seven essential strategies to safeguard your business against such risks. These strategies are not just about protecting your finances; they're about preserving the trust that your business is built on.

We'll discuss the importance of regular financial reviews, the division of accounting responsibilities, and the implementation of stringent internal controls. These measures are crucial for maintaining the integrity and sustainability of your business. By adopting these practices, you're taking proactive steps to ensure your business's financial health and the trust of your clients and employees remain intact.

Key takeaways

Trust is vital in small businesses but can make them vulnerable to bookkeeping fraud.

Small businesses are prone to fraud due to single ownership control.

Use secure communication and tech tools to minimise fraud.

Consider outsourcing bookkeeping services to add layers of oversight.

Why are small businesses more prone to bookkeeping fraud?

Small businesses are more prone to bookkeeping fraud for several reasons:

- Single ownership control: Often, a single person oversees various business units, leading to a lack of checks and balances.

- High trust in employees: Owners typically place great trust in their employees, which can sometimes result in less scrutiny over financial matters.

- Fewer fraud controls: They usually have fewer controls to prevent and detect fraud than larger organisations.

- Lack of formal reporting channels: There is often a lack of formal processes for reporting and addressing fraud-related concerns, allowing fraudulent activities to go unnoticed.

Efficiency in bookkeeping is crucial, and with CleanSlate, it's a guarantee.

Seven most effective strategies to prevent your bookkeeping fraud

In many small and mid-sized businesses, financial responsibilities are often concentrated in the hands of a single individual. While seemingly efficient, this setup creates a significant risk for bookkeeping fraud. Dividing financial responsibilities among multiple employees is crucial to mitigate this risk.

For instance, one employee could make or collect payments, while another is responsible for reconciling the books and verifying the reported amounts. This division of labour reduces the opportunity for a single individual to commit fraud and introduces a system of checks and balances.

Implementing strict access controls is crucial in safeguarding against bookkeeping fraud. By carefully limiting who can access financial data, businesses create a significant barrier against unauthorised transactions and potential breaches. This strategy involves establishing a clear permissions hierarchy, ensuring access to sensitive financial information is granted only to individuals whose roles necessitate it.

Equally important is the practice of regularly updating these access permissions. This process involves routinely reviewing who has access to financial systems and adjusting their level of access as needed, especially when there are changes in personnel or job responsibilities.

Manual payment methods, such as cash transactions or handwritten cheques, are particularly vulnerable to bookkeeping fraud. To mitigate this risk, it's advisable to transition to automated payment systems like Direct Entry (DE) transfers. DE transfers offer enhanced traceability and are less prone to manipulation, making altering pay-to-account details on bank statements challenging. When cheques are necessary, businesses should opt for banking services that facilitate online cheque creation and mailing or use accounting software that prints cheques with complete transaction details.

This ensures that cheque transactions are automatically logged in the accounting system, reducing the likelihood of unauthorised alterations. Additionally, substituting cash with company credit or debit cards wherever possible creates a thorough electronic paper trail, further safeguarding against bookkeeping fraud. This approach, leveraging Australia's advanced financial infrastructure, is a crucial step for small businesses in enhancing the security and integrity of their financial transactions.

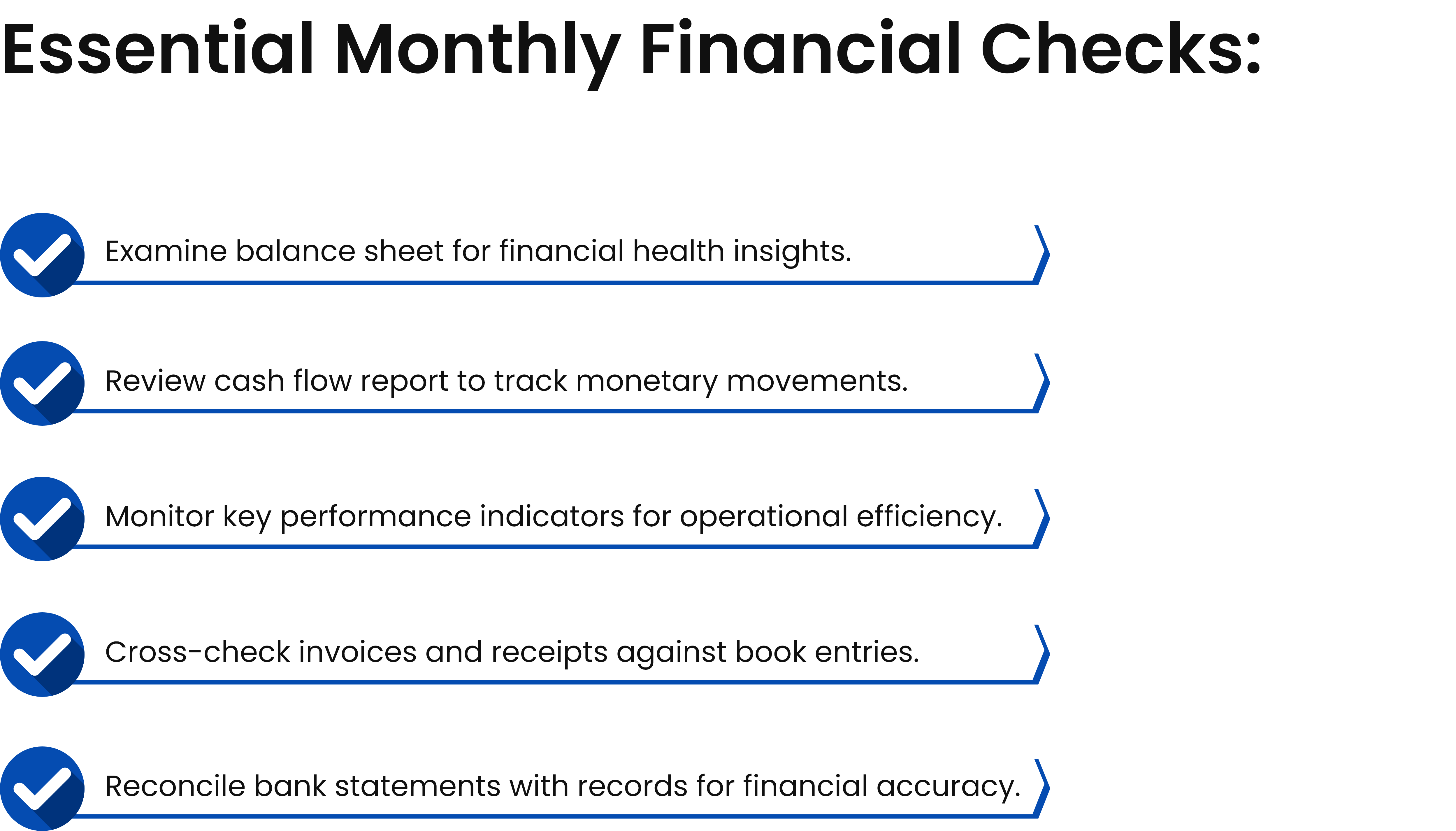

Regular review of financial reports is critical in detecting and preventing bookkeeping fraud. Even with divided responsibilities and automated payment systems, a manager or business owner must conduct a monthly review of all financial activities. This involves comparing the total of the month's receipts and invoices against the amounts entered in the books and cross-checking both figures against the bank statements.

Such reviews not only help in early detection of any discrepancies but also discourage fraudulent activities, as employees are aware of the ongoing oversight. This process also reinforces the culture of accountability and transparency within the organisation. While it may seem time-consuming, this practice is vital for maintaining the business's financial integrity. It can be streamlined with the help of modern accounting tools and services.

Employee training and awareness are key components in the prevention of bookkeeping fraud. It is crucial to educate staff about the various forms of fraud and how to recognise them. This involves training on identifying suspicious activities, such as unusual financial transactions or changes in vendor details, and understanding the proper channels for reporting these observations. Regular training sessions help keep the staff updated on the latest fraud schemes and the best prevention practices.

Additionally, fostering an environment where employees feel comfortable reporting anomalies without fear of retribution is essential. Organisations can create a vigilant workforce as the first defence against fraudulent activities by empowering employees with knowledge and awareness. This proactive approach not only helps in the early detection of fraud but also contributes to a culture of transparency and ethical behaviour within the organisation.

Utilising secure communication and technology is a critical step in preventing bookkeeping fraud. Implementing encrypted communication channels ensures that sensitive financial information remains confidential and secure from unauthorised access. This includes using secure email gateways and encrypted messaging systems for internal and external communications. Additionally, employing secure file transfer protocols is essential for the safe exchange of financial documents and data.

These protocols safeguard against data breaches and interception by cybercriminals. Equally important is the use of robust password management tools. These tools help generate and store complex passwords, reducing the risk of password-related breaches. By integrating these technologies into their operations, businesses can create a secure digital environment, significantly reducing the likelihood of fraud and enhancing overall data security.

Outsourcing bookkeeping services offers a strategic solution for businesses, particularly when facing staffing shortages, by ensuring that no single individual has complete control over financial processes, thereby significantly reducing the risk of undetected fraud. This approach involves entrusting your bookkeeping, accounting, and control functions to experienced providers with specialised expertise in promptly identifying and addressing any financial irregularities.

Such expertise enhances your business's fraud prevention mechanisms and adds multiple layers of oversight to your financial operations. This increased scrutiny makes your company a less attractive target for fraudsters as the complexity of committing fraud rises. Furthermore, the peace of mind that comes with knowing your financial records are being meticulously managed by professionals is invaluable, ensuring that every aspect of your financial management is under constant and careful scrutiny.

Conclusion

Bookkeeping fraud can devastate small businesses, impacting finances and risking the company's reputation and sustainability. Small businesses are particularly vulnerable due to limited resources and oversight. However, by implementing the seven key strategies outlined in this blog, small business owners can significantly reduce the risk of bookkeeping fraud. Partnering with CleanSlate's ISO 27001-certified bookkeeping services is a wise choice for added security and peace of mind.

At CleanSlate, we specialise in providing comprehensive online bookkeeping services tailored for small businesses in Australia. Our services include data entry, accounts reconciliation, financial reporting, payroll management, and tax return lodgements, ensuring your financial records are accurate and up-to-date. With our cost-effective pricing model and a 30-day money-back guarantee, we prioritise client satisfaction and offer flexible solutions like fixed fee packages.

By outsourcing your bookkeeping to us, you gain access to expertise, advanced technology, and efficient solutions, allowing you to focus on your core business activities. Kindly contact us to learn more about how we can assist your business.